Vea también

24.01.2025 12:49 PM

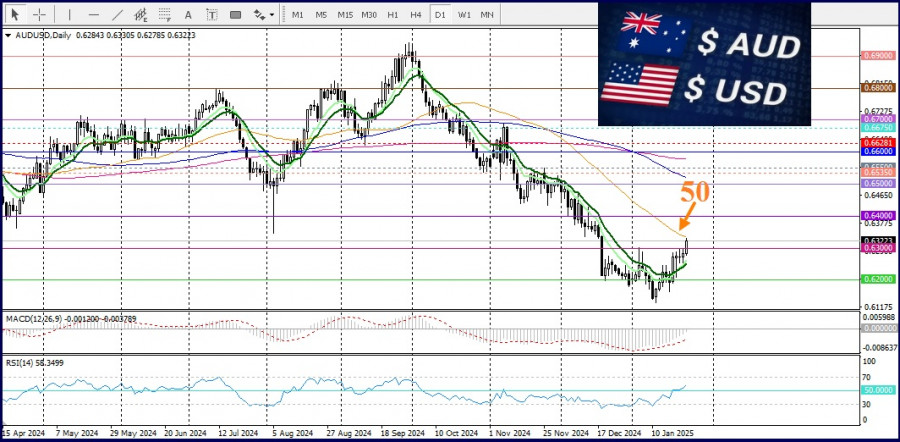

24.01.2025 12:49 PMThe AUD/USD pair has broken out of its two-day trading range, reaching a new monthly high. Spot prices are displaying positive momentum, pushing beyond the 50-day Simple Moving Average (SMA) and positioning for further gains amid U.S. dollar weakness.

The U.S. Dollar Index, which tracks the greenback against a basket of currencies, is falling to a new monthly low on expectations that the Federal Reserve will cut interest rates by the end of the year.

These expectations have been bolstered by comments from U.S. President Donald Trump, who called for immediate rate cuts. Combined with overall market optimism, this has weakened the dollar's safe-haven status and supported the rally in AUD/USD.

Global risk sentiment received an additional boost after Trump stated his preference for avoiding tariffs on China and highlighted the possibility of reaching a trade agreement. These remarks have eased inflationary concerns and contributed to a decline in U.S. Treasury yields, further pressuring the dollar. Additionally, technical buying above the 0.6300 level has driven the intraday rise in AUD/USD. The Relative Strength Index (RSI) has confidently crossed the 50-level on the daily chart in a positive direction, while the 9-day Exponential Moving Average (EMA) has moved above the 14-day EMA, further signaling potential for continued growth.

With the recent gains, spot prices have risen by approximately 200 points from the lowest levels reached earlier this month and are on track to break a three-week losing streak.

For better trading opportunities today, attention should focus on the release of preliminary U.S. PMI data, which could provide additional momentum during the early North American session. Moving into next week, Monday's official Chinese PMI figures will be key to influencing sentiment regarding the Australian dollar, a currency closely tied to China's economic performance.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

El par de divisas GBP/USD continuó su crecimiento el miércoles, que había comenzado el martes. Recordemos que el martes el mercado no tenía ninguna razón de peso para deshacerse masivamente

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.