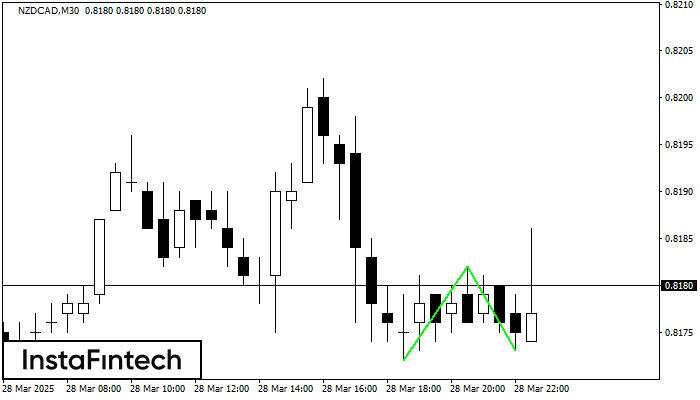

Double Bottom

was formed on 30.03 at 23:00:20 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on NZDCAD M30. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 0.8182 is broken. The further movements will rely on the width of the current pattern 10 points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

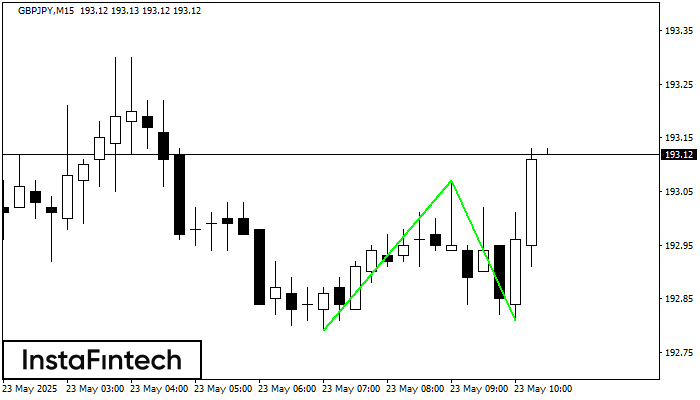

Double Bottom

was formed on 23.05 at 09:29:51 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on GBPJPY M15. Characteristics: the support level 192.79; the resistance level 193.07; the width of the pattern 28 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 23.05 at 09:10:52 (UTC+0)

signal strength 2 of 5

According to the chart of M15, AUDJPY formed the Bullish Symmetrical Triangle pattern, which signals the trend will continue. Description. The upper border of the pattern touches the coordinates 92.46/92.24

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 23.05 at 08:47:46 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCAD formed the Bullish Symmetrical Triangle pattern, which signals the trend will continue. Description. The upper border of the pattern touches the coordinates 0.8184/0.8177

The M5 and M15 time frames may have more false entry points.

Open chart in a new window