CADHUF (Canadian Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HUF pair is quite popular among some Forex traders. This trading instrument is a cross rate against the US dollar, which has a significant impact on the pair. So, when comparing the CAD/USD and USD/HUF charts, we can get an almost clear picture of CAD/HUF movements.

Features of CAD/HUF

The Canadian dollar is highly correlated with global oil prices. Canada is one of the largest oil-exporting countries. For this reason, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. Therefore, the CAD/HUF pair is dependent on the world price of this fuel.

Although Hungary is part of the European Union, it has its own national currency, the forint.

The Hungarian economy depends strongly on the organizations and countries that do business in its territory. The state is characterized by a high share of foreign capital in the economy.

A large part of Hungary's income is generated by tourism. In addition, such sectors of the economy as engineering, metallurgy, chemical industry, and agriculture are also flourishing in the country. Most of the production is exported abroad. Hungary's main trading partners are the EU countries and Russia. Therefore, when assessing the future exchange rate of the Hungarian forint, special attention should be paid to the economic indicators of these regions.

How to trade CAD/HUF

When trading cross rates, remember that brokers usually set a higher spread on such pairs than on more popular currency pairs. Therefore, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

The CAD/HUF pair is a cross rate. Therefore, the US dollar has a significant impact on each of the currencies in this trading instrument. For this reason, when predicting the movement of the pair, it is necessary to take into account the major US economic indicators. These include the refinancing rate, GDP growth, unemployment, number of new jobs, and many others. Notably, the currencies mentioned above may react differently to changes taking place in the US economy. Therefore, CAD/HUF could be an indicator of fluctuations in these currencies.

