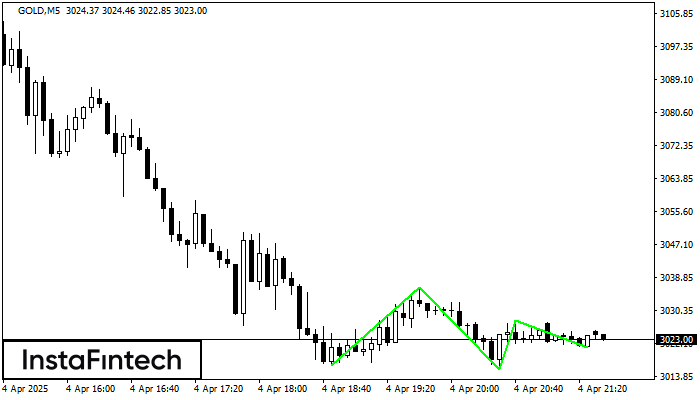

Triple Bottom

was formed on 04.04 at 20:35:18 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of GOLD M5. Features of the pattern: The lower line of the pattern has coordinates 3036.35 with the upper limit 3036.35/3028.06, the projection of the width is 1989 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 3016.46, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Rectangle

was formed on 17.04 at 01:12:52 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPCHF formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 1.0771, the lower border is 1.0754. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Rectangle

was formed on 17.04 at 01:06:37 (UTC+0)

signal strength 1 of 5

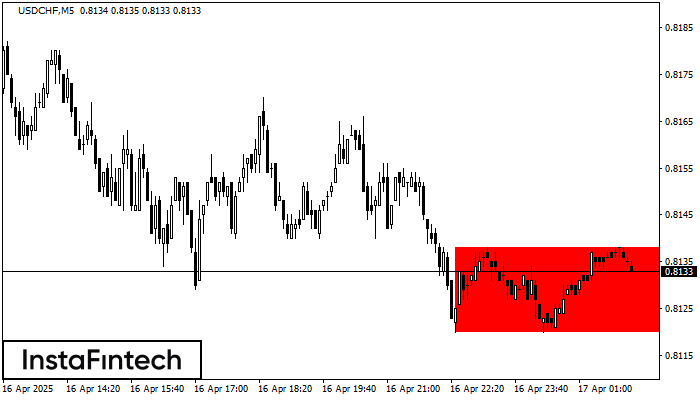

According to the chart of M5, USDCHF formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 0.8138, the lower border is 0.8120. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

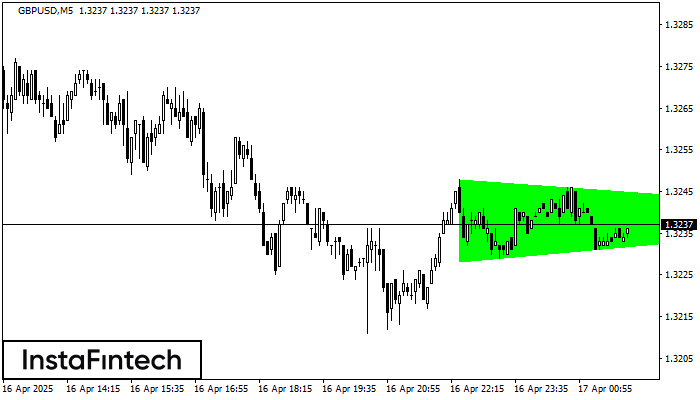

Bullish Symmetrical Triangle

was formed on 17.04 at 01:00:11 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPUSD formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 1.3248 and 1.3228 are the coordinates

The M5 and M15 time frames may have more false entry points.

Open chart in a new window