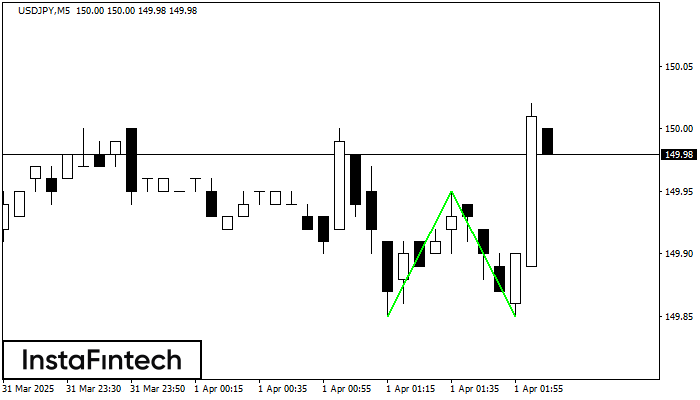

Double Bottom

was formed on 01.04 at 01:05:27 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on USDJPY M5; the upper boundary is 149.95; the lower boundary is 149.85. The width of the pattern is 10 points. In case of a break of the upper boundary 149.95, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

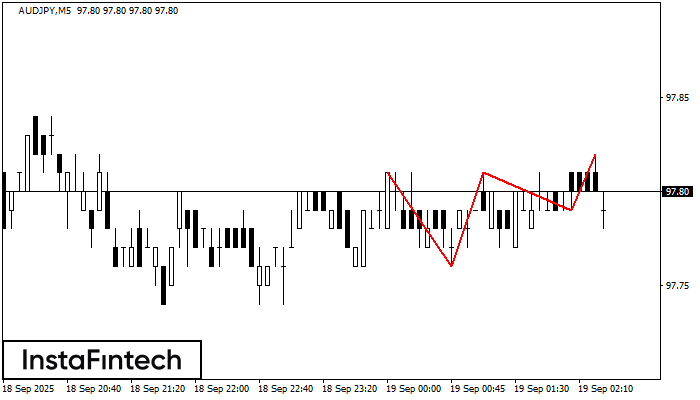

Triple Top

was formed on 19.09 at 01:30:38 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the AUDJPY M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 19.09 at 00:31:35 (UTC+0)

signal strength 3 of 5

The Triple Bottom pattern has been formed on AUDUSD M30. It has the following characteristics: resistance level 0.6660/0.6624; support level 0.6615/0.6609; the width is 45 points. In the event

Open chart in a new window

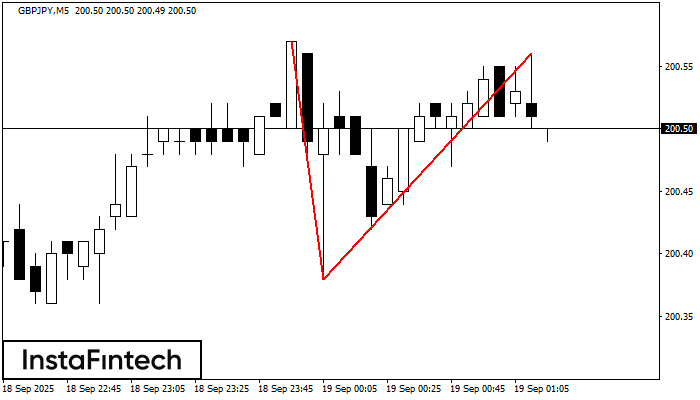

Double Top

was formed on 19.09 at 00:15:26 (UTC+0)

signal strength 1 of 5

On the chart of GBPJPY M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 200.56; the lower boundary 200.38; the width of the pattern 18 points

The M5 and M15 time frames may have more false entry points.

Open chart in a new window