#AEX25 (Netherlands 25 Index). Exchange rate and online charts.

See Also

- Technical analysis

Technical Analysis of Intraday Price Movement of Crude Oil Commodity Instrument, Monday April 24, 2025.

On the 4-hour chart of the Crude Oil commodity instrument,Author: Arief Makmur

07:19 2025-04-14 UTC+2

703

Fundamental analysisWhat to Pay Attention to on April 14? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

06:08 2025-04-14 UTC+2

688

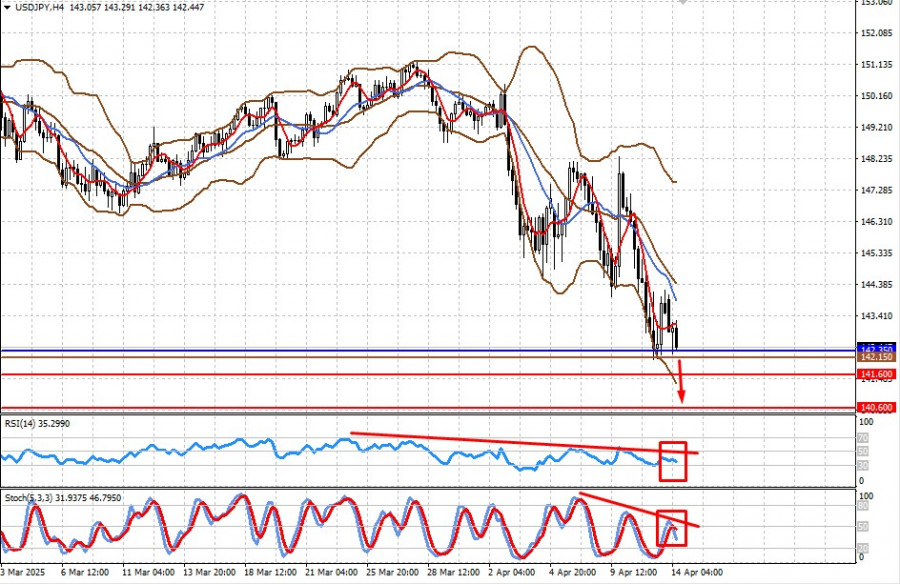

Fundamental analysisThe Uncertainty Factor Will Pressure the Dollar and Support Demand for Safe-Haven Assets (There is a likelihood of further decline in USD/JPY and rising gold prices)

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff dutiesAuthor: Pati Gani

09:45 2025-04-14 UTC+2

688

- Technical analysis

Technical Analysis of Intraday Price Movement of Palladium vs USD Commodity Instrument, Monday April 24, 2025.

With the appearance of Divergence from the Stochastic Oscillator indicator with theAuthor: Arief Makmur

