Inverse Head and Shoulder

was formed on 19.03 at 21:00:45 (UTC+0)

signal strength 3 of 5

According to M30, AUDCHF is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.5584/0.5578 is broken out, the instrument is likely to move toward 0.5608.

ดูเพิ่มเติม

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

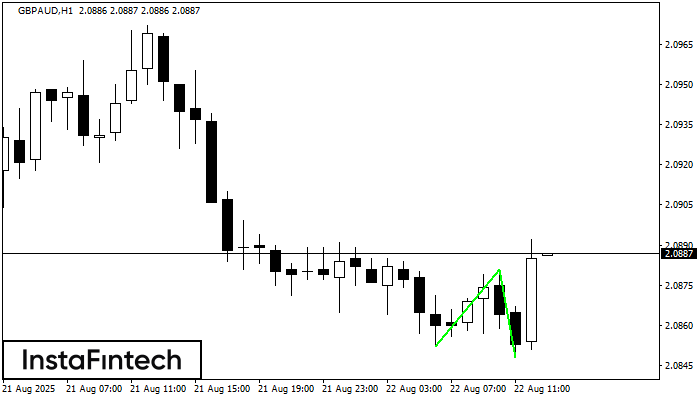

Đáy đôi

was formed on 22.08 at 12:00:25 (UTC+0)

signal strength 4 of 5

Mô hình Đáy đôi đã được hình thành trên GBPAUD H1. Đặc điểm: mức hỗ trợ 2.0852; mức kháng cự 2.0881; chiều rộng của mô hình 29 điểm

Open chart in a new window

Tam giác Cân Tăng

was formed on 22.08 at 09:45:52 (UTC+0)

signal strength 1 of 5

Theo biểu đồ của M5, AUDCAD đã hình thành mô hình Tam giác Cân Tăng. Đường biên giới thấp hơn của mô hình chạm tọa độ 0.8920/0.8929 trong khi đường

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

Open chart in a new window

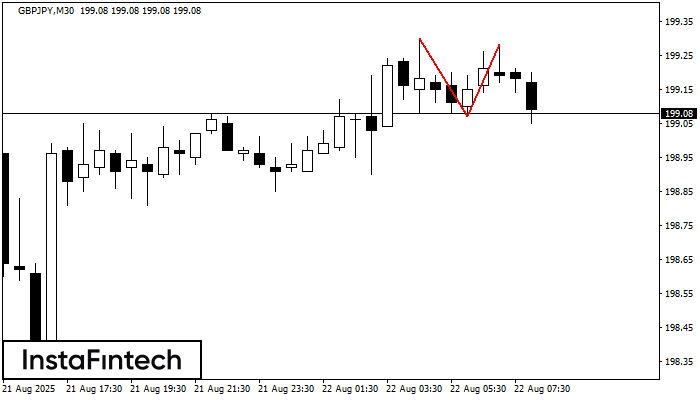

Đỉnh đôi

was formed on 22.08 at 07:30:33 (UTC+0)

signal strength 3 of 5

Mô hình đảo chiều Đỉnh đôi đã được hình thành trên GBPJPY M30. Đặc điểm: ranh giới trên 199.30; ranh giới dưới 199.07; chiều rộng của mô hình

Open chart in a new window