Lihat juga

19.02.2025 11:36 AM

19.02.2025 11:36 AMFutures on US stocks remained stable on Wednesday after another positive session on Wall Street. Investors continue to overlook Donald Trump's trade policies, the Federal Reserve's increasingly hawkish stance, and the potential end of the war in Ukraine, which has improved market sentiment in Europe.

However, individual stock movements remain mixed: Arista Networks dropped 5% despite strong quarterly results, while Bumble plunged 17% due to a weak forecast.

At the same time, the S&P 500 reached a new all-time high, gaining 0.24%, while the Dow and Nasdaq also posted modest gains.

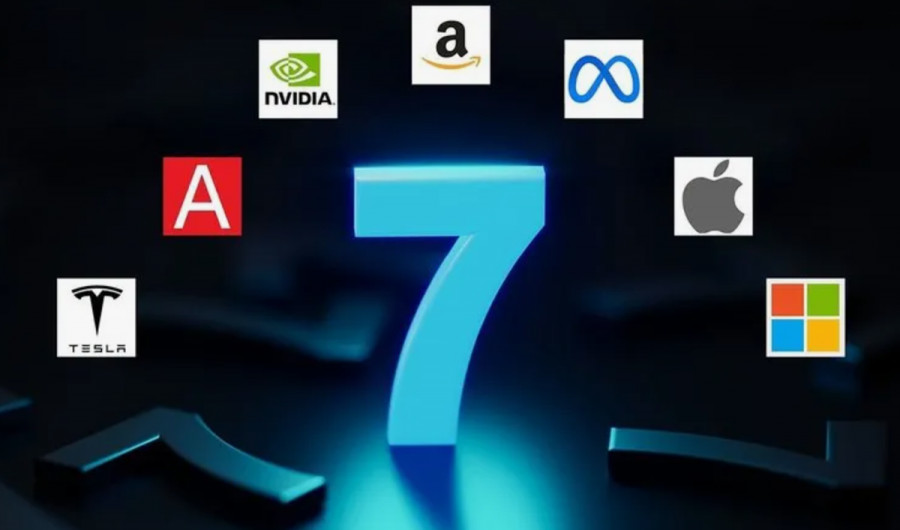

The tech sector continues to drive the market, but the S&P 500's reliance on the Magnificent Seven (Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Tesla) is raising concerns. After two consecutive years of over 20% growth, 2025 may bring more uncertainty for the index.

Why could the Magnificent Seven become a threat for the market?

Despite the tech giants' impressive rally, their earnings growth has been slowing for five consecutive quarters. In 2024, their combined growth was 63%, down from 75% in 2023. Now, three key factors could shift the balance:

1. Slowing earnings growth

The Magnificent Seven have been the primary driver of S&P 500 earnings growth in recent years, but their contribution is expected to decline. In 2025, their share of S&P 500 earnings growth may drop to 33%, down from 75% in 2024.

2. Surging capital expenditures

Tech giants are heavily investing in AI and cloud technologies, but these investments require massive resources. In 2024, capital expenditures among the seven largest companies surged by 40%, whereas the rest of the S&P 500 increased spending by only 3.5%.

For example, Alphabet announced a record $75 billion in investments for 2025, exceeding analysts' expectations.

3. Increased volatility and overvalued risks

At its peak in 2023, the tech sector traded at a 70% premium to the broader market. While this premium has since fallen to 40%, it remains high, making these stocks vulnerable to corrections if macroeconomic conditions deteriorate or AI monetization challenges arise.

Technical analysis of the S&P 500

The S&P 500 reached a new high and continues its upward trend, though momentum is slowing.

The key resistance level is at 6,150. If the index breaks above this level, further growth toward 6,180–6,200 could be expected.

The support level remains at 6,100. A break below it could lead to a decline to 6,050, with a deeper correction possible to 6,000, where the 50-day SMA is located.

Indicators:

RSI (14) = 63, signaling an approach to overbought territory.

MACD remains in positive territory, but momentum is weakening.

Nasdaq 100 maintains uptrend

The Nasdaq 100 is approaching strong resistance at 22,200–22,250. A breakout could pave the way for a rise to 22,500.

The support level is seen at 22,000. If it is broken, a pullback to 21,800 (50-day SMA) is possible.

Indicators:

RSI (14) = 69, indicating the market is overheating.

MACD still shows a bullish signal but is losing momentum.

The market remains in an uptrend, but the S&P 500's dependence on the Magnificent Seven raises concerns. In 2025, these stocks are unlikely to deliver the same level of returns as in previous years, increasing the risk of volatility.

As long as the indices hold above the key support levels, the trend remains bullish. However, investors should be prepared for potential corrections, especially if macroeconomic data or corporate earnings fail to meet expectations.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Semalam, indeks saham Amerika Syarikat ditutup bercampur-campur. S&P 500 meningkat sebanyak 0.36%, manakala Nasdaq 100 menambah 0.41%. Namun, indeks industri Dow Jones susut sebanyak 0.14%. Ekuiti Jepun meneruskan momentum kenaikan

Semalam, indeks saham AS ditutup lebih tinggi. S&P 500 meningkat sebanyak 0.34%, manakala Nasdaq 100 menambah 0.42%. Dow Jones Industrial Average naik sebanyak 0.09%. Pertumbuhan rekod dalam indeks global meluas

Pada penghujung dagangan semalam, indeks saham Amerika ditutup lebih tinggi. S&P 500 menokok 0.41%, manakala Nasdaq 100 menambah 0.30%. Dow Jones Industri pula meningkat 0.18%. Hari ini, niaga hadapan indeks

Menjelang akhir semalam, indeks saham AS ditutup lebih tinggi. S&P 500 naik sebanyak 0.26%, manakala Nasdaq 100 meningkat sebanyak 0.48%. Dow Jones Industrial Average melonjak sebanyak 0.15%. Hari ini, indeks

Pasaran sekali lagi digerakkan oleh berita utama: emas telah mencapai paras tertinggi sepanjang masa, melonjak kepada $3,812 per auns; minyak mentah Brent jatuh di bawah AS$70 di tengah lambakan bekalan;

Pada hari Jumaat lalu, indeks saham AS ditutup lebih tinggi. S&P 500 meningkat sebanyak 0.59%, manakala Nasdaq 100 menambah 0.44%. Dow Jones Industrial Average melonjak sebanyak 0.55%. Niaga hadapan

Setakat penutupan semalam, indeks saham utama AS berakhir lebih rendah. S&P 500 jatuh sebanyak 0.50%, manakala Nasdaq 100 kehilangan 0.50%. Dow Jones industri merosot sebanyak 0.38%. Saham global terus merosot

Indeks ekuiti AS ditutup lebih rendah semalam. S&P 500 kehilangan 0.55%, manakala Nasdaq 100 jatuh 0.95%. Dow Jones Industrial Average turun 0.15%. Saham Asia meningkat selepas saham teknologi China melonjak

Pada hari Jumaat lepas, indeks ekuiti AS ditutup lebih tinggi, dengan S&P 500 meningkat 0.49% dan Nasdaq 100 naik 0.72%. Dow Jones Industrial Average meningkat 0.47%. Indeks Asia bergerak lebih

Pasaran saham AS telah memasuki fasa baharu selepas Rizab Persekutuan melaksanakan pemotongan kadar faedah pertama tahun ini. Keputusan untuk menurunkan kadar dana persekutuan sebanyak 25 mata asas sudah dijangkakan secara

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.