spot.QIDUSD ( vs US Dollar). Exchange rate and online charts.

See Also

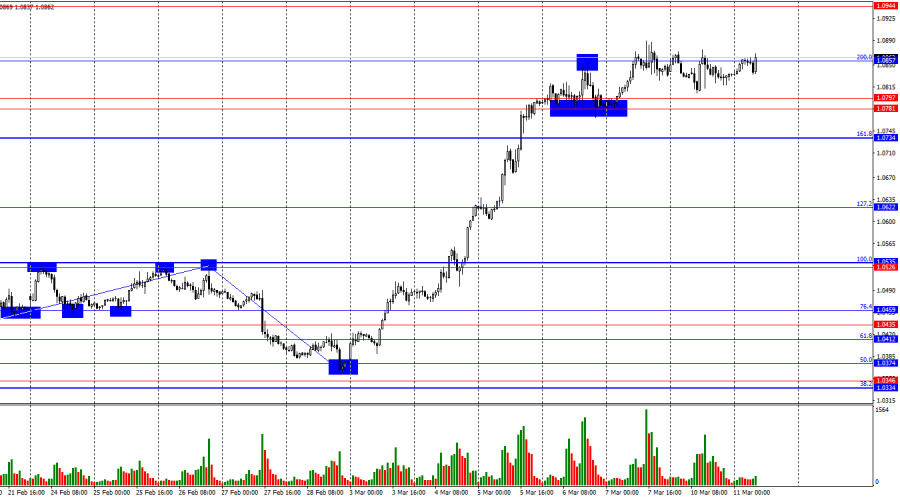

- Bulls continue their advance, utilizing all available opportunities.

Author: Samir Klishi

12:01 2025-03-11 UTC+2

1243

Technical analysisTrading Signals for GOLD (XAU/USD) for March 11-14, 2025: buy above $2,907 (21 SMA - 8/8 Murray)

In case gold breaks and consolidates above 2,925, the outlook could be positive and we can expect a new bullish sequence. Therefore, gold could reach 2,668 (8/8 Murray) and even the psychological level of $3,000.Author: Dimitrios Zappas

14:56 2025-03-11 UTC+2

1048

Trump's meeting with Wall Street leaders set to stabilize marketAuthor: Jakub Novak

14:32 2025-03-11 UTC+2

1018

- Bearish traders are struggling to take control

Author: Samir Klishi

12:00 2025-03-11 UTC+2

1018

The latest news from the US stock marketAuthor: Andreeva Natalya

12:07 2025-03-11 UTC+2

958

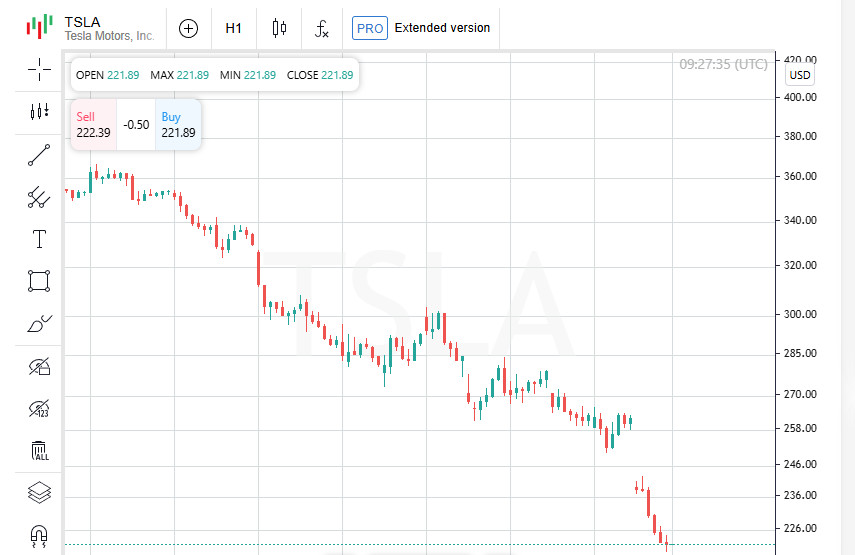

Crypto Stocks Fall on Low Bitcoin Prices HSBC Downgrades US Stocks S&P 500 Closes Below 200-Day Moving Average Nasdaq Suffering Biggest One-Day Drop Since September 2022 Delta Air Lines Cuts Forecast on Growing Economic Uncertainty Tesla Loses More Than $125 Billion in Value in One Day Indices.Author: Thomas Frank

