Triple Bottom

was formed on 03.04 at 04:50:12 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of USDJPY M5. Features of the pattern: The lower line of the pattern has coordinates 148.35 with the upper limit 148.35/147.90, the projection of the width is 65 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 147.70, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

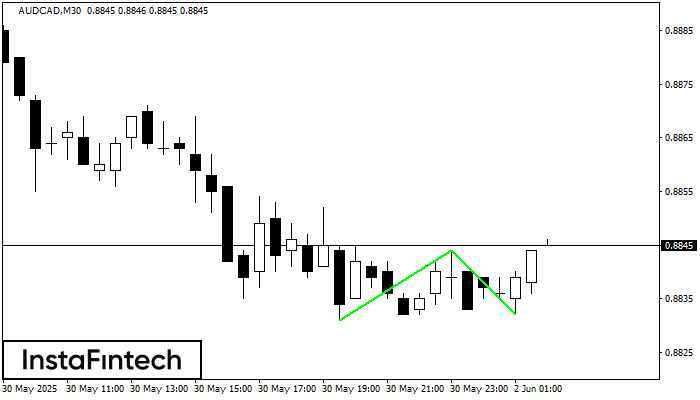

Bawah Ganda

was formed on 02.06 at 01:00:44 (UTC+0)

signal strength 3 of 5

Pola Bawah Ganda telah terbentuk pada AUDCAD M30. Karakteristik: level support 0.8831; level resistance 0.8844; lebar pola 13 poin. Jika level resistance ditembus, perubahan dalam tren dapat diprediksi dengan target

Open chart in a new window

Panji Bullish

was formed on 02.06 at 00:35:10 (UTC+0)

signal strength 1 of 5

Pola Panji Bullish terbentuk di grafik GOLD M5. Ini adalah jenis pola kelanjutan. Diduga, jika harga ditetapkan di atas titik tertinggi panji di 3309.60, tren naik selanjutnya mungkin terjadi

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window

Bawah Ganda

was formed on 02.06 at 00:30:12 (UTC+0)

signal strength 2 of 5

Pola Bawah Ganda telah terbentuk pada AUDCAD M15. Formasi ini mensinyalkan reversal tren dari arah penurunan ke arah kenaikan. Sinyal menunjukkan bahwa transaksi beli harus dibuka setelah batas atas pola

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window