Vea también

10.04.2025 12:59 AM

10.04.2025 12:59 AMTrouble often comes in pairs or groups. The decline of American exceptionalism is only one of the challenges facing EUR/USD bears. The main currency pair remains resilient and occasionally goes on the offensive, even amid declining European stock indices and escalating trade tensions between the U.S. and China. The root of the issue lies in the sell-off of U.S. Treasury bonds. This market is no longer a safe haven for frightened investors. At this rate, the dollar may soon lose its status as the world's primary reserve currency.

An eye for an eye, a tooth for a tooth. China was not intimidated by the U.S. raising tariffs by another 50%, bringing the total to 104%. In response, Beijing retaliated by increasing its tariffs on U.S. imports to 84%. Moreover, the rising yield on U.S. Treasuries signals that China may begin offloading its holdings of U.S. debt — which could be even more damaging than the tariffs themselves.

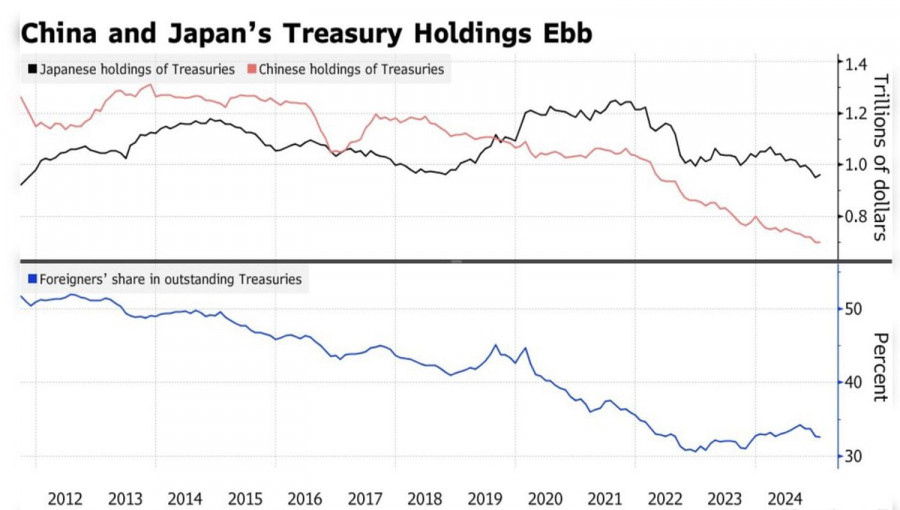

China and Japan are the largest holders of U.S. government bonds, and non-residents collectively own over 30% of the market. After the White House announced its new tariffs on America's "Liberation Day," investors faced a natural question: will other countries still want to fund the U.S. economy by continuing to purchase or hold its debt?

Beijing and Tokyo had previously funneled their trade surpluses with the U.S. into Treasury purchases. However, once the current account balance is factored in, they may be forced to dump those holdings. Rising yields on 10-year notes could even trigger Federal Reserve intervention. Deutsche Bank is predicting the launch of a new quantitative easing (QE) program.

Thus, while non-residents' initial response to Trump's sweeping tariffs was to dump U.S. stocks en masse, U.S. bonds had become the next target by early April. The capital outflow from North America is putting pressure on the U.S. dollar, whose throne has begun to wobble. Given current developments in the global economy, the "greenback" may risk losing its role as the world's primary reserve currency.

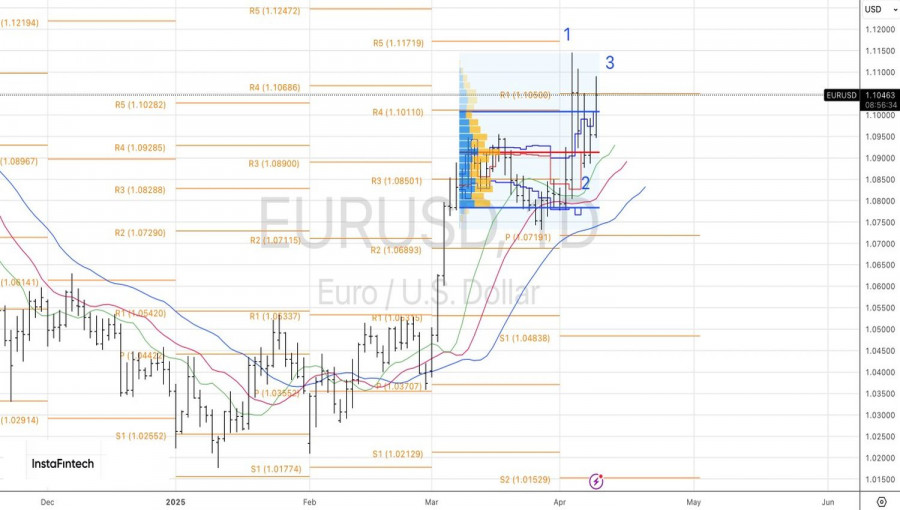

Bank of America believes losing trust and other factors will drive EUR/USD to rally toward 1.12, 1.50, and 1.20 over the next 3, 6, and 12 months, respectively. Conversely, ING sees 1.09 as the fair value for the pair, where it is likely to remain in the near term. Bears may find support in expectations of an ECB deposit rate cut in April, while the Fed is expected to keep its federal funds rate unchanged.

Technically, a 1-2-3 reversal pattern may be forming on the daily EUR/USD chart, but for that to materialize, bears would need to push prices below the fair value level of 1.092. That seems unlikely, so long positions opened from 1.097 should be held and potentially increased. Target levels are 1.130 and 1.160.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

El par de divisas GBP/USD continuó su crecimiento el miércoles, que había comenzado el martes. Recordemos que el martes el mercado no tenía ninguna razón de peso para deshacerse masivamente

El par de divisas EUR/USD continuó su recuperación durante el miércoles en un contexto de calendario macroeconómico absolutamente vacío. Ni siquiera destacamos el único informe del día sobre la inflación

El lunes, la moneda estadounidense se fortaleció considerablemente tras el éxito en la primera ronda de negociaciones entre EE. UU. y China, aunque, en esencia, ambas partes solo acordaron

Ferrari F8 TRIBUTO

de InstaForex

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.