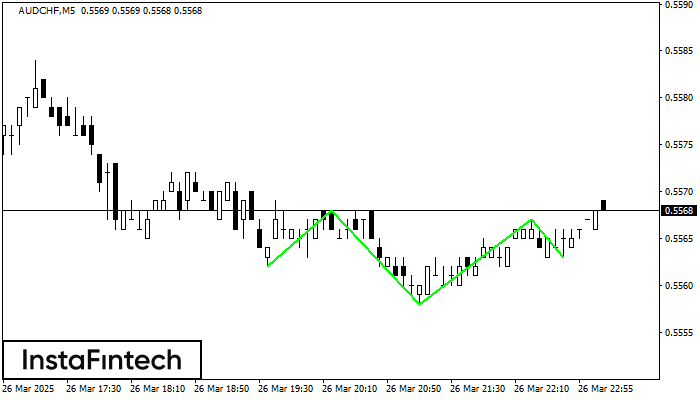

Inverse Head and Shoulder

was formed on 26.03 at 23:16:57 (UTC+0)

signal strength 1 of 5

According to M5, AUDCHF is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.5568/0.5567 is broken out, the instrument is likely to move toward 0.5582.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Double Bottom

was formed on 05.08 at 09:30:12 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on NZDJPY M30. Characteristics: the support level 86.63; the resistance level 86.92; the width of the pattern 29 points. If the resistance level

Open chart in a new window

Triple Bottom

was formed on 05.08 at 09:00:14 (UTC+0)

signal strength 4 of 5

The Triple Bottom pattern has been formed on GBPJPY H1. It has the following characteristics: resistance level 196.50/195.52; support level 195.27/195.23; the width is 123 points. In the event

Open chart in a new window

Triple Bottom

was formed on 05.08 at 08:29:59 (UTC+0)

signal strength 3 of 5

The Triple Bottom pattern has formed on the chart of the AUDJPY M30 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

Open chart in a new window