AUDHKD (Australian Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/HKD is not a very popular currency pair on Forex market. AUD/HKD represents the cross rate against the U.S. dollar. Although the U.S. dollar is not obviously presented within this currency pair, it still has a significant influence on it. Thus, by combining AUD/USD and USD/HKD charts, you can get an approximate AUD/HKD chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the U.S. major economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces and many others. Is necessary to note that AUD and HKD can respond differently towards the changes in the U.S. economy, therefore, AUD/HKD currency pair can be a specific indicator reflecting changes within the two currencies.

Hong Kong is famous for having one of the largest stock exchanges. The country leapfrogs a number of major European and American stock exchanges. As of today, Hong Kong takes a leading position among the top financial centers all over the world.

Hong Kong's economy is based on the free market principle, low taxation, and the non-interventional policy. Hong Kong lacks a mineral and food resources, which is why its economy depends on the mentioned above factors. Most of Hong Kong's income is generated by service industries, as well as re-exports from China. In addition, the tourism sector is well developed, too.

AUD/HKD is relatively illiquid compared with major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, while analyzing this financial instrument, one should focus primarily on the currency pairs that include the U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for this currency pair than for more popular ones, so before you start working with the cross rates, learn carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

1933

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1843

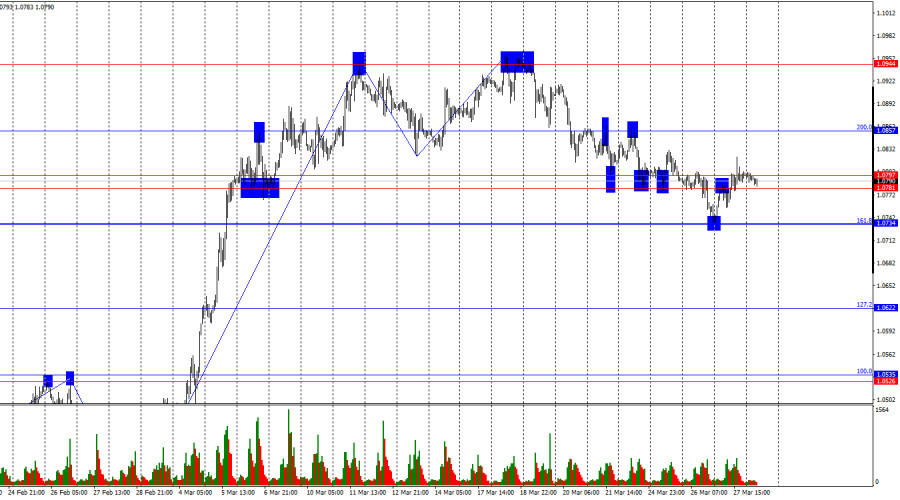

The EUR/USD pair rose by 60 basis points over the course of Thursday.Author: Chin Zhao

