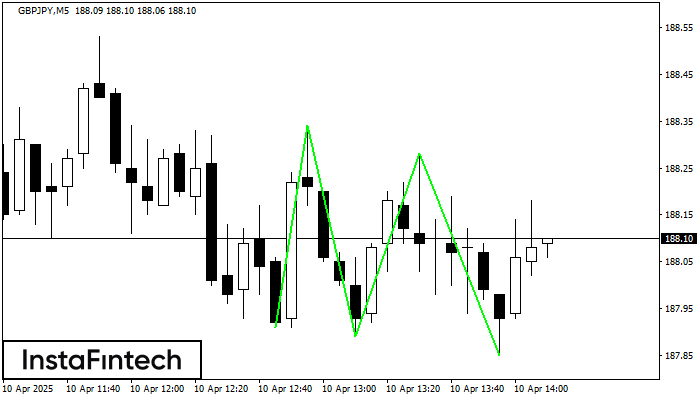

Triple Bottom

was formed on 10.04 at 13:10:17 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of GBPJPY M5. Features of the pattern: The lower line of the pattern has coordinates 188.34 with the upper limit 188.34/188.28, the projection of the width is 43 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 187.91, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Бычий симметричный треугольник

сформирован 24.05 в 18:46:25 (UTC+0)

сила сигнала 2 из 5

По #Bitcoin на M15 сформировалась фигура «Бычий симметричный треугольник», которая сигнализирует нам о продолжении тенденции. Характеристика: Верхняя граница фигуры имеет координаты 109440.14/108872.57; Нижняя граница 108311.13/108872.57; Проекция ширины фигуры 112901 пунктов

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

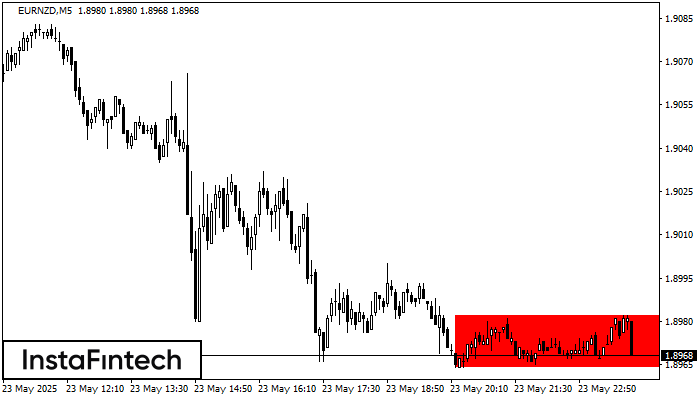

Прямоугольник

сформирован 23.05 в 23:00:20 (UTC+0)

сила сигнала 1 из 5

Сформирована фигура «Прямоугольник» на графике EURNZD M5. Тип фигуры: Продолжение тренда; Границы: Верхняя 1.8982, Нижняя 1.8964; Сигнал: позиция на продажу открывается после фиксации цены ниже границы прямоугольника 1.8964

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

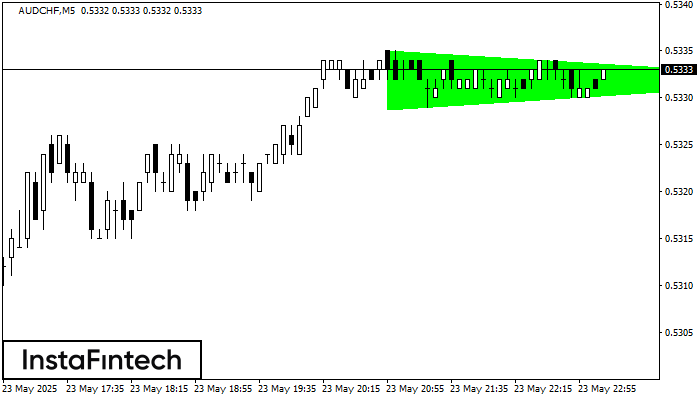

Бычий симметричный треугольник

сформирован 23.05 в 22:14:53 (UTC+0)

сила сигнала 1 из 5

По AUDCHF на M5 фигура «Бычий симметричный треугольник». Характеристика: Фигура продолжения тренда; Координаты границ – верхняя 0.5335, нижняя 0.5329. Проекция ширины фигуры 6 пунктов. Прогноз: В случае пробоя верхней границы

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне