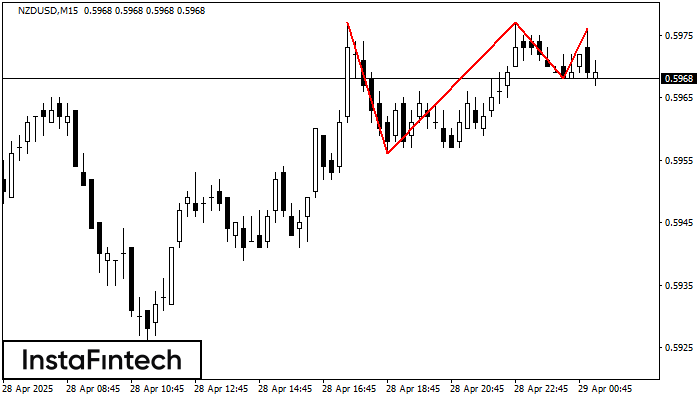

Triple Top

was formed on 29.04 at 00:30:39 (UTC+0)

signal strength 2 of 5

The Triple Top pattern has formed on the chart of the NZDUSD M15 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 1, support level -12, and pattern’s width 21. Forecast If the price breaks through the support level 0.5956, it is likely to move further down to 0.5954.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

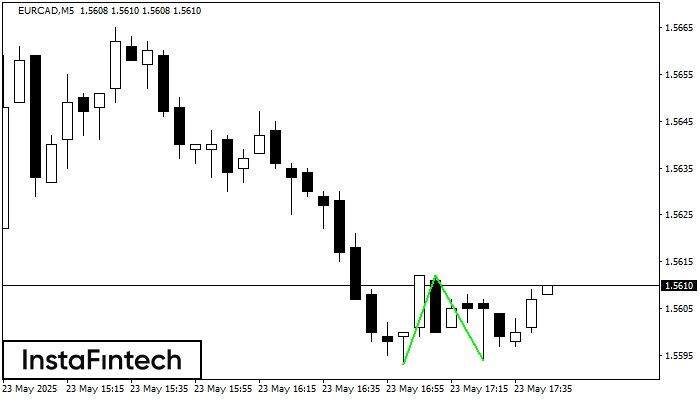

Двойное дно

сформирован 23.05 в 16:44:58 (UTC+0)

сила сигнала 1 из 5

Сформирована фигура «Двойное дно» на графике EURCAD M5. Верхняя граница 1.5612; Нижняя граница 1.5594; Ширина фигуры 19 пунктов. В случае пробоя верхней границы 1.5612 можно будет прогнозировать изменение тенденции

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

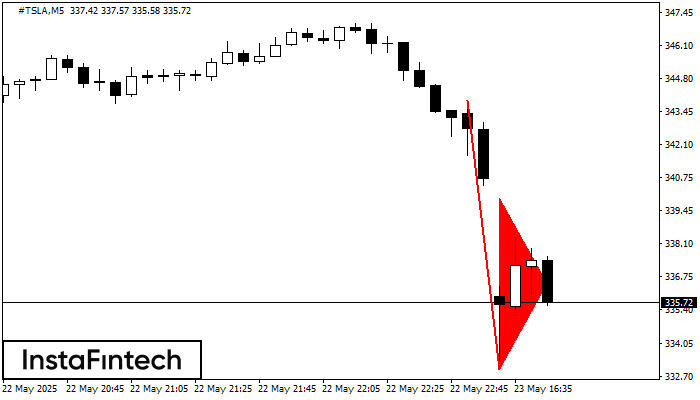

Медвежий вымпел

сформирован 23.05 в 15:46:06 (UTC+0)

сила сигнала 1 из 5

На графике #TSLA M5 сформировалась фигура «Медвежий вымпел», которая сигнализирует о возможном продолжении тренда. Характеристика: основание фигуры имеет координаты 332.99; проекция высоты флагштока равна 1089 пунктов. В случае если цена

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

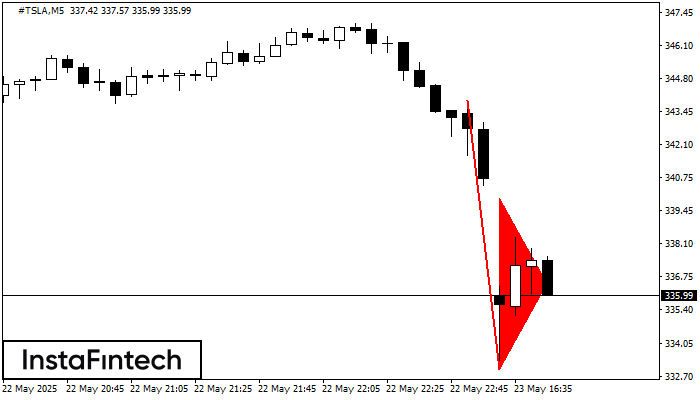

Медвежий вымпел

сформирован 23.05 в 15:45:52 (UTC+0)

сила сигнала 1 из 5

На графике #TSLA M5 сформировалась фигура «Медвежий вымпел». Фигура сигнализирует о продолжении нисходящего тренда в случае пробоя минимума вымпела 332.99. Рекомендации: Отложенный ордер Sell Stop выставляется на 10 пунктов ниже

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне