Lihat juga

24.03.2025 11:25 AM

24.03.2025 11:25 AMToday, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

News that emerged over the weekend indicates that U.S. President Donald Trump is planning a narrower and more targeted agenda on reciprocal tariffs set to take effect on April 2. This has increased investors' appetite for risk assets, set a positive tone in equity markets, and consequently undermined demand for the precious metal today.

At the same time, U.S. delegations are engaged in talks with Ukrainian officials and are planning meetings with Russian representatives. Earlier this month, Trump and Russian President Vladimir Putin agreed to a 30-day pause in strikes on Ukrainian energy infrastructure, which may help ease tensions in the region.

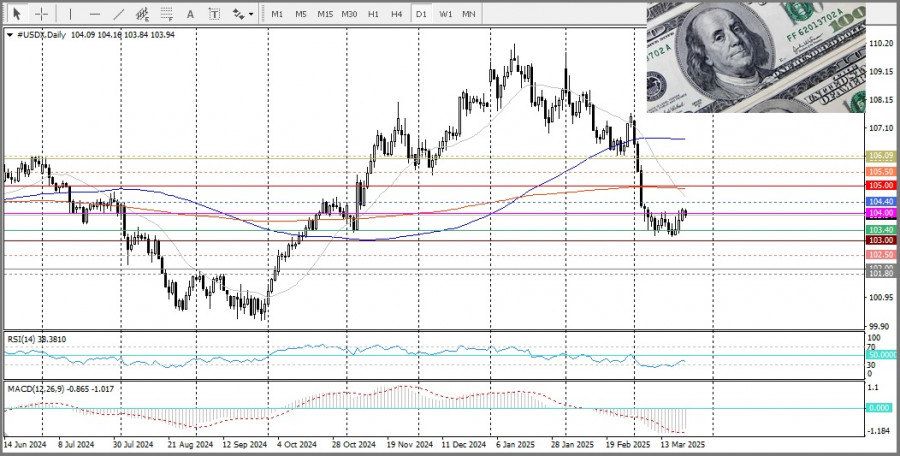

The U.S. dollar is hovering near a 1.5-week high reached last week.

However, expectations that economic slowdown caused by tariffs may force the Fed to resume rate cuts are also limiting the downside in gold prices. This creates uncertainty, and it would be prudent to wait for a more significant decline before opening new short positions.

Adding to the uncertainty is the tense situation in the Middle East: Israel continues its strikes on Gaza, while Iran-backed Houthis in Yemen launched a ballistic missile at Israel, though it was successfully intercepted. These developments increase the risk of further conflict escalation in the region.

Today, traders should pay close attention to the release of PMI data, which will provide fresh insight into the state of the U.S. economy and may impact commodities. Also in focus is the U.S. Core PCE Price Index, due to be published on Friday.

From a technical perspective, the $3000 level may attract buyers, but a break below it could trigger technical selling, pushing gold prices down toward the $2980–2978 area. If the correction continues, the next support lies at $2956–2954.

On the other hand, last week's all-time high near $3057–3058 could act as the nearest resistance. Given that the daily RSI has exited overbought territory, renewed buying may become the next trigger for bulls, opening the way for the continuation of the uptrend observed over the past three months.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Euro mencatatkan kenaikan sederhana setelah berita bahawa pengeluaran industri di Jerman meningkat lebih daripada yang dijangkakan pada bulan Julai, memberikan sedikit harapan bahawa sektor utama negara tersebut mungkin sedang stabil

Laporan pekerjaan Amerika Syarikat terkini menjadi bukti nyata bahawa Rizab Persekutuan tidak mempunyai pilihan selain kembali kepada dasar monetari yang lebih longgar . Beberapa tahun lalu , kadar pengangguran berada

Minggu lalu menunjukkan hasil yang tidak jelas bagi pasaran global dalam menentukan apa yang boleh dijangka untuk ekonomi Amerika Syarikat dalam masa terdekat dan sama ada kemerosotan ketara dalam pasaran

Harga emas terus melonjak , dipacu oleh jangkaan bahawa Rizab Persekutuan AS akan melonggarkan dasar monetari dalam tempoh terdekat . Namun , faktor sokongan kepada logam berharga ini tidak terhad

Hanya segelintir penerbitan makroekonomi dijadualkan pada hari Isnin. Sebenarnya, satu-satunya laporan yang perlu diberi perhatian adalah laporan mengenai import, eksport, imbangan perdagangan, dan pengeluaran perindustrian di Jerman. Laporan-laporan ini bukanlah

Pada hari Jumaat, pasangan GBP/USD juga mencatatkan keuntungan yang kukuh, pulih sepenuhnya daripada penurunan hari Selasa "atas sebab-sebab yang tidak diketahui." Sebabnya, tentu saja, menjadi jelas keesokan harinya: pasaran bertindak

Pada hari Jumaat, pasangan mata wang EUR/USD mencatatkan kenaikan yang agak kukuh , sudah tentu didorong oleh data pasaran buruh dan kadar pengangguran Amerika Syarikat. Sebulan sebelumnya , Donald Trump

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.