#BTU (Peabody Energy Corporation). Exchange rate and online charts.

See Also

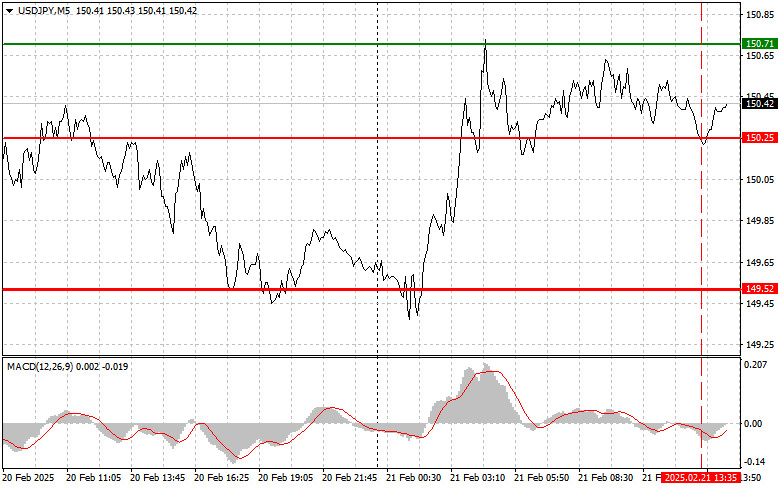

- The test of 150.25 earlier in the day occurred when the MACD indicator had already moved significantly below the zero level

Author: Jakub Novak

17:32 2025-02-21 UTC+2

1753

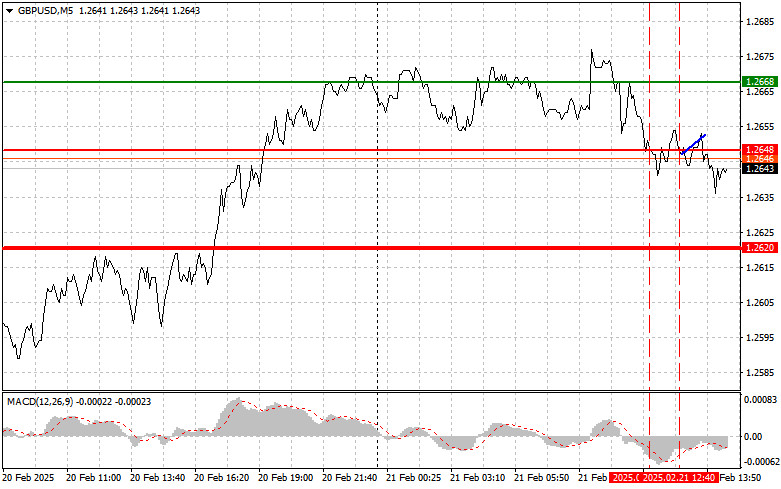

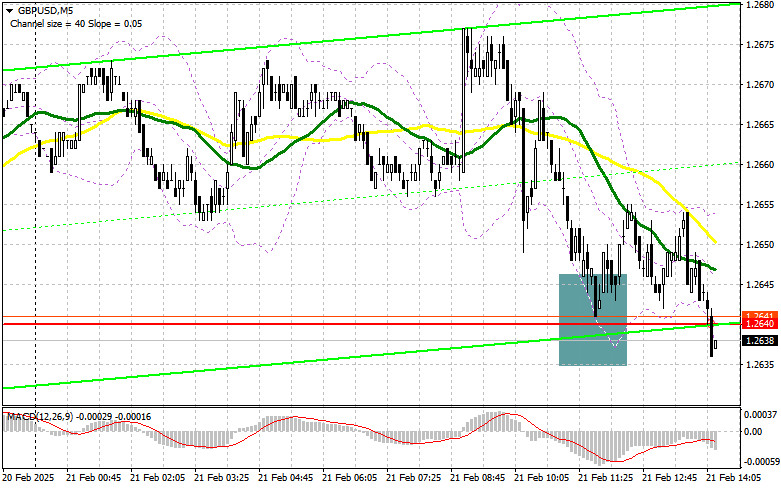

The test of 1.2648 in the first half of the day coincided with the MACD indicator having already moved significantly below the zero levelAuthor: Jakub Novak

