EURMXN (Euro vs Mexican Peso). Exchange rate and online charts.

Currency converter

02 Apr 2025 21:54

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/MXN is not in a great demand on Forex, however, it represents a cross rate against the U.S. dollar. Despite the U.S. dollar is not obviously presented in this currency pair, it still has a significant influence on it. Thus, an approximate EUR/MXN price chart can be generated by combining EUR/USD and USD/MXN price charts.

The U.S. dollar has a significant influence on both currencies. Thus, to analyze EUR/MXN correctly, one should keep a close eye on such U.S. economic indicators as the discount rate, GDP, unemployment, new created workplaces and the others. However, it should be noted that the currencies can respond differently to changes in the U.S. economy, therefore, EUR/MXN currency pair may be a specific indicator of changes within the given currencies.

Nowadays, Mexico is one of the most developed countries in Latin America. The country ranks first among Latin American countries in terms of per capita income. The Mexican economy is largely composed of private sector due to mass privatization of state enterprises happened in the 80s of last century as a measure to overcome the economic crisis. The greater part of the former state owned enterprises are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country is involved in active trading with its rich neighbors - the United States and Canada, which results in a significant part of government revenue in Mexico.

Mexico is the largest exporter of oil in its region. To date, oil sector generates most of the country's revenues . However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. This makes the government of the country to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to forecasts, with such a policy, Mexico will soon be forced to import oil from abroad to meet the needs of its economy. All these circumstances have a significant impact on the currency of Mexico, which is largely dependent on world oil prices, which are formed on global financial markets. In addition, the Mexican peso exchange rate is highly dependent on the international ranking of the country, which is based on complex economic formulas calculated by major rating agencies.

It is necessary to remember that brokers usually set a higher spread on the cross rates rather than on the more popular currency pairs. So before you start working with the cross rates, read carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

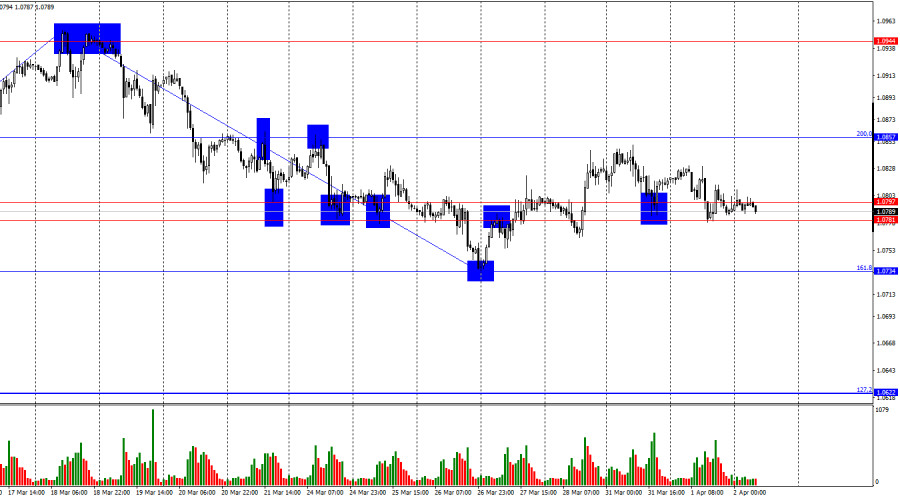

- Forecast for EUR/USD on April 2, 2025

Author: Samir Klishi

11:23 2025-04-02 UTC+2

958

Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin.Author: Sebastian Seliga

11:34 2025-04-02 UTC+2

868

XAU/USD. Analysis and ForecastAuthor: Irina Yanina

13:22 2025-04-02 UTC+2

838

- Today, the AUD/USD pair is showing positive momentum, rebounding from nearly a four-week low.

Author: Irina Yanina

12:25 2025-04-02 UTC+2

823

Today the USD/CAD pair is attempting to halt yesterday's decline, trying to hold above the 1.4300 level.Author: Irina Yanina

12:22 2025-04-02 UTC+2

778

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 2-5, 2025: sell below $3,140 or buy above $3,110 (21 SMA - symmetrical triangle)

The symmetrical triangle pattern observed on the H4 chart shows that gold could experience a strong bullish impulse to reach 3,169, where resistance R_1 is located. Below this area, a technical correction could occur.Author: Dimitrios Zappas

