Veja também

18.03.2025 07:40 PM

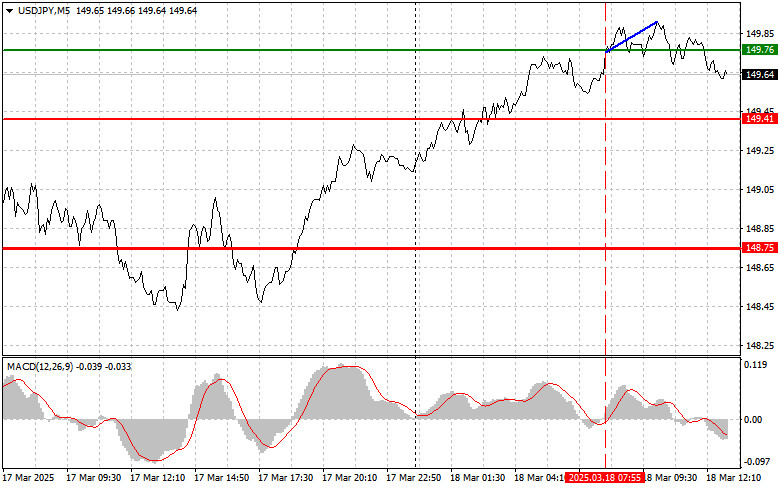

18.03.2025 07:40 PMThe test of the 149.76 price level occurred when the MACD indicator had just started moving up from the zero mark, confirming a valid buy entry for the dollar. As a result, the pair rose by 15 points, but that was the extent of the movement.

During the U.S. trading session, data on building permits and industrial production in the U.S. will be released. Together, these reports will provide investors with a clearer picture of the current state of the U.S. economy. Industrial production is a key economic indicator, as it reflects the health of the manufacturing sector. An increase in industrial production typically signals rising demand for goods and services, supporting economic growth and boosting the U.S. dollar.

However, the upcoming Bank of Japan (BoJ) meeting is the most crucial event that could significantly impact USD/JPY dynamics.

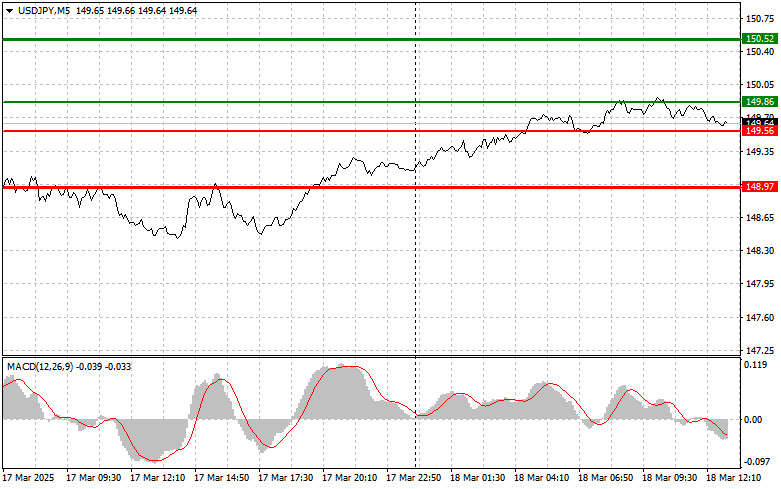

Regarding intraday trading strategy, I will focus on Scenario #1 and Scenario #2.Scenario #1: I plan to buy USD/JPY today at 149.86 (green line on the chart) with a target of 150.52. At 150.52, I will exit my buy position and sell USD/JPY for a 30-35 point pullback. The pair is expected to rise as part of a corrective move. Important: Before buying, ensure the MACD indicator is above zero and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today if the price tests 149.56 twice, while MACD is in the oversold area. This will limit the pair's downward potential and trigger a market reversal to the upside, targeting 149.86 and 150.52.

Scenario #1: I plan to sell USD/JPY after reaching 149.56 (red line on the chart), expecting a quick decline. The main target for sellers will be 148.97, where I will exit my sell position and buy USD/JPY immediately for a 20-25 point pullback. Selling pressure could intensify at any moment. Important: Before selling, ensure the MACD indicator is below zero and just starting to decline.

Scenario #2: I also plan to sell USD/JPY today if the price tests 149.86 twice, while MACD is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward, targeting 149.56 and 148.97.Forex trading requires careful decision-making. It is best to stay out of the market before major fundamental reports to avoid unexpected price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you risk losing your entire deposit quickly, especially if you trade with large volumes and do not follow risk management rules.

For successful trading, you need a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

A libra esterlina, como já se tornou prática comum, foi negociada hoje seguindo a estratégia de reversão à média. Para outros instrumentos, incluindo o iene, não identifiquei oportunidades relevantes

Análise das operações e dicas para negociar a libra esterlina O teste de preço em 1,3584 aconteceu quando o indicador MACD já havia avançado bem acima da linha zero

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.