20:10 2025-03-28 UTC+2

1798

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1693

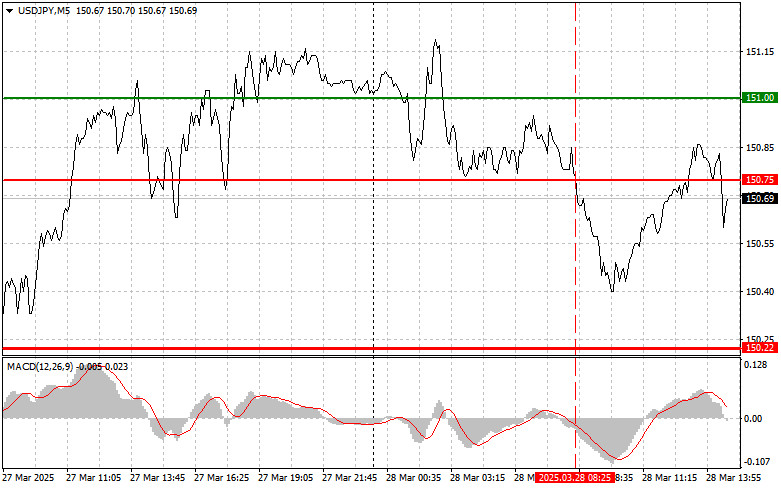

USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:04 2025-03-28 UTC+2

1573

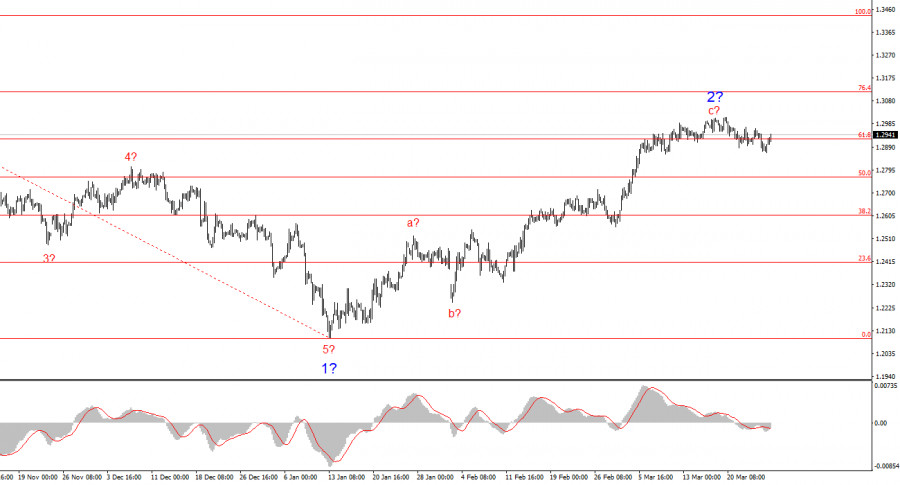

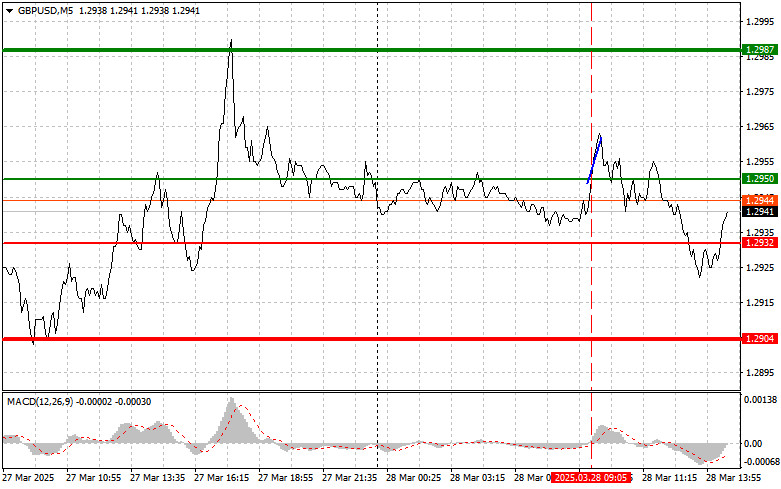

The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.Author: Chin Zhao

20:07 2025-03-28 UTC+2

1483

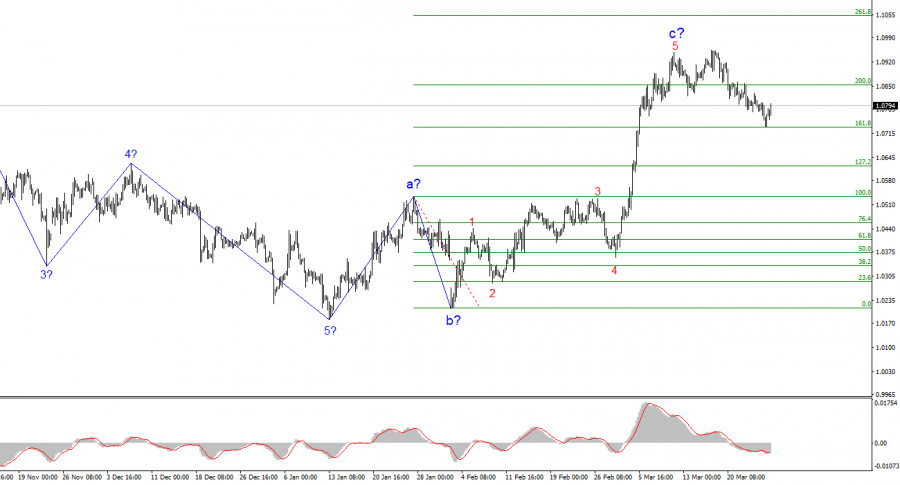

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1483

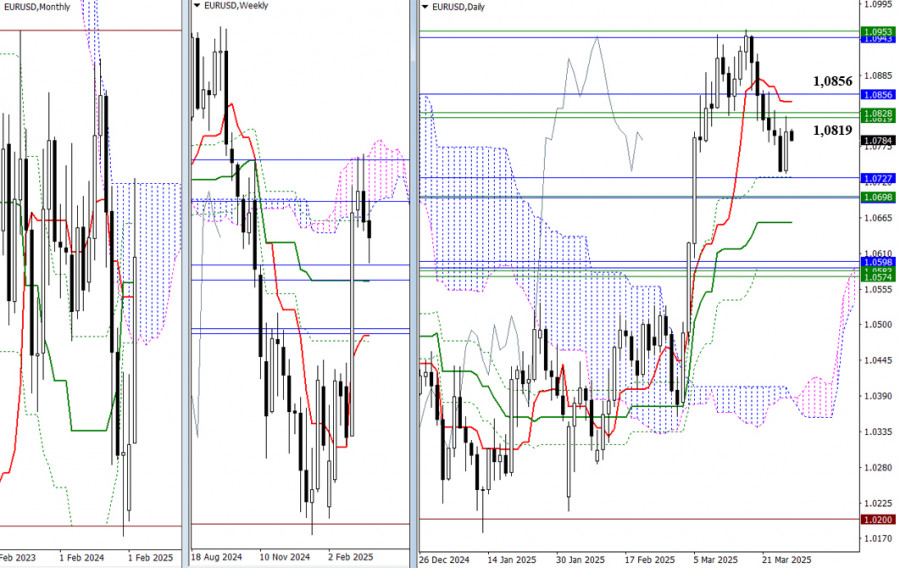

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1408

GBPUSD: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:00 2025-03-28 UTC+2

1393

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

1933

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1843

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

1798

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1693

- USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:04 2025-03-28 UTC+2

1573

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1483

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1483

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1408

- GBPUSD: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:00 2025-03-28 UTC+2

1393