Lihat juga

13.02.2025 01:30 PM

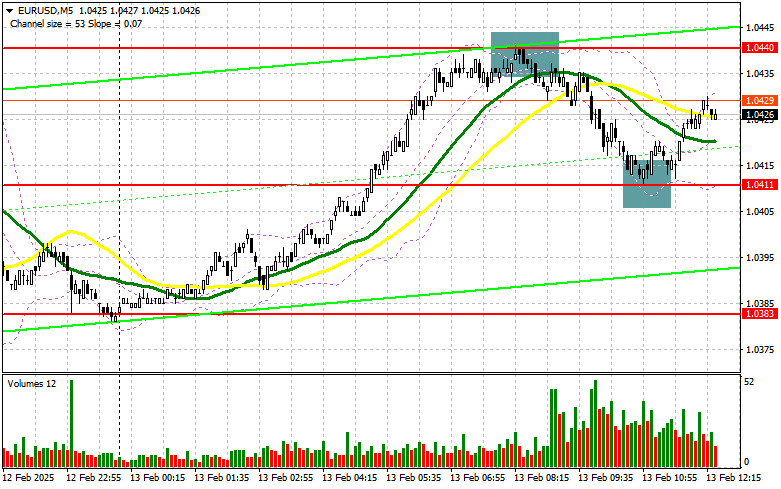

13.02.2025 01:30 PMIn my morning forecast, I focused on the 1.0440 level and planned to make trading decisions based on it. Let's examine the 5-minute chart to see what happened. A rise and false breakout at 1.0440 provided a strong short entry point, resulting in a 30-point decline. Buying at the 1.0411 support level on a similar signal secured about 15 points in profit. The technical outlook was revised for the second half of the day.

German CPI data met economists' expectations, preventing the euro from extending its gains in the first half of the day. As a result, the pair remained within a sideways range, with only minor adjustments to key support levels.

In the second half of the session, markets will focus on the U.S. Producer Price Index (PPI), both overall and core, as well as the weekly jobless claims report. Stronger-than-expected figures could increase pressure on the euro, while weaker data may spark a new bullish movement.

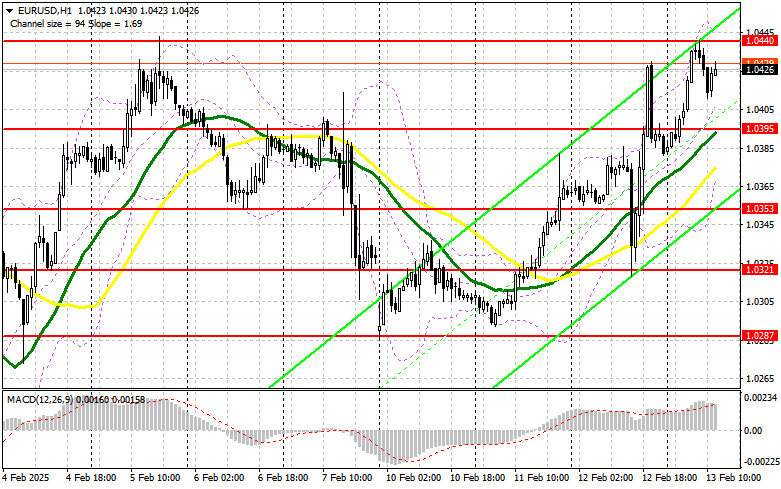

If EUR/USD declines due to strong data, I will look for a false breakout at 1.0395 to enter a long position, targeting resistance at 1.0440—which has remained a key barrier. A break and retest of this level will confirm a buying opportunity, pushing EUR/USD towards 1.0468. The final target will be 1.0495, where I plan to lock in profits.

If EUR/USD drops further and no buying interest appears at 1.0395, buyers may lose momentum, allowing sellers to drive the pair to 1.0353. Only after a false breakout at this level will I consider long positions. I also plan to buy immediately on a bounce from 1.0321, aiming for a 30-35 point intraday correction.

Sellers successfully defended 1.0440, leading to a significant euro sell-off in the morning session. Moving forward, caution is required since U.S. inflation data could surprise the market.

A false breakout at 1.0440, similar to the morning setup, will confirm the presence of strong sellers, providing a short entry opportunity targeting support at 1.0395. This level also coincides with the 30- and 50-period moving averages, which currently support the bulls.

A break below 1.0395, especially with strong U.S. economic data, followed by a retest from below, will offer another short setup, aiming for a new low at 1.0353, signaling a potential bearish reversal. The final downside target will be 1.0321, where I will take profits.

If EUR/USD rises in the second half of the session and sellers fail to act at 1.0440, buyers may push the pair higher. In this case, I will delay short entries until 1.0468, looking for a false breakout. If the pair reaches 1.0495, I will short immediately, targeting a 30-35 point pullback.

