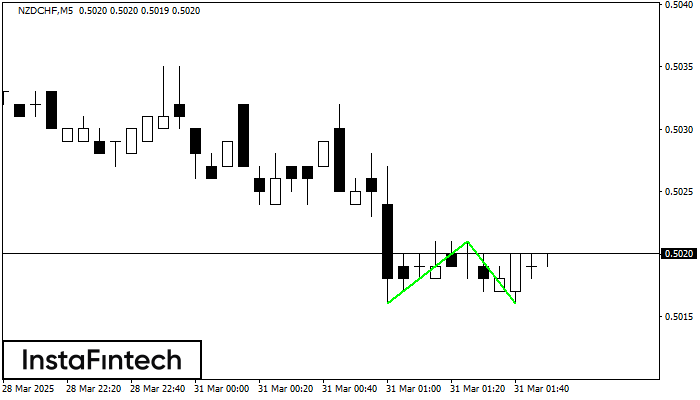

Double Bottom

was formed on 31.03 at 00:50:23 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on NZDCHF M5; the upper boundary is 0.5021; the lower boundary is 0.5016. The width of the pattern is 5 points. In case of a break of the upper boundary 0.5021, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Symmetrical Triangle

was formed on 28.04 at 14:56:35 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCAD formed the Bearish Symmetrical Triangle pattern. This pattern signals a further downward trend in case the lower border 0.8230 is breached. Here

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

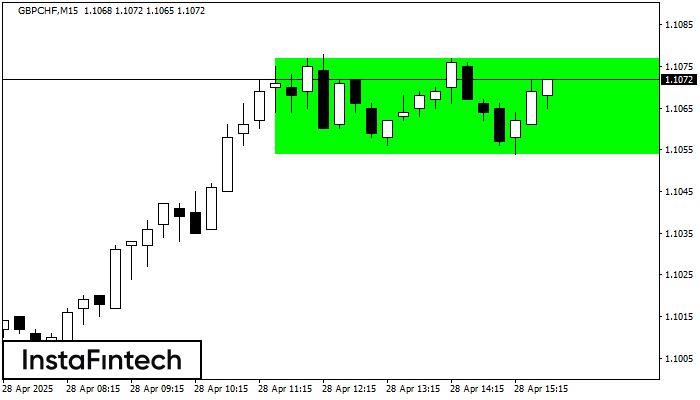

Bullish Rectangle

was formed on 28.04 at 14:53:28 (UTC+0)

signal strength 2 of 5

According to the chart of M15, GBPCHF formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 1.1077, the lower border is 1.1054. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Rectangle

was formed on 28.04 at 14:32:27 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPCHF formed the Bullish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 1.1078 and support 1.1054

The M5 and M15 time frames may have more false entry points.

Open chart in a new window