Lihat juga

28.03.2025 12:16 PM

28.03.2025 12:16 PMThe AUD/USD pair continues its sideways consolidation, remaining within a familiar range near the key psychological level of 0.6300. This movement is driven by several factors impacting global market sentiment.

Recent announcements by U.S. President Donald Trump regarding new tariffs on imported cars and light trucks have had a negative impact on the market. The anticipation of reciprocal tariffs set to take effect next week also contributes to investor uncertainty, as these measures affect the global economy. At the same time, the modest rise in the U.S. dollar is seen as a limiting factor for the growth of the risk-sensitive Australian dollar.

However, the intraday strength of the U.S. dollar has not sparked much optimism. Amid concerns about the potential economic consequences of Trump's aggressive trade policies, markets are now pricing in a 65% probability that the Federal Reserve will cut borrowing costs by 25 basis points in June. This curbs aggressive dollar-buying activity.

In addition, renewed hopes for stimulus from China are helping to limit losses for the Australian dollar.

Today, for additional trading opportunities, attention should be paid to the release of the U.S. PCE – the Personal Consumption Expenditures Price Index. This data will influence the Fed's decisions regarding its future monetary policy, which in turn will play a key role in driving demand for the U.S. dollar and may provide new momentum for the AUD/USD pair.

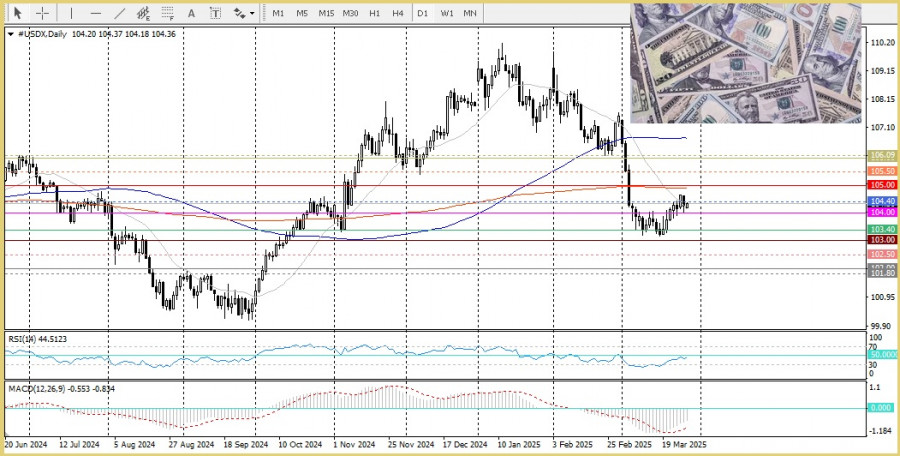

From a technical perspective, the pair needs to break above the round level of 0.6300 to pave the way for further upside. The Relative Strength Index (RSI) has yet to move into positive territory. However, oscillators on the daily chart remain mixed, so it may be wise to wait for the release of key U.S. economic data during the North American session before entering new buy or sell positions.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.