یہ بھی دیکھیں

24.02.2025 09:22 AM

24.02.2025 09:22 AMThe main U.S. stock indexes ended the week in negative territory, reflecting a surprising increase in pessimism amid signs of a slowdown in the national economy.

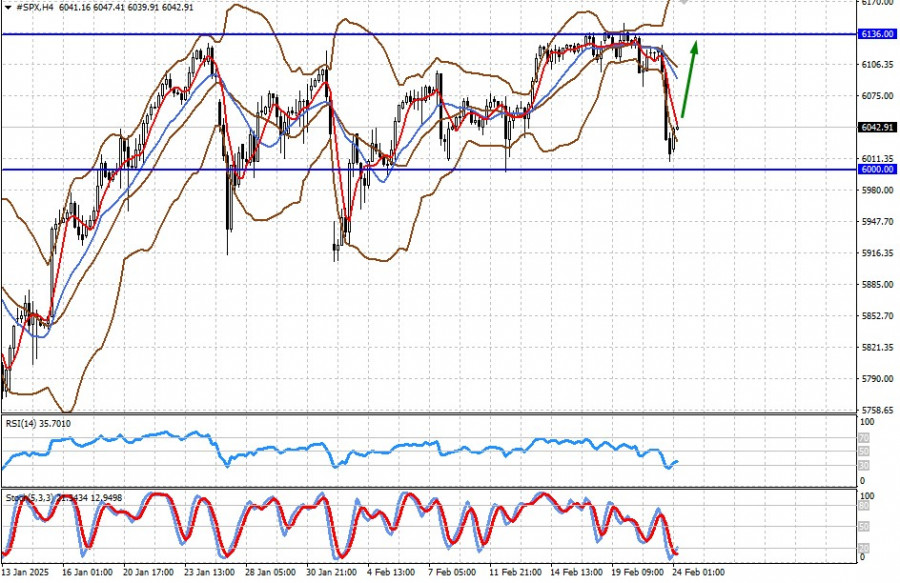

The Friday sell-off in U.S. stocks was largely driven by growing concerns about economic conditions. The Dow index fell by 1.69% by the end of trading, marking its worst weekly performance since October. Meanwhile, the S&P 500 and the Nasdaq Composite declined by 1.71% and 2.20%, respectively. This sharp drop was triggered by the release of the services PMI report for February, which showed a decrease to 49.7, falling below the threshold of 50 points. This was contrary to expectations of an increase to 53.0 from the previous 52.9 points. Additionally, disappointing forecasts from major retailer Walmart and data indicating weakening consumer sentiment amid ongoing inflationary pressures further contributed to the decline.

This week will focus on the personal consumption expenditure (PCE) report, the preferred inflation measure for the Federal Reserve's interest rate decision. The key corporate earnings reports from major retailers such as Home Depot and Lowe's are also expected to provide additional insight into consumer spending in the U.S. The market is also awaiting the quarterly earnings report from AI leader Nvidia this Wednesday, which will be especially interesting following the emergence of the Chinese company DeepSeek.

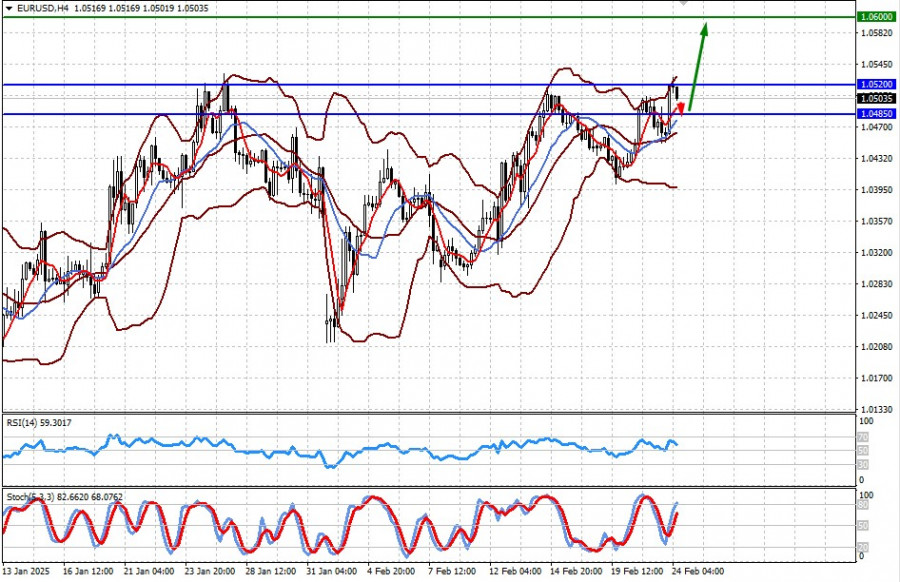

Attention should be focused on the eurozone's consumer inflation report today. According to the consensus forecast, the year-over-year consumer price index (CPI) is expected to rise to 2.5% from 2.4%, but the monthly comparison is expected to drop by 0.3% in January, compared to a 0.4% increase in December. The core CPI is expected to maintain a growth rate of 2.7% year-over-year but decrease by 1% month-over-month, compared to a 0.5% increase in the previous month.

How might the euro react to this news?

The euro has gained some support following the results of the German elections, where the Christian Democratic Union (CDU) won as anticipated. Investors are now turning their attention to the coalition-building process. It is expected that the new government will prioritize key tax reforms. These election results come against a backdrop of economic stagnation in Germany, the ongoing conflict in Ukraine involving Russia, its allies, and NATO countries, as well as an escalation of the trade war that began under Donald Trump. The proposed reforms are expected to address the prolonged period of underinvestment in the local economy, which could strengthen both the stocks of eurozone companies and the single currency in the Forex market.

Furthermore, if today's consumer inflation data in the EU does not fall below the consensus forecast, this could create a strong basis for further local strengthening of the euro in the Forex market.

The CFD contract on the S&P 500 futures is recovering in morning trading after Friday's plunge. This sharp drop will likely turn out to be local, as fundamentally, U.S. companies' stocks will likely receive support under Trump's protectionist economic policies. The previously presented corporate reports reflect the results of actions taken by the U.S. Administration in the past, so demand for cheaper stocks can be expected to recover after the local negative sentiment. On this wave, the contract may rise to 6136.00 after falling to the strong psychological level of 6000.00 points.

The pair has not yet been able to break the 1.0520 mark, but its growth above this level amid a possible increase in consumer inflation could lead to overcoming this level and pushing towards a new target at 1.0600.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

انسٹافاریکس

پی اے ایم ایم اکاؤنٹس

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.