See Also

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2008

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1963

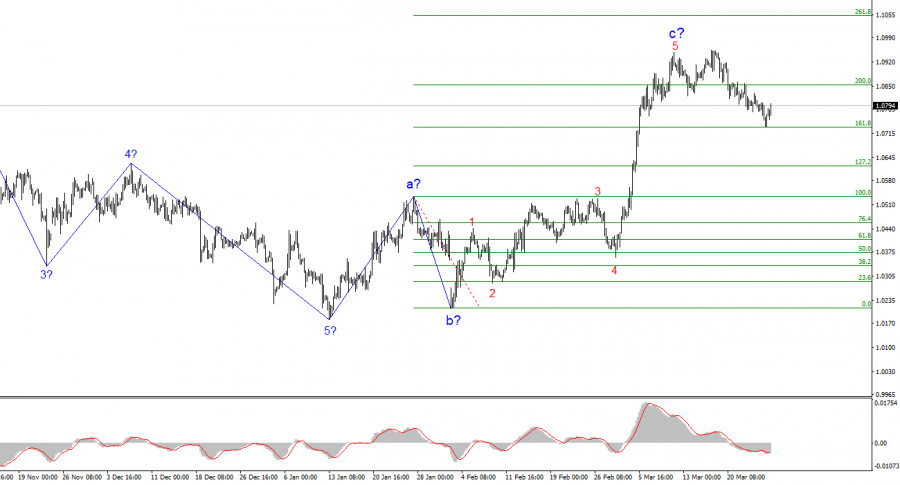

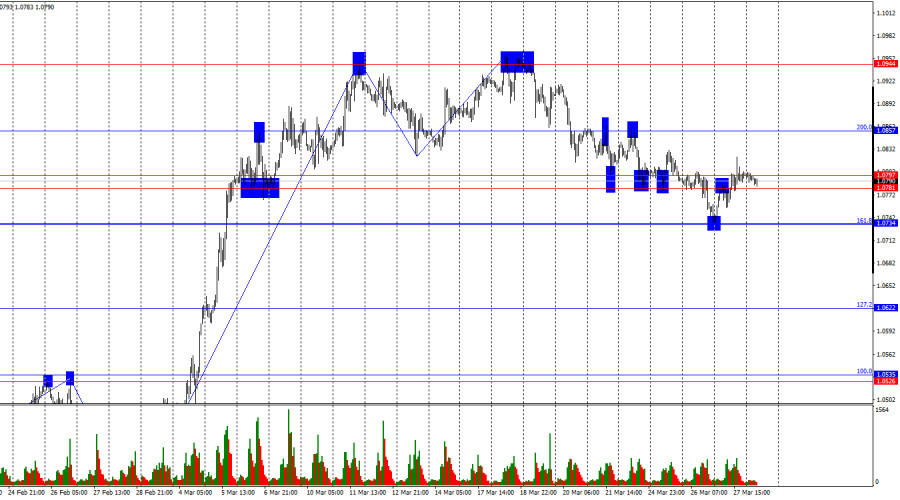

The EUR/USD pair rose by 60 basis points over the course of Thursday.Author: Chin Zhao

20:10 2025-03-28 UTC+2

1873

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1858

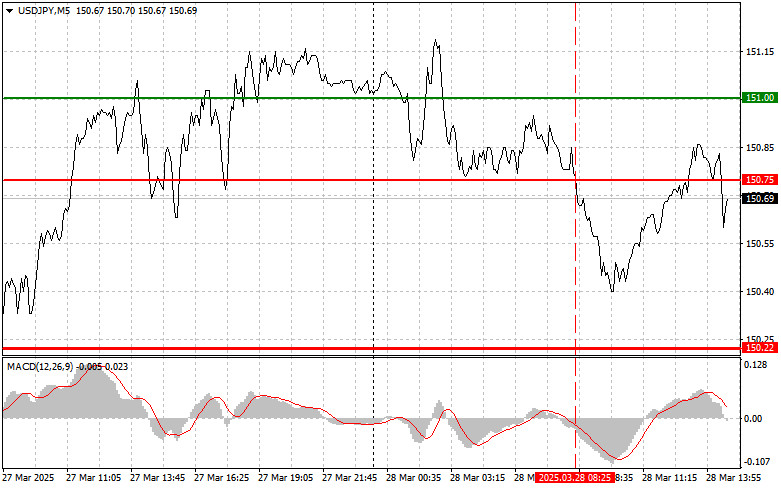

USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:04 2025-03-28 UTC+2

1663

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

1633

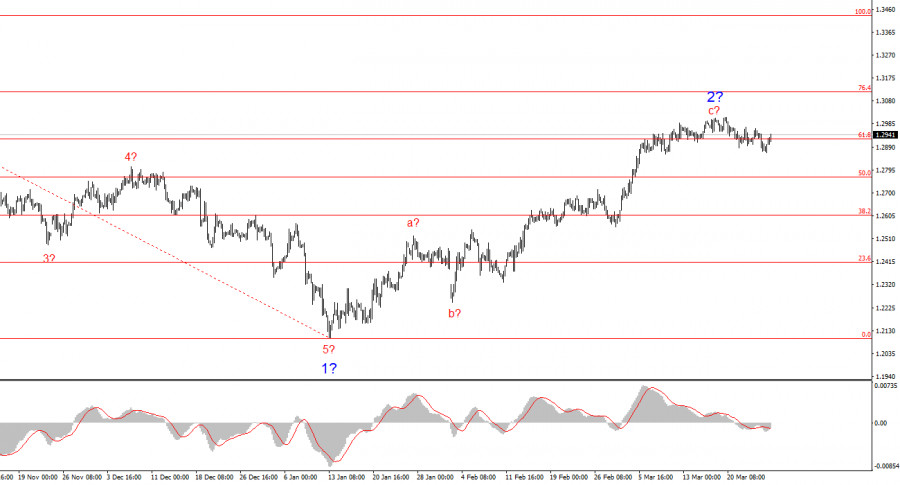

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1588

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

1513

Technical analysisTrading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

The euro's outlook is still bearish. We believe that the decline could continue below 1.08 in the coming days toward 1.0620.Author: Dimitrios Zappas

15:09 2025-03-28 UTC+2

1498

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2008

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1963

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

1873

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1858

- USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:04 2025-03-28 UTC+2

1663

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1633

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1588

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

1513

- Technical analysis

Trading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

The euro's outlook is still bearish. We believe that the decline could continue below 1.08 in the coming days toward 1.0620.Author: Dimitrios Zappas

15:09 2025-03-28 UTC+2

1498