Lihat juga

03.04.2025 03:53 AM

03.04.2025 03:53 AMThe EUR/USD currency pair traded on Wednesday as it did on Monday and Tuesday. For most of the day, we observed low-volatility, erratic movements with no clear logic. No information on tariffs was released by Donald Trump on Wednesday, so any analysis of the U.S. President's trade-related announcements will need to be conducted today. The ADP employment report was published only during the U.S. trading session, which turned out to be nearly twice as strong as forecasted—yet it still failed to support the dollar. As we warned yesterday, this report is secondary. Even if not entirely secondary, the market places much more weight on the Nonfarm Payrolls report when assessing the state of the U.S. labor market.

Thus, nothing interesting, logical, or consistent was observed on Wednesday. A week that initially seemed full of potential for significant market moves turned out to be dull. The market continues to ignore most macroeconomic reports and is even reacting rather indifferently to new statements from Donald Trump.

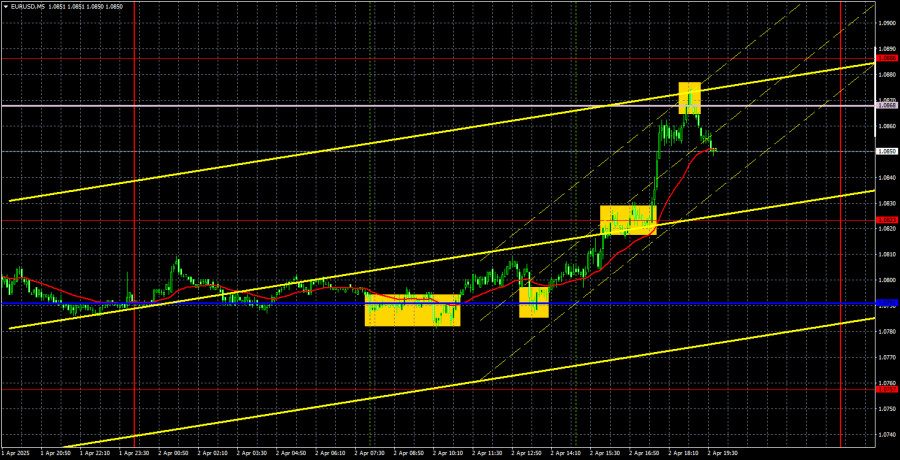

Based on Wednesday's trading signals, we can emphasize two rebounds from the critical line. However, these rebounds were not very precise. Nevertheless, long positions could be opened based on them—even though the dollar's decline contradicted the macroeconomic backdrop. During the U.S. session, the dollar faced renewed pressure, allowing the price to reach the Senkou Span B line by day's end. As a result, the single long position could yield about 50–60 pips in profit.

The latest COT report is dated March 25. The illustration above clearly shows that the net position of non-commercial traders had remained bullish for a long time. Bears struggled to gain dominance, but now the bulls have retaken the initiative. The bears' advantage has faded since Trump became President, and the dollar started plummeting. We cannot say with certainty that the decline of the U.S. currency will continue, as COT reports reflect the sentiment of large players—which, under current circumstances, can change rapidly.

We still see no fundamental factors supporting the strengthening of the euro, but one very significant factor has emerged for the weakening of the dollar. The pair may continue to correct for several more weeks or months, but a 16-year downward trend will not be reversed so quickly.

The red and blue lines have crossed again, indicating that the market trend is now "bullish." During the last reporting week, the number of long positions in the "Non-commercial" group increased by 800, while the number of short positions decreased by 5,200. Accordingly, the net position increased by another 44,400 thousand contracts.

On the hourly chart, the downward movement of the EUR/USD pair ended quickly as Trump announced new tariffs. We still believe that a decline will resume in the medium term due to the divergence in monetary policy between the ECB and the Fed. However, it's unclear how long the market will continue reacting solely to the "Trump factor." Traders are ignoring many reports and news events, the dollar is being sold off at every opportunity, and even when conditions favor it, the greenback struggles to gain. In recent weeks, volatility has also dropped, and price movements have become increasingly erratic.

For April 3, we identify the following trading levels: 1.0340–1.0366, 1.0461, 1.0524, 1.0585, 1.0658–1.0669, 1.0757, 1.0797, 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, along with the Senkou Span B line (1.0868) and the Kijun-sen line (1.0791). Remember that Ichimoku indicator lines can shift throughout the day, so this should be considered when identifying trading signals. Don't forget to move your Stop Loss to breakeven once the price moves 15 pips in the right direction—this will protect against potential losses if the signal turns out to be false.

On Thursday, service sector PMIs will be released in Germany, the Eurozone, and the U.S. However, we strongly doubt that the market will react to these indices. Traders are largely ignoring macroeconomic data, and the focus remains on Donald Trump's anticipated announcement of new tariffs—not business activity. A relatively strong reaction is only likely for the ISM Services Index from the U.S.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Jumat, pasangan GBP/USD juga melanjutkan pergerakan naiknya. Alasannya sama seperti untuk pasangan EUR/USD. Seluruh latar belakang makroekonomi pada hari Jumat sekali lagi hampir tidak relevan bagi para trader

Pada hari Jumat, pasangan mata uang EUR/USD umumnya melanjutkan pergerakan naik. Dan mengapa harus berhenti? Perang dagang antara AS dan Tiongkok terus meningkat, dengan kedua negara memberlakukan tarif dan sanksi

Pada hari Jumat, pasangan mata uang GBP/USD terus diperdagangkan naik, meskipun kali ini dolar menghindari penurunan besar. Meskipun satu hari tanpa penurunan besar dolar mungkin tampak signifikan, hal ini tidak

Pada hari Jumat, pasangan mata uang EUR/USD melanjutkan reli ultra-kuatnya—sesuatu yang tidak lagi mengejutkan siapa pun. Tarif timbal balik antara AS dan Tiongkok terus meningkat, sementara semua berita lainnya tetap

Dalam prediksi pagi saya, saya menyoroti level 1,2986 dan merencanakan keputusan memasuki pasar dari titik tersebut. Mari kita lihat grafik 5 menit dan analisis apa yang terjadi. Penurunan dan penembusan

Dalam prediksi pagi, saya fokus pada level 1,1336 dan merencanakan keputusan masuk pasar berdasarkan level tersebut. Mari kita perhatikan grafik 5 menit dan analisis apa yang terjadi. Breakout dan pengujian

Dalam 24 jam terakhir, pasangan GBP/USD naik sebanyak 170 pip. Pada malam menjelang Jumat, pound sterling terus menguat. Beberapa hari yang lalu, kami mencatat bahwa dolar telah menguat secara signifikan

Pada hari Kamis, pasangan mata uang EUR/USD melanjutkan pergerakan naiknya dan mencatat kenaikan lebih dari 300 pip. Saat hari Jumat dimulai, pasangan ini terus mengalami pertumbuhan tanpa henti. Alasan

Pada hari Kamis, pasangan mata uang EUR/USD menunjukkan pertumbuhan yang sangat kuat—sebuah pergerakan yang mungkin tidak mengejutkan siapa pun saat ini. Tepat ketika kami melaporkan bahwa tarif terhadap Tiongkok telah

Dalam prediksi pagi saya, saya menyoroti level 1,2871 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Kenaikan

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.