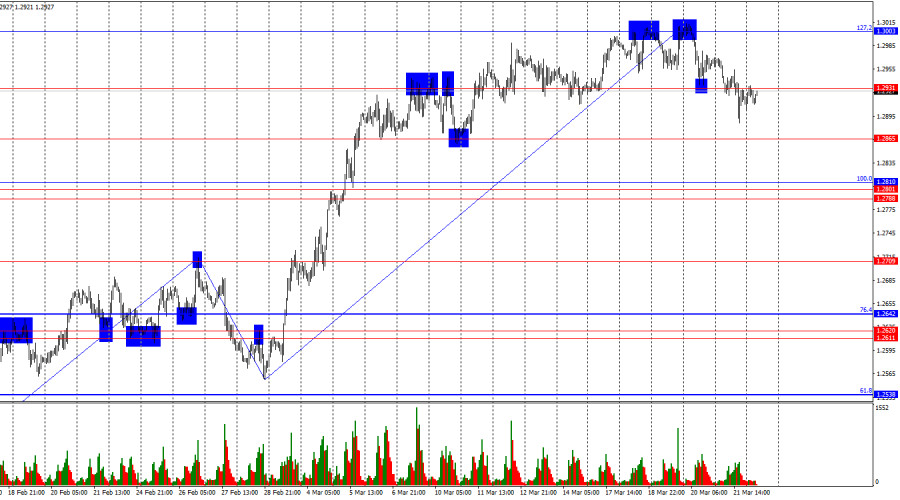

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1168

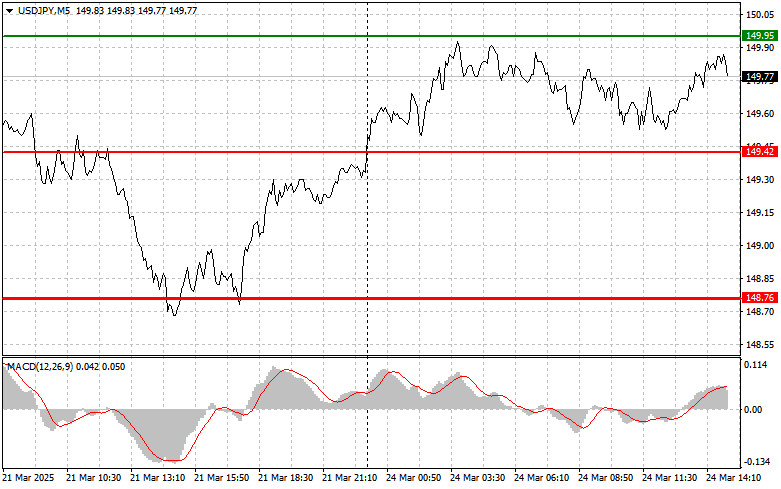

USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:13 2025-03-24 UTC+2

883

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

868

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

838

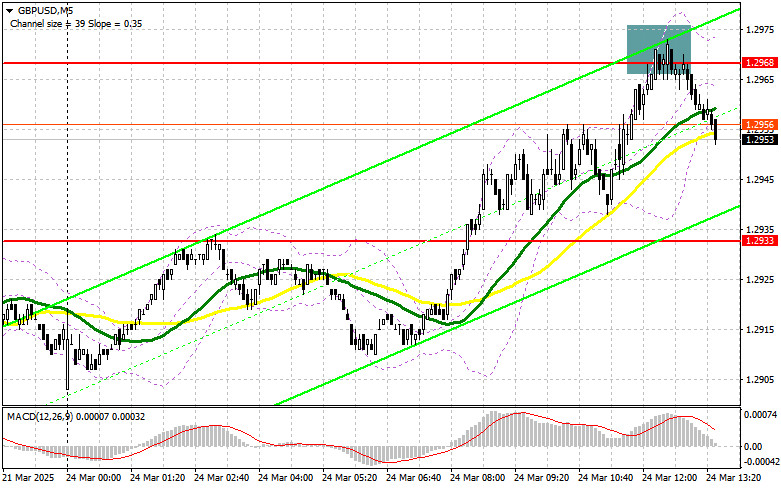

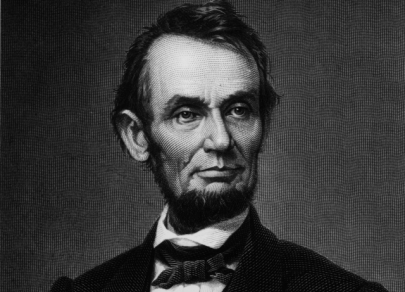