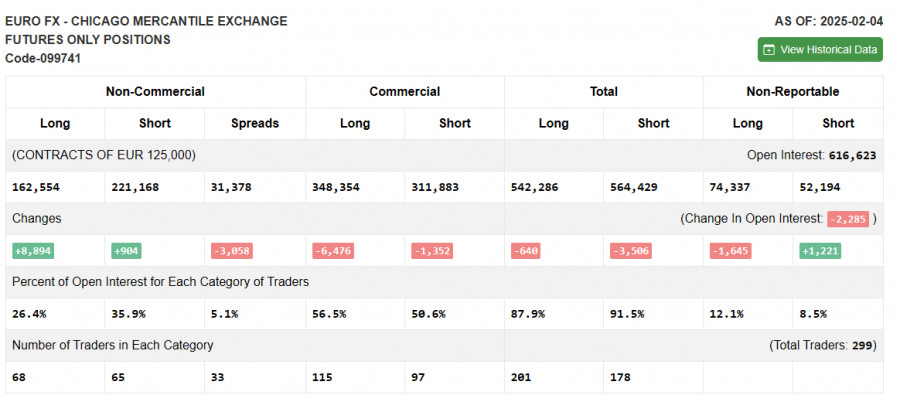

Commitment of Traders (COT) Report Analysis:

The February 4 COT report showed an increase in both long and short positions. More traders showed interest in buying the euro after concerns over a potentially aggressive U.S. trade war under Donald Trump eased. However, these data do not yet reflect the strong U.S. labor market report or the new steel and aluminum tariffs, suggesting that the outlook remains uncertain.

Risky asset purchases should be approached cautiously, as the trade war is just beginning. Long non-commercial positions increased by 8,894 to 162,554. Short non-commercial positions increased by 904 to 221,168. The gap between long and short positions narrowed by 3,058.

Indicator Signals

EUR/USD is trading above the 30- and 50-day moving averages, signaling further potential upside.

Note: The author uses H1 chart moving averages, which may differ from traditional daily moving averages on the D1 chart.

If EUR/USD declines, the lower Bollinger Band near 1.0385 will serve as support.

Technical Indicator Descriptions:

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dalam ramalan pagi saya, saya telah menekankan tahap 1.3247 sebagai titik rujukan untuk keputusan kemasukan pasaran. Mari kita lihat carta 5 minit dan analisis apa yang berlaku. Pasangan itu memang

Dalam ramalan pagi, saya menonjolkan paras 1.1341 sebagai titik utama untuk keputusan kemasukan pasaran. Mari kita lihat carta 5 minit dan menganalisis apa yang berlaku di sana. Penurunan diikuti dengan

Sepanjang hari Selasa, pasangan GBP/USD terus bergerak ke atas. Seperti yang kita lihat, mata wang British tidak memerlukan alasan khusus untuk terus meningkat. Kami telah berkata beberapa kali bahawa terdapat

Analisis Dagangan Hari Selasa Carta 1 Jam pasangan EUR/USD Pada hari Selasa, pasangan mata wang EUR/USD mengalami sedikit pembetulan, yang boleh dianggap sebagai pembetulan teknikal semata-mata. Semalam — dan secara

Analisis EUR/USD carta 5-Minit Pasangan mata wang EUR/USD mula menunjukkan penurunan yang telah lama dinantikan pada hari Selasa, walaupun kejatuhan tersebut tidak terlalu ketara mahupun berpanjangan. Perlu ditegaskan bahawa tiada

Pada hari Selasa, pasangan mata wang GBP/USD meneruskan pergerakan menaik untuk sebahagian besar hari. Tiada alasan penting atau asas yang kukuh untuk ini, namun seluruh pasaran mata wang bergerak secara

Dalam ramalan pagi saya, saya memfokuskan pada tahap 1.3204 dan merancang untuk membuat keputusan perdagangan daripadanya. Mari kita lihat carta 5 minit dan lihat apa yang berlaku. Penembusan pada tahap1.3204

Dalam ramalan pagi ini, saya telah menonjolkan tahap 1.1377 dan bercadang untuk membuat keputusan dagangan dari situ. Mari kita lihat carta 5 minit dan pecahkan apa yang telah berlaku. Kenaikan

Pada hari Isnin, pasangan GBP/USD meneruskan pergerakan menaiknya tanpa sebarang masalah. Tidak ada alasan makroekonomi untuk ini, malah euro menunjukkan pergerakan yang lebih perlahan menjelang akhir hari tersebut. Walau bagaimanapun

Analisis Dagangan Hari Isnin Carta 1 Jam pasangan EUR/USD Pada hari Isnin, pasangan mata wang EUR/USD didagangkan lebih kepada pergerakan mendatar berbanding kenaikan, walaupun nilainya masih mencatat peningkatan menjelang penghujung

E-mel/SMS

pemberitahuan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.