Inverse Head and Shoulder

was formed on 09.04 at 13:59:51 (UTC+0)

signal strength 3 of 5

According to the chart of M30, SILVER formed the Inverse Head and Shoulder pattern. The Head’s top is set at 30.37 while the median line of the Neck is found at 29.30/30.05. The formation of the Inverse Head and Shoulder pattern evidently signals a reversal of the downward trend. In other words, in case the scenario comes true, the price of SILVER will go towards 30.40

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

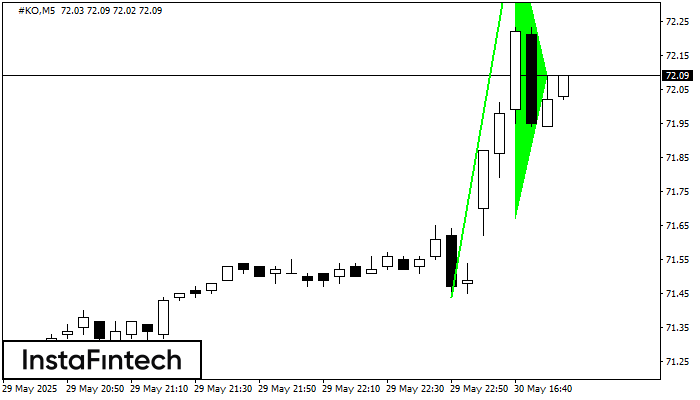

Bullish pennant

was formed on 30.05 at 15:57:40 (UTC+0)

signal strength 1 of 5

The Bullish pennant signal – Trading instrument #KO M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 72.50, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

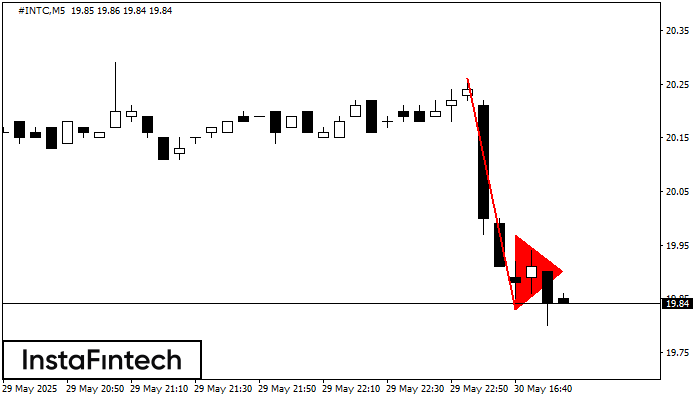

Bearish pennant

was formed on 30.05 at 15:55:30 (UTC+0)

signal strength 1 of 5

The Bearish pennant pattern has formed on the #INTC M5 chart. The pattern signals continuation of the downtrend in case the pennant’s low of 19.83 is broken through. Recommendations: Place

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

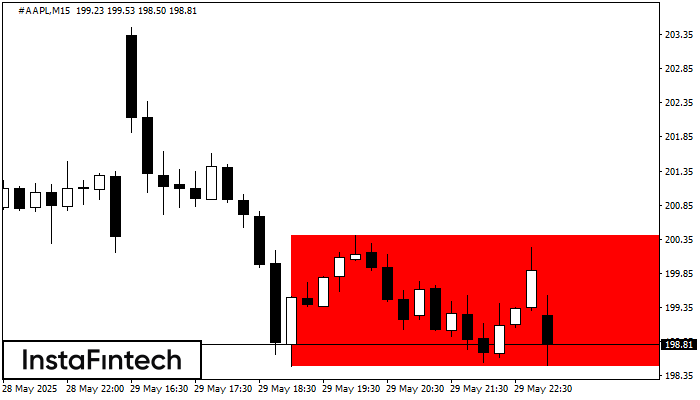

Bearish Rectangle

was formed on 30.05 at 15:34:48 (UTC+0)

signal strength 2 of 5

According to the chart of M15, #AAPL formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 200.40, the lower border is 198.49. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window