07:19 2025-04-14 UTC+2

688

Intraday Strategies for Beginner Traders on April 14Author: Miroslaw Bawulski

07:31 2025-04-14 UTC+2

688

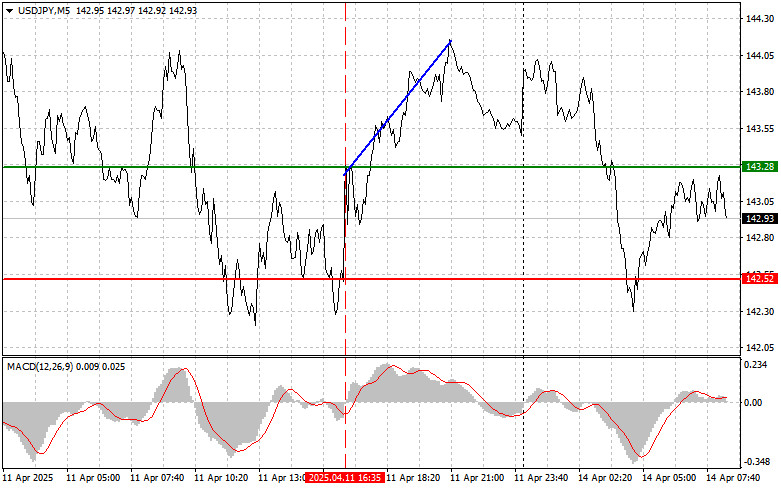

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

688

- Type of analysis

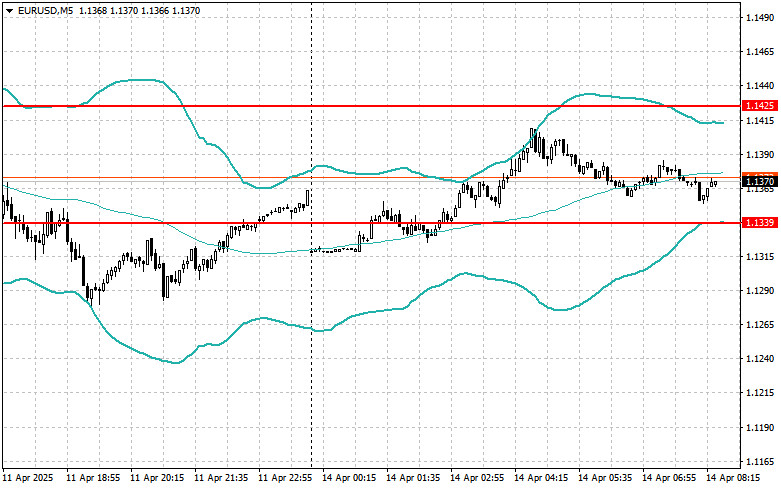

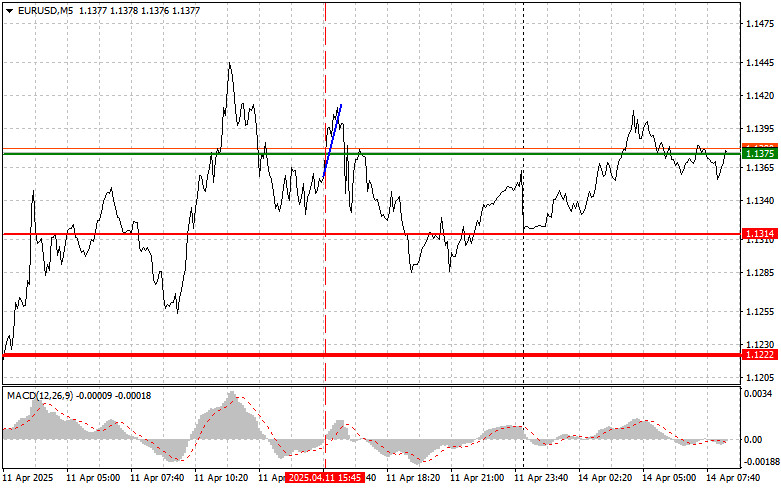

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

673

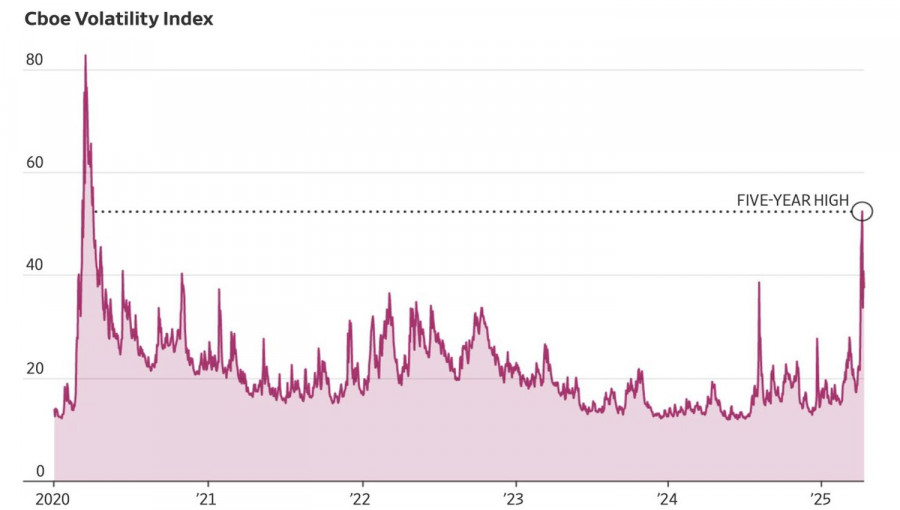

Recession fears prompt investors to sell the S&P 500 — but what if they're wrong?Author: Marek Petkovich

