CADMXN (Canadian Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

14 Apr 2025 19:02

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/MXN currency pair is rather popular on Forex market. This pair is the cross rate against the U.S. dollar. There is no U.S. Dollar in this currency pair, however CAD/MXN is under its great influence. You can see that graphically: just combine two charts (CAD/USD and USD/MXN) in the same price chart, and you will get the approximate CAD/MXN chart.

The U.S. dollar affects both currencies profoundly. So for a better forecasting the future rate of this currency pair you need to consider the main indicators of the U.S. economy. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Remember that the CAD/MXN currency pair can react in a different way to the U.S. economic changes.

Since Canada has been one of the largest world oil exporters, the world oil prices significantly influence the Canadian dollar. That is why the value of the Canadian dollar varies in direct proportion to the oil prices.

Mexico has the highest income per capita in Latin America that put this country among the most developed countries of that region. In the 80s to overcome the economic crisis, most of the Mexican state enterprises got privatized. Therefore, private sector comprises the bigger part of the Mexican economy. A great part of the former state-owned enterprises now belongs to the foreign companies.

Thanks to Mexican membership in the North American Free Trade Agreement (NAFTA), it has an active trade with United States and Canada, which, so to speak, generates considerable part of government revenue of Mexico.

Moreover, Mexico is the largest exporter of oil in Latin America, so the oil sector provides most of the country’s revenues. But the service sector stays the main source of Mexican income.

Despite of its huge oil and gas reserves, Mexican natural hydrocarbons are getting depleted. In order to avoid new economical problems, the Mexican government has to reduce the amount of extracted oil and natural gas. According to the experts, such restrictive policy can soon make Mexico to import oil from abroad to meet the needs of its economy. So you can see that the Mexican peso is dependent on the world oil prices. Furthermore, its exchange rate is closely dependent on the international ranking of Mexico, which is based on complex economic analysis and published by the most authoritative rating agencies.

Please note that the spread for cross currency pairs is usually higher than for more popular ones. So before you start dealing with the cross rates, study properly the broker’s conditions of trading with the specified trade instrument.