15:15 2025-04-02 UTC+2

688

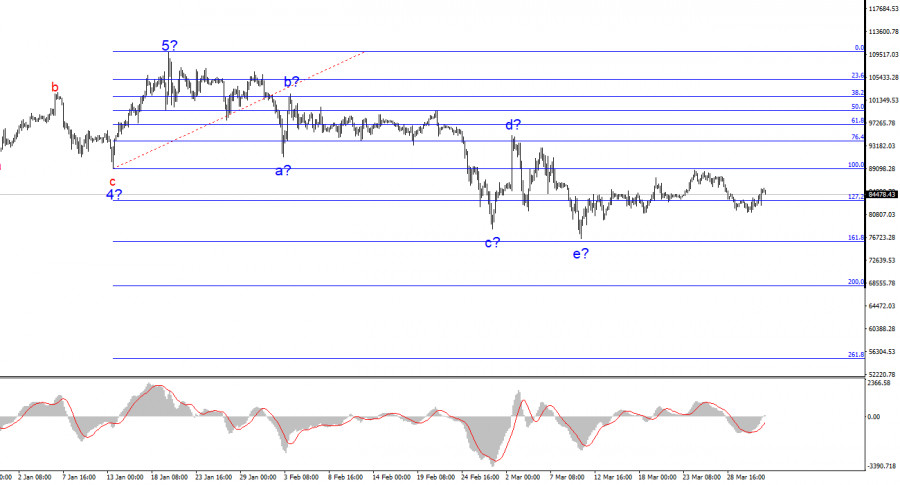

The BTC/USD pair managed to halt its decline, and the current wave structure suggests a potential rise in the world's leading cryptocurrency.Author: Chin Zhao

12:17 2025-04-02 UTC+2

673

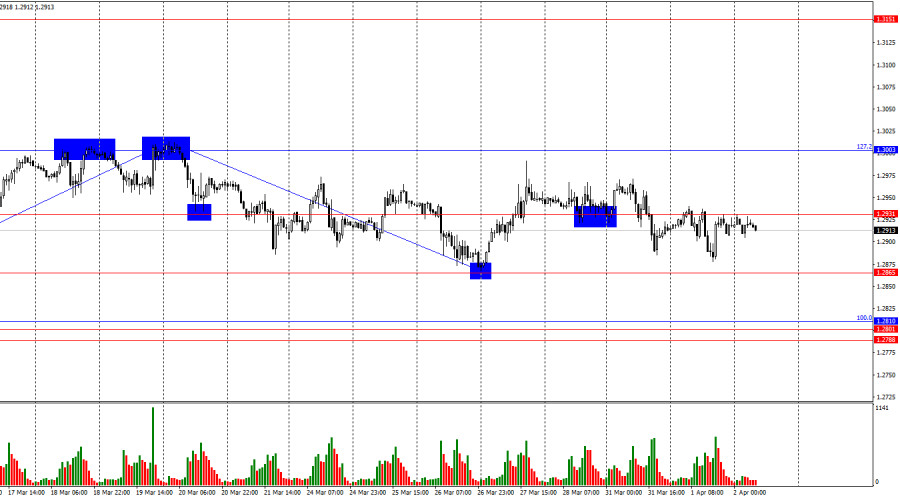

Forecast for GBP/USD on April 2, 2025Author: Samir Klishi

11:17 2025-04-02 UTC+2

673

- Forecast for EUR/USD on April 2, 2025

Author: Samir Klishi

11:23 2025-04-02 UTC+2

958

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin.

Author: Sebastian Seliga

11:34 2025-04-02 UTC+2

868

- XAU/USD. Analysis and Forecast

Author: Irina Yanina

13:22 2025-04-02 UTC+2

838

- Today, the AUD/USD pair is showing positive momentum, rebounding from nearly a four-week low.

Author: Irina Yanina

12:25 2025-04-02 UTC+2

823

- Today the USD/CAD pair is attempting to halt yesterday's decline, trying to hold above the 1.4300 level.

Author: Irina Yanina

12:22 2025-04-02 UTC+2

778

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 2-5, 2025: sell below $3,140 or buy above $3,110 (21 SMA - symmetrical triangle)

The symmetrical triangle pattern observed on the H4 chart shows that gold could experience a strong bullish impulse to reach 3,169, where resistance R_1 is located. Below this area, a technical correction could occur.Author: Dimitrios Zappas

15:15 2025-04-02 UTC+2

688

- The BTC/USD pair managed to halt its decline, and the current wave structure suggests a potential rise in the world's leading cryptocurrency.

Author: Chin Zhao

12:17 2025-04-02 UTC+2

673

- Forecast for GBP/USD on April 2, 2025

Author: Samir Klishi

11:17 2025-04-02 UTC+2

673