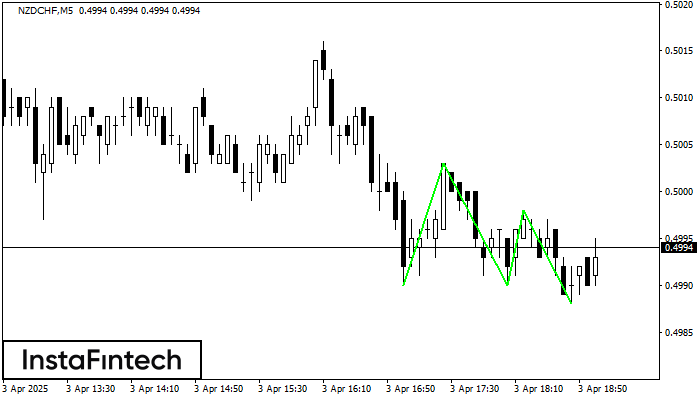

Triple Bottom

was formed on 03.04 at 18:04:53 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of NZDCHF M5. Features of the pattern: The lower line of the pattern has coordinates 0.5003 with the upper limit 0.5003/0.4998, the projection of the width is 13 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 0.4990, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Double Bottom

was formed on 22.04 at 23:05:56 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDUSD M5; the upper boundary is 0.6368; the lower boundary is 0.6362. The width of the pattern is 6 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

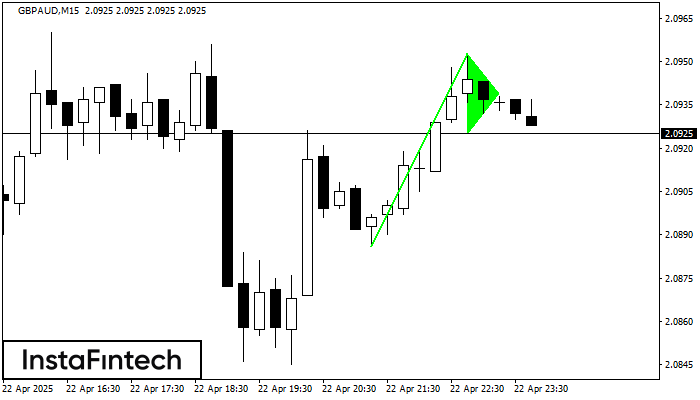

Bullish pennant

was formed on 22.04 at 23:00:37 (UTC+0)

signal strength 2 of 5

The Bullish pennant signal – Trading instrument GBPAUD M15, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 2.0953, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Rectangle

was formed on 22.04 at 22:14:12 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPCHF formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border

The M5 and M15 time frames may have more false entry points.

Open chart in a new window