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

763

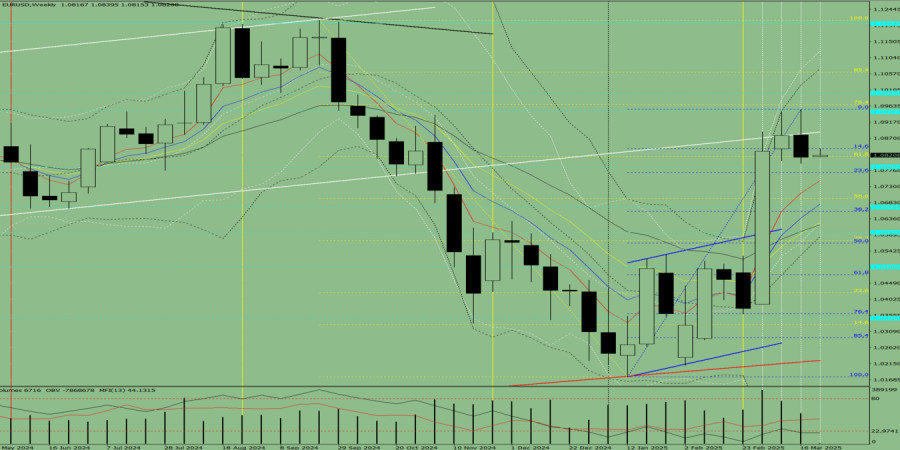

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

733

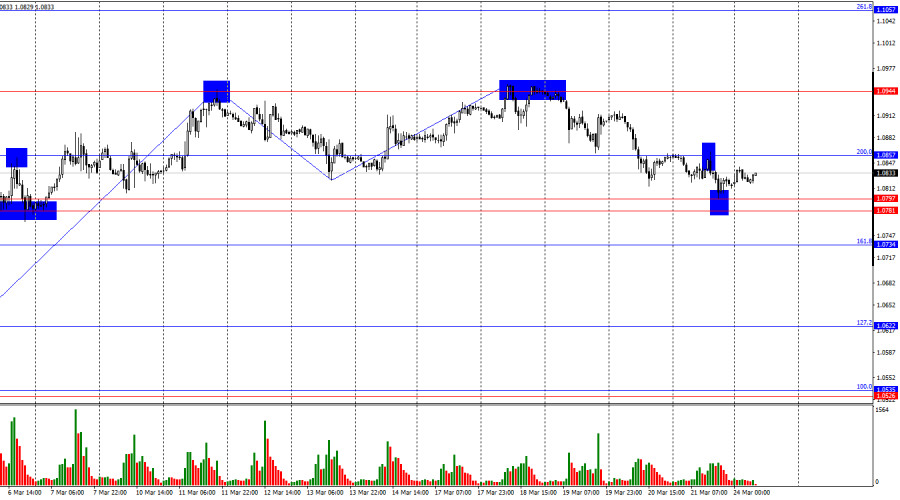

Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:22 2025-03-24 UTC+2

718

Diverging expectations regarding the policies of the Bank of Japan and the Federal Reserve may limit further growth of the pair.Author: Irina Yanina

14:20 2025-03-24 UTC+2

718

See also