09:45 2025-04-14 UTC+2

658

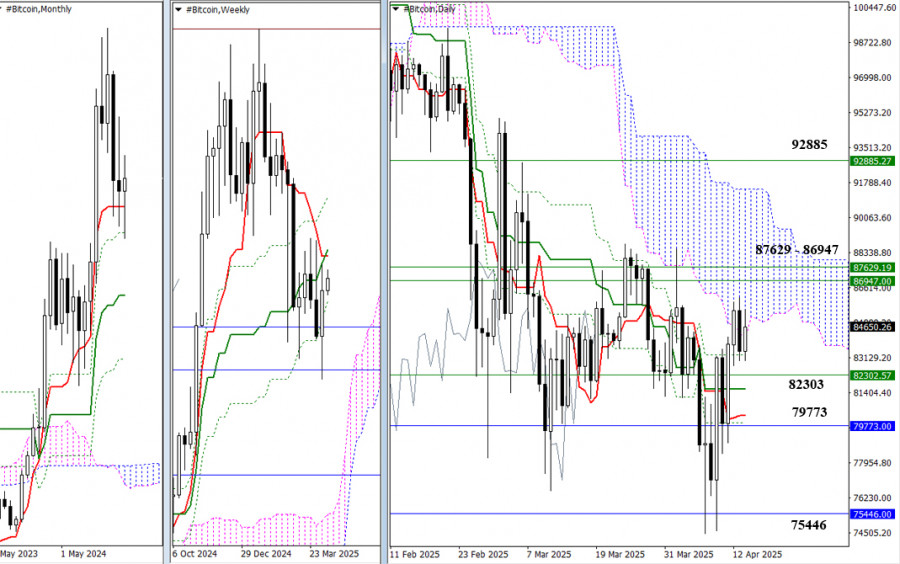

Last trading week, the market indicated a potential opportunity for bulls to regain control. Whether this potential is realized now depends on whether the bulls can exit the previous consolidation area (88743) and break through the resistance levels of the Ichimoku weekly cross (86947 – 87629 and 9.Author: Evangelos Poulakis

06:37 2025-04-14 UTC+2

643

- Technical analysis

Technical Analysis of Intraday Price Movement of Crude Oil Commodity Instrument, Monday April 24, 2025.

On the 4-hour chart of the Crude Oil commodity instrument,Author: Arief Makmur

07:19 2025-04-14 UTC+2

703

- Fundamental analysis

What to Pay Attention to on April 14? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

06:08 2025-04-14 UTC+2

688

- Fundamental analysis

The Uncertainty Factor Will Pressure the Dollar and Support Demand for Safe-Haven Assets (There is a likelihood of further decline in USD/JPY and rising gold prices)

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff dutiesAuthor: Pati Gani

09:45 2025-04-14 UTC+2

688

- Technical analysis

Technical Analysis of Intraday Price Movement of Palladium vs USD Commodity Instrument, Monday April 24, 2025.

With the appearance of Divergence from the Stochastic Oscillator indicator with theAuthor: Arief Makmur

07:19 2025-04-14 UTC+2

688

- Intraday Strategies for Beginner Traders on April 14

Author: Miroslaw Bawulski

07:31 2025-04-14 UTC+2

688

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

688

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

673

- Recession fears prompt investors to sell the S&P 500 — but what if they're wrong?

Author: Marek Petkovich

09:45 2025-04-14 UTC+2

658

- Last trading week, the market indicated a potential opportunity for bulls to regain control. Whether this potential is realized now depends on whether the bulls can exit the previous consolidation area (88743) and break through the resistance levels of the Ichimoku weekly cross (86947 – 87629 and 9.

Author: Evangelos Poulakis

06:37 2025-04-14 UTC+2

643