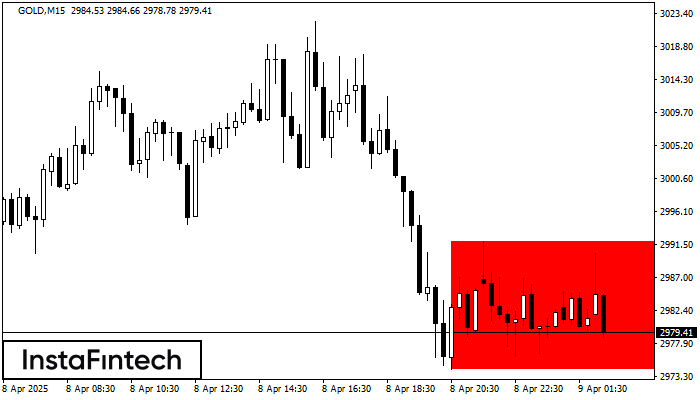

Bearish Rectangle

was formed on 09.04 at 01:24:35 (UTC+0)

signal strength 2 of 5

According to the chart of M15, GOLD formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 2991.89 - 0.00 and support 2974.26 – 2974.26. In case the resistance level 2974.26 - 2974.26 is broken, the instrument is likely to follow the bearish trend.

The M5 and M15 time frames may have more false entry points.

Juga lihat

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

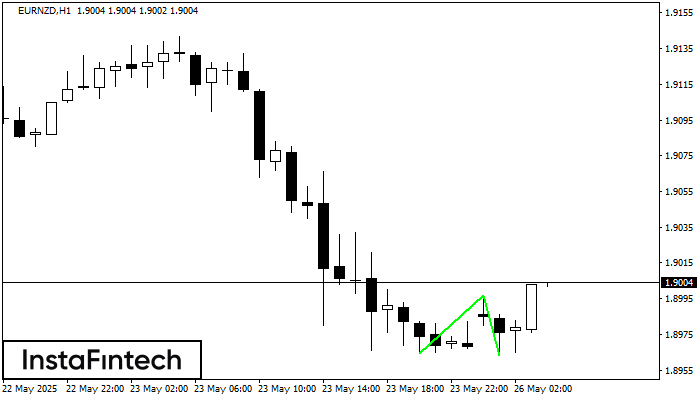

Double Bottom

was formed on 26.05 at 03:00:31 (UTC+0)

signal strength 4 of 5

The Double Bottom pattern has been formed on EURNZD H1. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

Open chart in a new window

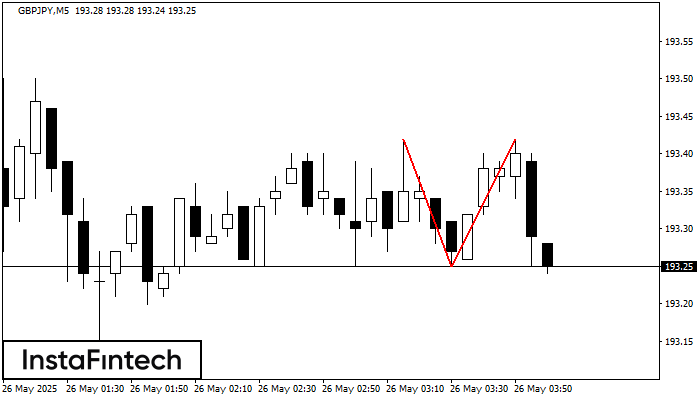

Double Top

was formed on 26.05 at 03:00:31 (UTC+0)

signal strength 1 of 5

On the chart of GBPJPY M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 193.42; the lower boundary 193.25; the width of the pattern 17 points

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

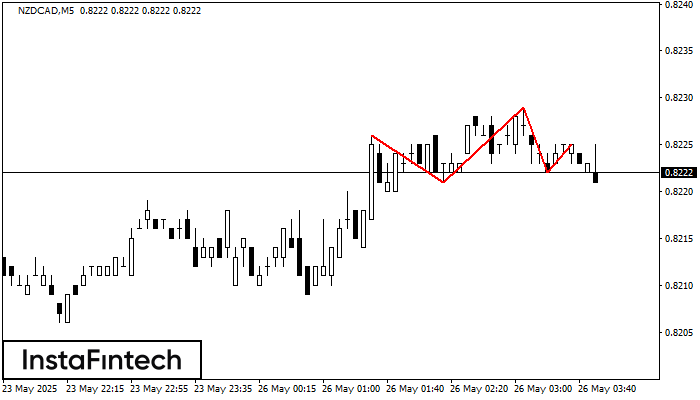

Head and Shoulders

was formed on 26.05 at 02:56:04 (UTC+0)

signal strength 1 of 5

The NZDCAD M5 formed the Head and Shoulders pattern with the following features: The Head’s top is at 0.8229, the Neckline and the upward angle are at 0.8221/0.8222. The formation

The M5 and M15 time frames may have more false entry points.

Open chart in a new window