Vea también

26.03.2024 04:37 PM

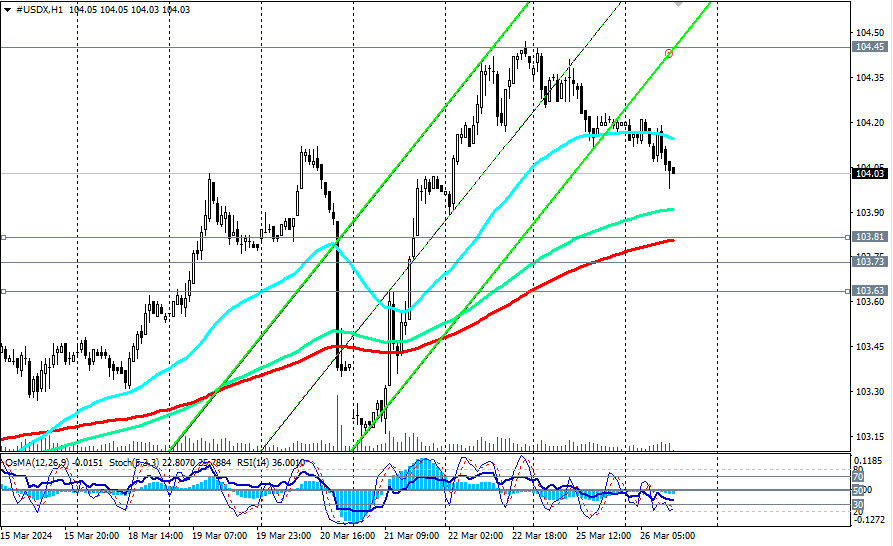

26.03.2024 04:37 PMAt the beginning of the week, the last in this month and quarter, the dollar is slightly losing its positions, declining for the second trading day from the local 4-week high of 104.20 reached last week.

Market and economists' expectations regarding the start of the Fed's monetary policy easing have shifted mainly to the second half of the year.

However, if inflation continues to accelerate and the U.S. economy and labor market demonstrate the same resilience, the start of the Fed's monetary policy easing cycle may be pushed even further into the future, perhaps even to the next year. This, in turn, will provide support to the dollar.

As of writing, the dollar index (CFD #USDX in the MT4 terminal) was trading near the 104.00 mark, declining towards the support zone around the levels of 103.81 (200 EMA on the 1-hour chart), 103.73 (200 EMA on the daily chart), 103.63 (200 EMA on the 4-hour chart).

If today's macroeconomic statistics from the U.S. at the beginning of the American trading session turn out to be weak, then we should expect the above-mentioned support levels to be reached.

In turn, their breakdown may signal an increase in short positions with targets at key support levels of 102.00 (144 EMA on the weekly chart), 100.90 (200 EMA on the weekly chart), 100.00, still separating the long-term bullish market from the bearish one and making long-term long positions preferable.

In an alternative scenario, the first signal for new purchases here may be the breakout of the local resistance level of 104.24, and the breakout of the local resistance level of 104.45 (upper boundary of the downward channel on the weekly chart) will confirm this.

Here, the growth target may be the local resistance level of 104.95 and the level of 105.00.

Support levels: 104.00, 103.81, 103.73, 103.63, 103.00, 102.60, 102.30, 102.00, 101.90, 101.00, 100.90, 100.00

Resistance levels: 104.24, 104.45, 104.95, 105.00, 106.00, 106.80, 107.00, 107.30

Trading Scenarios

Alternative scenario: Buy Stop 104.30. Stop-Loss 103.90. Targets 104.45, 104.95, 105.00, 106.00, 106.80, 107.00, 107.30

Main scenario: Sell Stop 103.90. Stop-Loss 104.30. Targets 103.81, 103.73, 103.63, 103.00, 102.60, 102.30, 102.00, 101.90, 101.00, 100.90, 100.00

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but they can serve as a guide when planning and placing your trading positions.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD también reanudó su movimiento ascendente el miércoles. El crecimiento de la libra esterlina, que en realidad sigue siendo una caída del dólar estadounidense, comenzó durante

El par de divisas EUR/USD reanudó su movimiento ascendente durante el miércoles, y ahora se puede decir que existe una tendencia alcista no solo en el marco temporal

GBP/USD: plan para la sesión europea del 9 de mayo. Informes COT (Commitment of Traders, análisis de las operaciones de ayer). La libra se desplomó tras la bajada de tasas

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.1269

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel 1.3335

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel 1.1379

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.3282

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.1320

GBP/USD: plan para la sesión europea del 30 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra se prepara para un nuevo salto, pero

Ayer se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió allí. En mi pronóstico de a mañana presté atención

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.