Lihat juga

25.02.2025 01:59 PM

25.02.2025 01:59 PMMarkets follow a natural cycle: trends give way to consolidations, and consolidations lead to new trends.

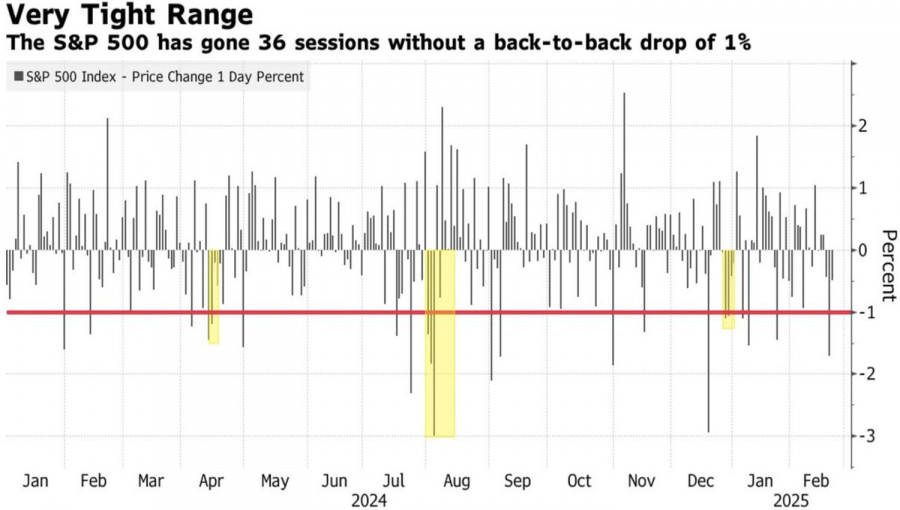

Before the sell-off on February 23–24, the S&P 500 had gone 35 consecutive trading sessions without a 1% decline, marking its longest streak since December. This has happened only three times in 2024. Since the November presidential election, the broad stock index had been stuck in a tight 4% trading range—the narrowest since 2017. A breakout was inevitable, and bulls fled the battlefield.

S&P 500's performance

The market was falling ahead of NVIDIA's earnings report, despite expectations that the company's earnings would exceed forecasts. Strong economic data, corporate earnings which are twice higher than Wall Street estimates, and even a bullish shift from Morgan Stanley—all failed to support US stocks.

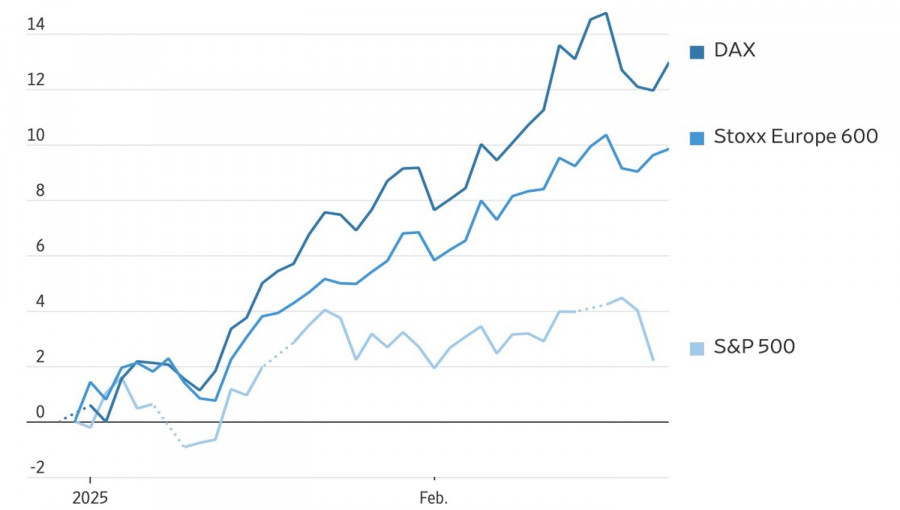

Even Morgan Stanley, which was previously bearish, now claims that the US stock market's underperformance compared to Europe and other regions won't last long. The S&P 500, they argue, remains the highest-quality index with the best profit potential.

According to Principal Asset Management, since 1965, 10%+ corrections in the S&P 500 have primarily been caused by either a hawkish Federal Reserve's policy shift, or prolonged high interest rates. Something similar is happening now, as derivatives markets don't expect rate cuts before June. However, the situation differs significantly—no one is even hinting at a hard landing.

S&P 500 and European stock index performance

The key drivers of the S&P 500 pullback include Donald Trump's confirmation that tariffs on Mexico and Canada will proceed as planned; the victory of Germany's Christian Democratic Union (CDU) in parliamentary elections; and investors' belief in an imminent resolution of the conflict in Ukraine. For a long time, the S&P 500 rallied as markets grew indifferent to Trump's tariff threats, which could slow the US economy.

However, the clock is ticking:

March 1: 25% tariffs on Mexico and Canada could take effect.

