Triple Bottom

was formed on 31.03 at 01:40:32 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of EURCHF M5. Features of the pattern: The lower line of the pattern has coordinates 0.9536 with the upper limit 0.9536/0.9530, the projection of the width is 15 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 0.9521, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

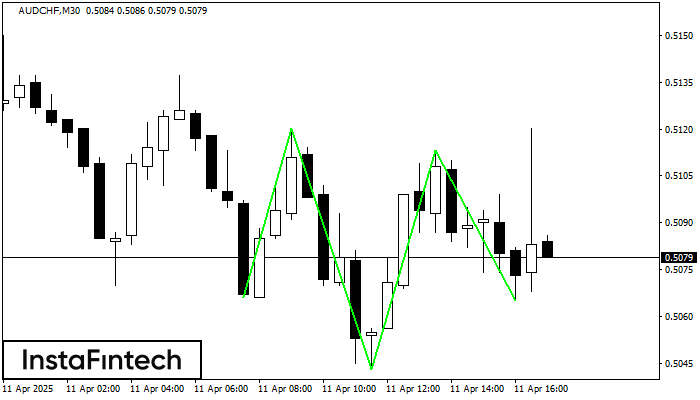

Kepala dan Bahu Terbalik

was formed on 11.04 at 15:59:57 (UTC+0)

signal strength 3 of 5

Menurut grafik M30, AUDCHF menghasilkan pola yang disebut Kepala dan Bahu Terbalik. The Head ditetapkan di 0.5043 sementara garis median The Neck ditetapkan di 0.5120/0.5113. Formasi Pola Kepala dan Bahu

Open chart in a new window

Bawah Triple

was formed on 11.04 at 15:59:46 (UTC+0)

signal strength 3 of 5

Pola Bawah Triple telah terbentuk pada grafik instrumen trading USDCHF M30. Pola tersebut menandakan perubahan dalam trend dari menurun menjadi naik jika terjadi pemecahan (breakdown) 0.8256/0.8211

Open chart in a new window

Bawah Triple

was formed on 11.04 at 15:45:01 (UTC+0)

signal strength 2 of 5

Pola Bawah Triple telah terbentuk pada grafik instrumen trading USDCHF M15. Pola tersebut menandakan perubahan dalam trend dari menurun menjadi naik jika terjadi pemecahan (breakdown) 0.8256/0.8211

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window