Triple Top

was formed on 28.03 at 01:30:25 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the USDJPY M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -2, support level -41, and pattern’s width 50. Forecast If the price breaks through the support level 150.60, it is likely to move further down to 150.86.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Rectangle

was formed on 16.04 at 05:35:30 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCHF formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 0.4828 - 0.0000

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 16.04 at 05:26:29 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURJPY formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 161.35/161.59 whereas the upper border goes across 161.79/161.59

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

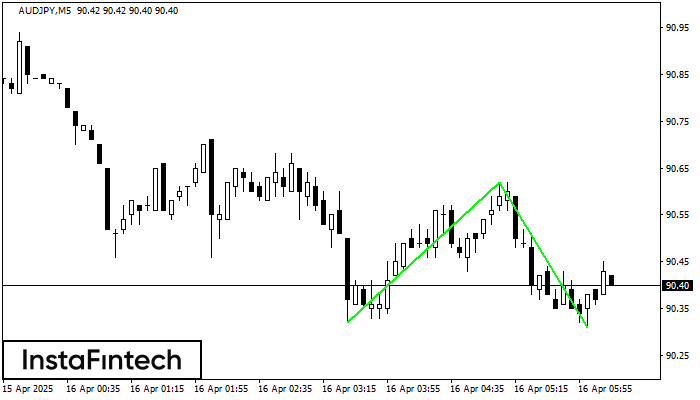

Double Bottom

was formed on 16.04 at 05:15:27 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDJPY M5. Characteristics: the support level 90.32; the resistance level 90.62; the width of the pattern 30 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window