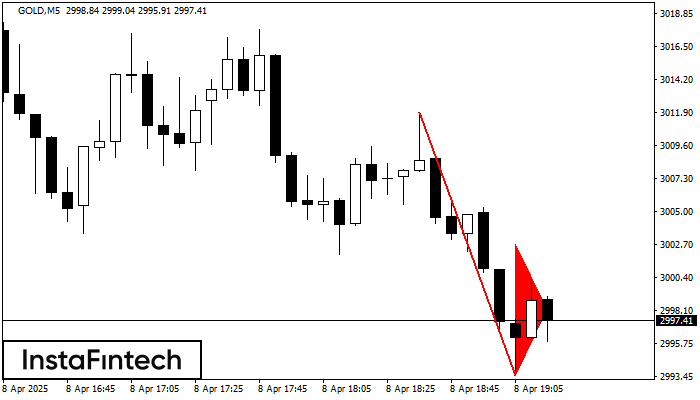

Bearish pennant

was formed on 08.04 at 18:17:34 (UTC+0)

signal strength 1 of 5

The Bearish pennant pattern has formed on the GOLD M5 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction of the original trend. In case the price fixes below the pattern’s low of 2993.55, a trader will be able to successfully enter the sell position.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

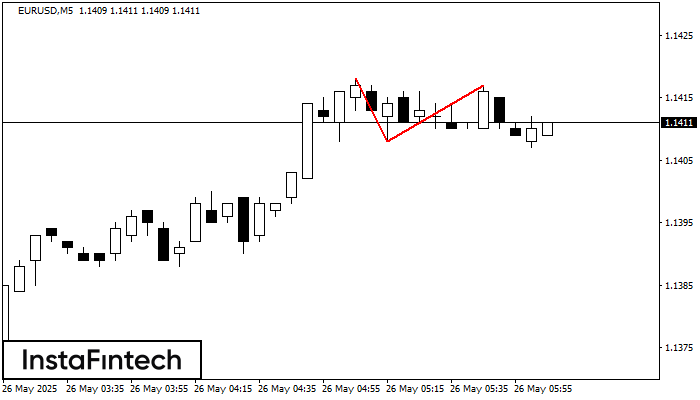

डबल टॉप

was formed on 26.05 at 05:05:43 (UTC+0)

signal strength 1 of 5

EURUSD M5 के चार्ट पर डबल टॉप रीवर्सल पैटर्न बना है। विशेषताएं: ऊपरी सीमा 1.1417; निचली सीमा 1.1408; पैटर्न की चौड़ाई 9 पॉइंट्स। संकेत: निचली सीमा के टूटने से 1.1393

M5 और M15 समय सीमा में अधिक फाल्स एंट्री पॉइंट्स हो सकते हैं।

Open chart in a new window

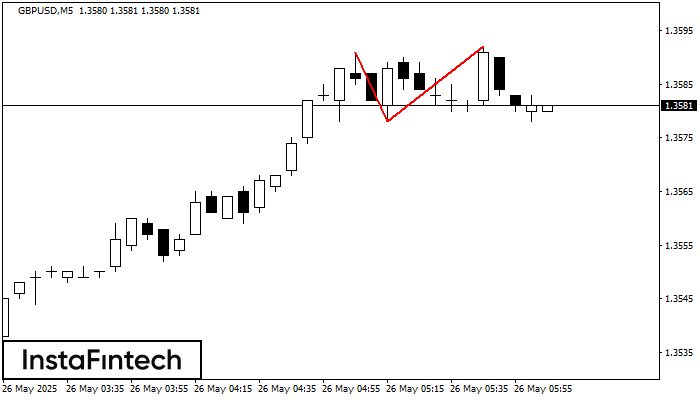

डबल टॉप

was formed on 26.05 at 05:05:40 (UTC+0)

signal strength 1 of 5

GBPUSD M5 के चार्ट पर डबल टॉप रीवर्सल पैटर्न बना है। विशेषताएं: ऊपरी सीमा 1.3592; निचली सीमा 1.3578; पैटर्न की चौड़ाई 14 पॉइंट्स। संकेत: निचली सीमा के टूटने से 1.3563

M5 और M15 समय सीमा में अधिक फाल्स एंट्री पॉइंट्स हो सकते हैं।

Open chart in a new window

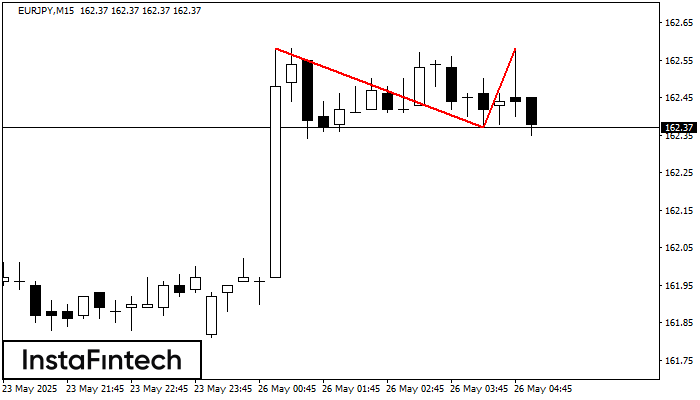

डबल टॉप

was formed on 26.05 at 04:15:25 (UTC+0)

signal strength 2 of 5

EURJPY M15 के चार्ट पर डबल टॉप रीवर्सल पैटर्न बना है। विशेषताएं: ऊपरी सीमा 162.58; निचली सीमा 162.37; पैटर्न की चौड़ाई 21 पॉइंट्स। संकेत: निचली सीमा के टूटने से 162.15

M5 और M15 समय सीमा में अधिक फाल्स एंट्री पॉइंट्स हो सकते हैं।

Open chart in a new window