Bullish Symmetrical Triangle

was formed on 10.04 at 19:35:35 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #NTDOY formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 17.50 and 16.89 are the coordinates of the upper and lower borders respectively. The pattern width is measured on the chart at 61 pips. Outlook: If the upper border 17.50 is broken, the price is likely to continue its move by 17.40.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

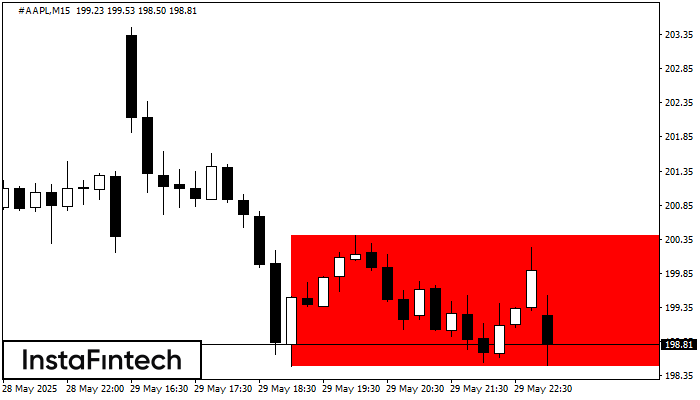

Bearish Rectangle

was formed on 30.05 at 15:34:48 (UTC+0)

signal strength 2 of 5

According to the chart of M15, #AAPL formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 200.40, the lower border is 198.49. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

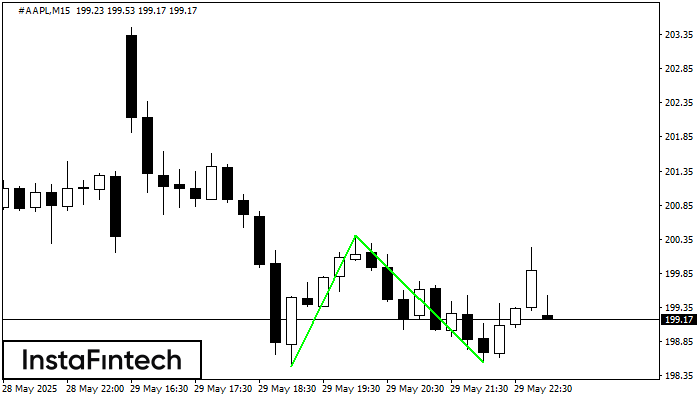

Double Bottom

was formed on 30.05 at 15:30:16 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on #AAPL M15. Characteristics: the support level 198.49; the resistance level 200.40; the width of the pattern 191 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

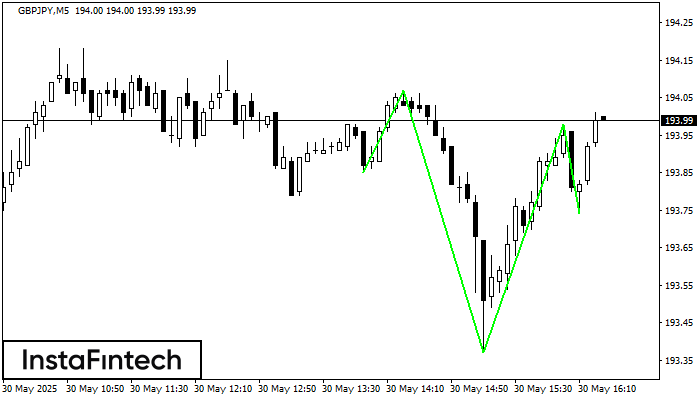

Inverse Head and Shoulder

was formed on 30.05 at 15:25:34 (UTC+0)

signal strength 1 of 5

According to M5, GBPJPY is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 194.07/193.98 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window