11:34 2025-03-11 UTC+2

958

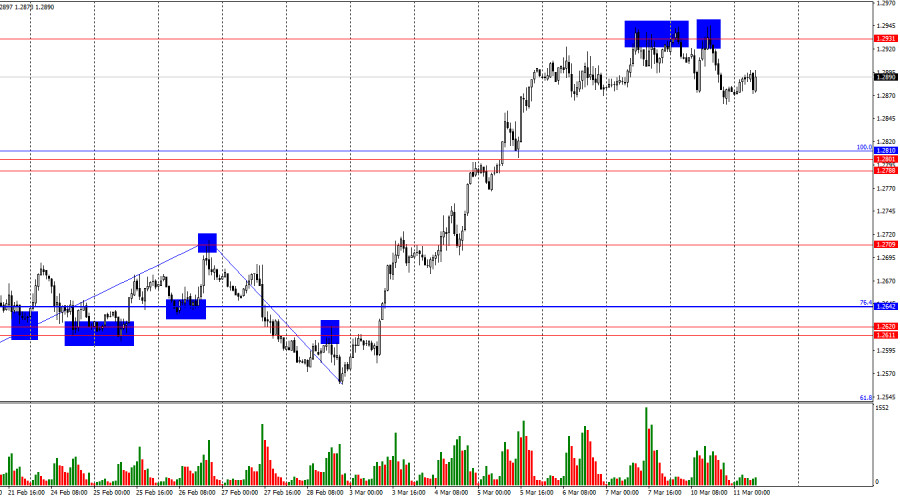

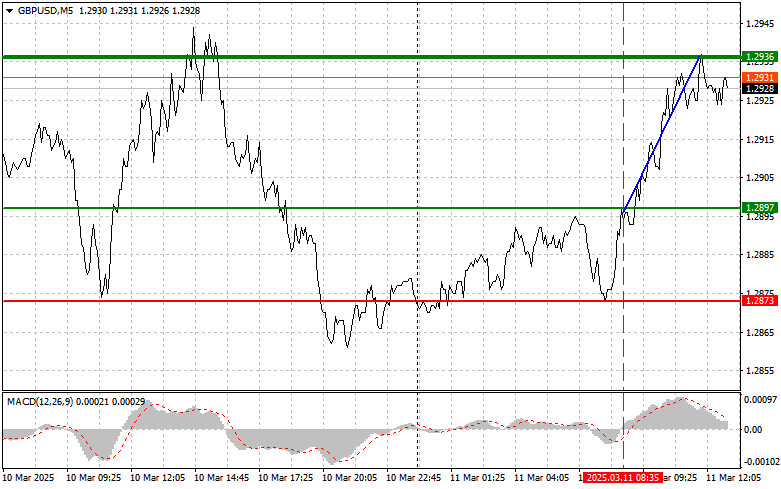

- The test of the 1.2897 price level occurred when the MACD indicator was just starting to rise from the zero mark

Author: Jakub Novak

19:20 2025-03-11 UTC+2

928

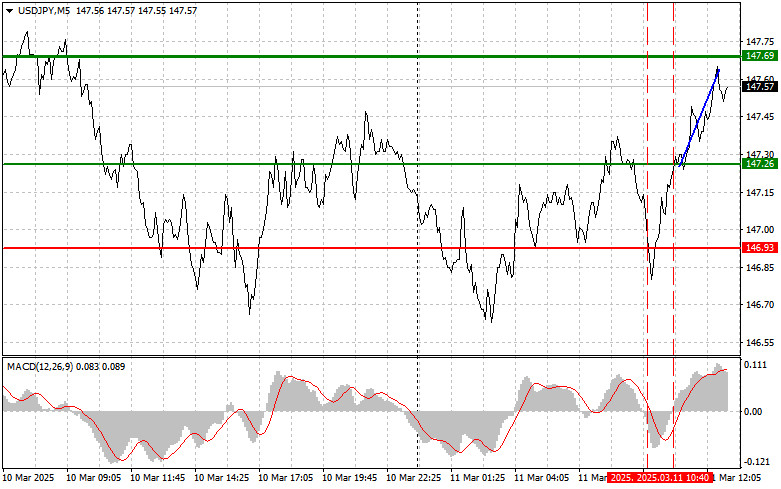

The test of the 146.93 price level occurred when the MACD indicator was just starting to move downward from the zero markAuthor: Jakub Novak

19:23 2025-03-11 UTC+2

868

Japanese yen gains strength as a safe-haven assetAuthor: Irina Yanina

11:57 2025-03-11 UTC+2

853

- Bulls continue their advance, utilizing all available opportunities.

Author: Samir Klishi

12:01 2025-03-11 UTC+2

1243

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 11-14, 2025: buy above $2,907 (21 SMA - 8/8 Murray)

In case gold breaks and consolidates above 2,925, the outlook could be positive and we can expect a new bullish sequence. Therefore, gold could reach 2,668 (8/8 Murray) and even the psychological level of $3,000.Author: Dimitrios Zappas

14:56 2025-03-11 UTC+2

1048

- Trump's meeting with Wall Street leaders set to stabilize market

Author: Jakub Novak

14:32 2025-03-11 UTC+2

1018

- Bearish traders are struggling to take control

Author: Samir Klishi

12:00 2025-03-11 UTC+2

1018

- The latest news from the US stock market

Author: Andreeva Natalya

12:07 2025-03-11 UTC+2

958

- Crypto Stocks Fall on Low Bitcoin Prices HSBC Downgrades US Stocks S&P 500 Closes Below 200-Day Moving Average Nasdaq Suffering Biggest One-Day Drop Since September 2022 Delta Air Lines Cuts Forecast on Growing Economic Uncertainty Tesla Loses More Than $125 Billion in Value in One Day Indices.

Author: Thomas Frank

11:34 2025-03-11 UTC+2

958

- The test of the 1.2897 price level occurred when the MACD indicator was just starting to rise from the zero mark

Author: Jakub Novak

19:20 2025-03-11 UTC+2

928

- The test of the 146.93 price level occurred when the MACD indicator was just starting to move downward from the zero mark

Author: Jakub Novak

19:23 2025-03-11 UTC+2

868

- Japanese yen gains strength as a safe-haven asset

Author: Irina Yanina

11:57 2025-03-11 UTC+2

853