See Also

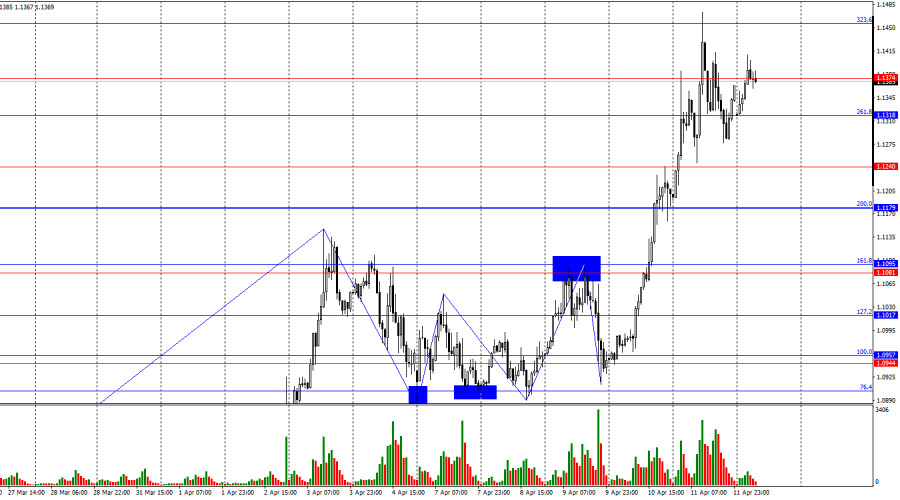

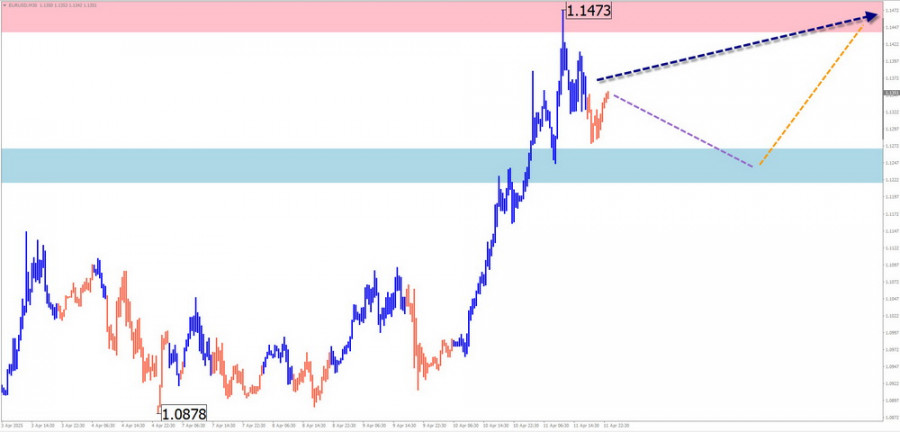

- Forecast for EUR/USD on April 14, 2025

Author: Samir Klishi

12:28 2025-04-14 UTC+2

988

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14th

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14thAuthor: Isabel Clark

12:16 2025-04-14 UTC+2

898

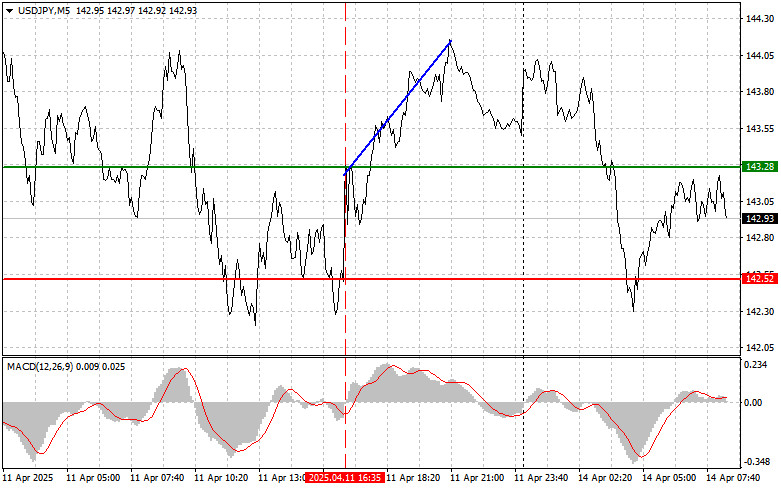

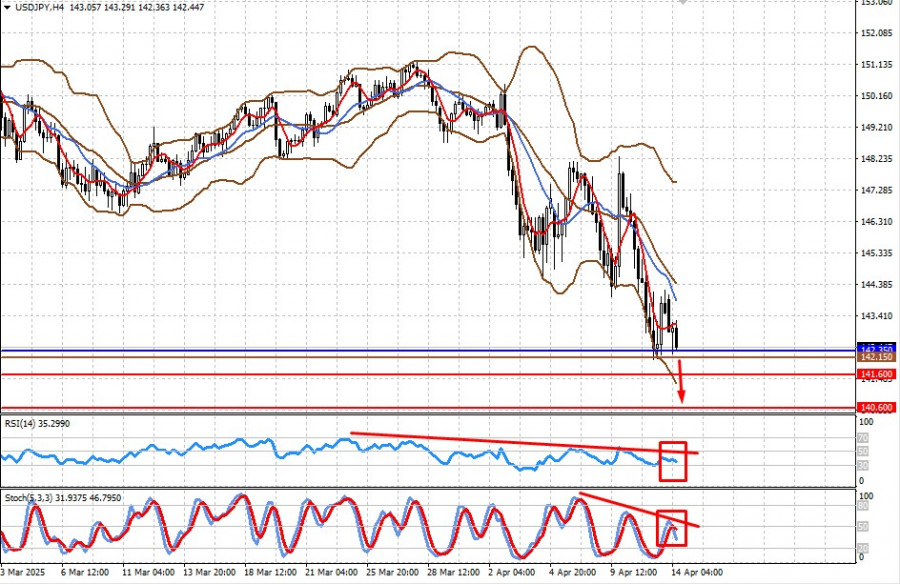

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

883

- Type of analysis

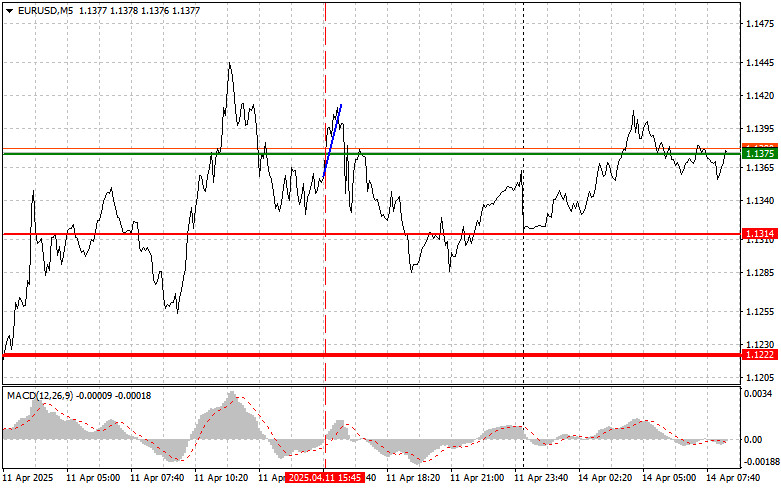

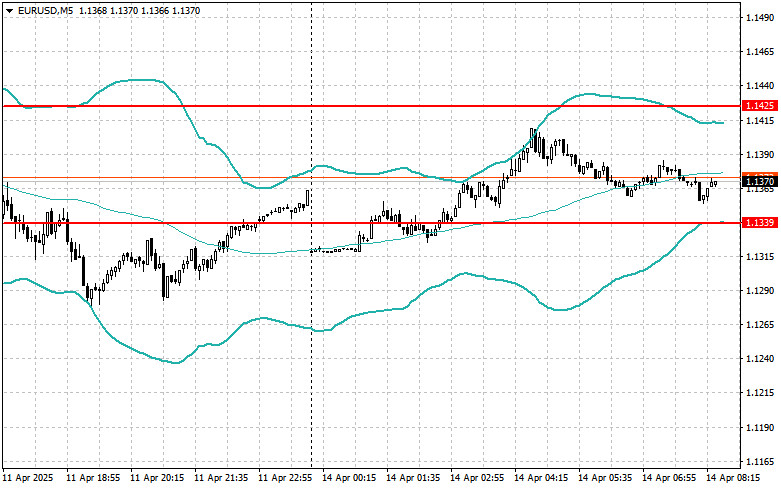

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

883

Technical analysisTechnical Analysis of Intraday Price Movement of Palladium vs USD Commodity Instrument, Monday April 24, 2025.

With the appearance of Divergence from the Stochastic Oscillator indicator with theAuthor: Arief Makmur

07:19 2025-04-14 UTC+2

823

Fundamental analysisThe Uncertainty Factor Will Pressure the Dollar and Support Demand for Safe-Haven Assets (There is a likelihood of further decline in USD/JPY and rising gold prices)

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff dutiesAuthor: Pati Gani

09:45 2025-04-14 UTC+2

808

- Technical analysis

Technical Analysis of Intraday Price Movement of Crude Oil Commodity Instrument, Monday April 24, 2025.

On the 4-hour chart of the Crude Oil commodity instrument,Author: Arief Makmur

07:19 2025-04-14 UTC+2

778

Intraday Strategies for Beginner Traders on April 14Author: Miroslaw Bawulski