March 12: Steel and aluminum duties—to which the EU has promised retaliation.

April 1: Reciprocal tariffs with China are set to roll out.

Meanwhile, 10% duties on Chinese imports remain in place.

The CDU's victory under Friedrich Merz sent European stock indices, led by the DAX 40, soaring. This accelerated capital outflows from the US to Europe, reinforcing the narrative of waning US market dominance and diminished faith in American tech giants.

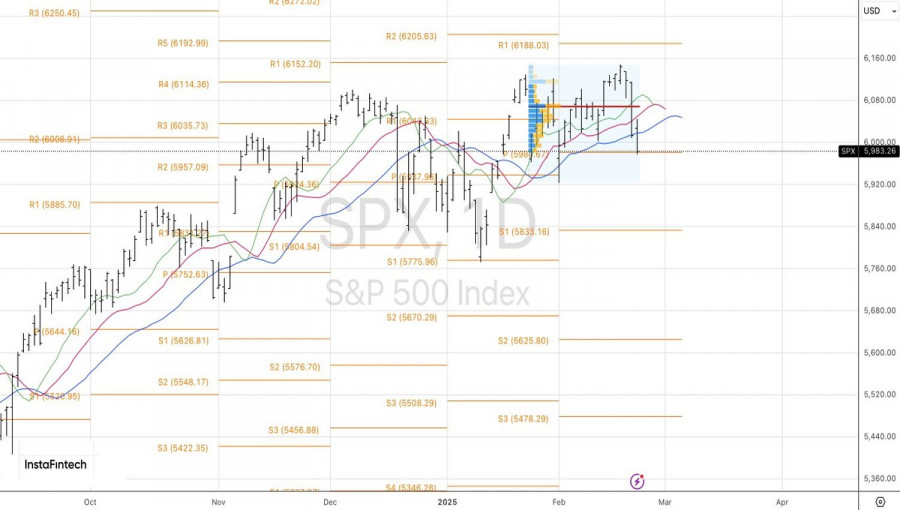

Technical outlook for S&P 500

On the daily chart, the S&P 500 continues to form an expanding wedge reversal pattern. For confirmation, the index needs to break below 5,925. Once this occurs, a short-term rebound is expected, providing an opportunity to increase short positions from 6,083.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bagaimanakah caranya untuk menggembirakan pasaran? Ambil mainan kegemarannya dan kemudian pulangkannya semula. Bagi S&P 500, mainan ini adalah jangkaan pemotongan kadar oleh Fed pada bulan Disember. Selepas penerbitan minit mesyuarat

Analisis Laporan Makroekonomi: Beberapa laporan makroekonomi dijadualkan untuk hari Rabu, dan hanya segelintir yang penting. Pada dasarnya, hanya laporan pesanan barang tahan lama di Amerika Syarikat yang boleh diketengahkan. Laporan

Pasangan mata wang GBP/USD didagangkan dengan agak tenang pada hari Selasa, tetapi akhirnya menunjukkan beberapa keuntungan. Begitu juga dengan pasangan EUR/USD. Laporan ADP memainkan peranan penting dalam penurunan dolar

Pada hari Selasa, pasangan mata wang EUR/USD tidak menunjukkan peningkatan volatiliti, dan minat pasaran adalah terhad. Secara keseluruhannya, pergerakan dalam beberapa bulan kebelakangan ini adalah mendatar. Dalam beberapa hari terakhir

S&P 500 mencatatkan kenaikan harian terbaik dalam enam minggu yang lalu, manakala Nasdaq 100 mengalami prestasi terkuat sejak Mei, apabila jangkaan untuk pelonggaran dasar monetari oleh Fed pada bulan Disember

Beberapa acara asas dijadualkan pada hari Selasa, tetapi ia tidak menarik banyak perhatian. Di zon Euro, wakil-wakil daripada Bank Pusat Eropah, Chipollone dan Donnery, akan memberikan ucapan, tetapi perlu diperhatikan

Pasangan mata wang GBP/USD kebanyakannya kekal tidak bergerak pada hari Isnin dan tidak berdagang secara aktif. Walau bagaimanapun, melihat kepada kalendar acara untuk hari pertama minggu ini, semua persoalan hilang

Pasangan mata wang EUR/USD berdagang dengan sangat tenang pada hari Isnin. Pada separuh hari pertama, euro naik sedikit, tetapi secara keseluruhan volatiliti kekal rendah, dan pasangan ini tidak menunjukkan pergerakan

Pada hari Isnin, harga emas meningkat dengan mendadak, melepasi paras $4,110, didorong oleh jangkaan yakin pelabur terhadap kemungkinan pemotongan kadar oleh Rizab Persekutuan pada mesyuarat bulan Disember, memandangkan aliran data

Buat pertama kalinya dalam tempoh empat tahun, Rusia dan Ukraine hampir mencapai persetujuan damai. Sudah tentu, tiada pihak yang sepenuhnya menerima syarat yang ditetapkan oleh pihak lain, tetapi itulah intipati

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.