17:30 2025-02-21 UTC+2

1588

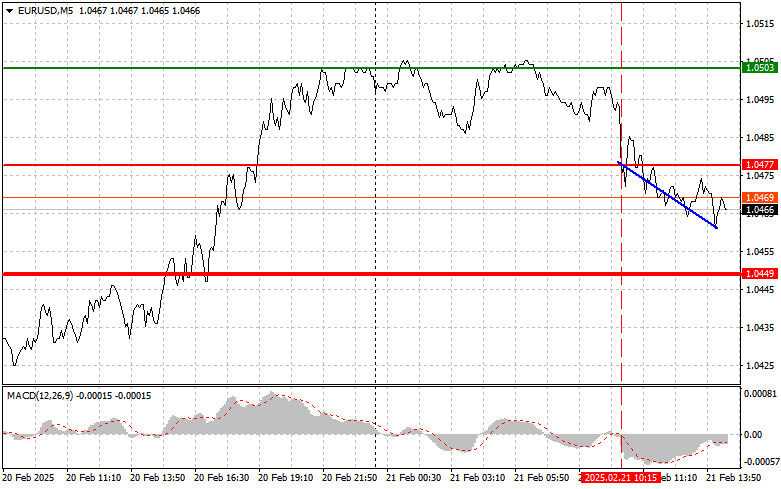

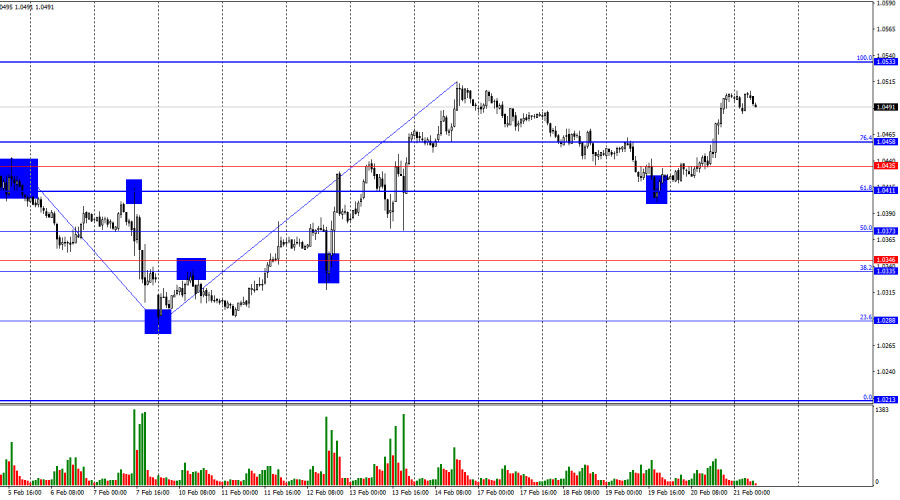

The test of 1.0477 in the first half of the day coincided with the MACD indicator beginning to rise from the zero levelAuthor: Jakub Novak

17:27 2025-02-21 UTC+2

1513

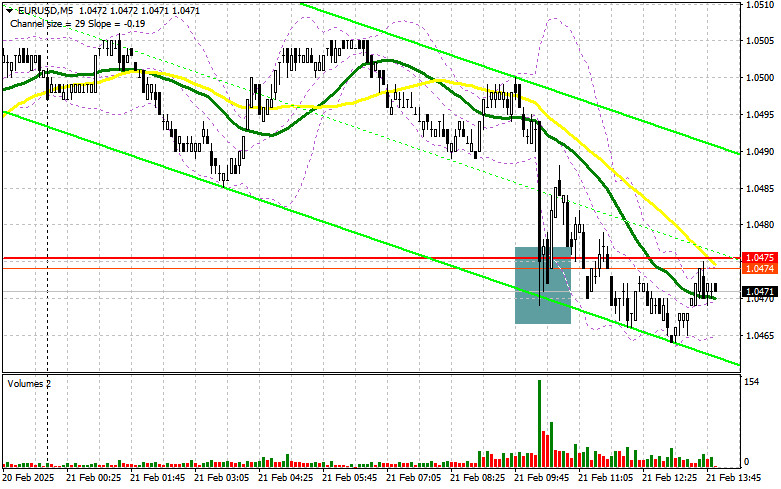

- In my morning forecast, I focused on the 1.0475 level as a key entry point

Author: Miroslaw Bawulski

17:17 2025-02-21 UTC+2

1498

Bulls hold a fragile advantage in the marketAuthor: Samir Klishi

13:05 2025-02-21 UTC+2

1408

Technical analysis of EUR/USD, GBP/USD, SP500 and Bitcoin.Author: Sebastian Seliga

16:22 2025-02-21 UTC+2

1408

- The USD/JPY pair is staging a strong recovery, climbing nearly 150 points from the 149.30-149.25 level

Author: Irina Yanina

13:31 2025-02-21 UTC+2

1363

In my morning forecast, I focused on the 1.2640 level as a key decision pointAuthor: Miroslaw Bawulski

17:24 2025-02-21 UTC+2

1303

Technical analysisTrading Signals for GOLD (XAU/USD) for February 21-24, 2025: buy above $2,933 (21 SMA - 6/8 Murray)

We believe that if the metal consolidates above 2,933 in the next few hours, we could expect it to continue rising until it reaches the 6/8 Murray located at 2,968.Author: Dimitrios Zappas

14:52 2025-02-21 UTC+2

1258

- The test of 150.25 earlier in the day occurred when the MACD indicator had already moved significantly below the zero level

Author: Jakub Novak

17:32 2025-02-21 UTC+2

1753

- The test of 1.2648 in the first half of the day coincided with the MACD indicator having already moved significantly below the zero level

Author: Jakub Novak

17:30 2025-02-21 UTC+2

1588

- The test of 1.0477 in the first half of the day coincided with the MACD indicator beginning to rise from the zero level

Author: Jakub Novak

17:27 2025-02-21 UTC+2

1513

- In my morning forecast, I focused on the 1.0475 level as a key entry point

Author: Miroslaw Bawulski

17:17 2025-02-21 UTC+2

1498

- Bulls hold a fragile advantage in the market

Author: Samir Klishi

13:05 2025-02-21 UTC+2

1408

- Technical analysis of EUR/USD, GBP/USD, SP500 and Bitcoin.

Author: Sebastian Seliga

16:22 2025-02-21 UTC+2

1408

- The USD/JPY pair is staging a strong recovery, climbing nearly 150 points from the 149.30-149.25 level

Author: Irina Yanina

13:31 2025-02-21 UTC+2

1363

- In my morning forecast, I focused on the 1.2640 level as a key decision point

Author: Miroslaw Bawulski

17:24 2025-02-21 UTC+2

1303

- Technical analysis

Trading Signals for GOLD (XAU/USD) for February 21-24, 2025: buy above $2,933 (21 SMA - 6/8 Murray)

We believe that if the metal consolidates above 2,933 in the next few hours, we could expect it to continue rising until it reaches the 6/8 Murray located at 2,968.Author: Dimitrios Zappas

14:52 2025-02-21 UTC+2

1258