07:31 2025-04-14 UTC+2

778

USD/JPY. Analysis and ForecastAuthor: Irina Yanina

12:31 2025-04-14 UTC+2

778

- Forecast for EUR/USD on April 14, 2025

Author: Samir Klishi

12:28 2025-04-14 UTC+2

988

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14th

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14thAuthor: Isabel Clark

12:16 2025-04-14 UTC+2

898

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

883

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

883

- Technical analysis

Technical Analysis of Intraday Price Movement of Palladium vs USD Commodity Instrument, Monday April 24, 2025.

With the appearance of Divergence from the Stochastic Oscillator indicator with theAuthor: Arief Makmur

07:19 2025-04-14 UTC+2

823

- Fundamental analysis

The Uncertainty Factor Will Pressure the Dollar and Support Demand for Safe-Haven Assets (There is a likelihood of further decline in USD/JPY and rising gold prices)

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff dutiesAuthor: Pati Gani

09:45 2025-04-14 UTC+2

808

- Technical analysis

Technical Analysis of Intraday Price Movement of Crude Oil Commodity Instrument, Monday April 24, 2025.

On the 4-hour chart of the Crude Oil commodity instrument,Author: Arief Makmur

07:19 2025-04-14 UTC+2

778

- Intraday Strategies for Beginner Traders on April 14

Author: Miroslaw Bawulski

07:31 2025-04-14 UTC+2

778

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

12:31 2025-04-14 UTC+2

778