Lihat juga

02.04.2025 08:14 PM

02.04.2025 08:14 PMTrade Breakdown and Tips for Trading the Japanese Yen

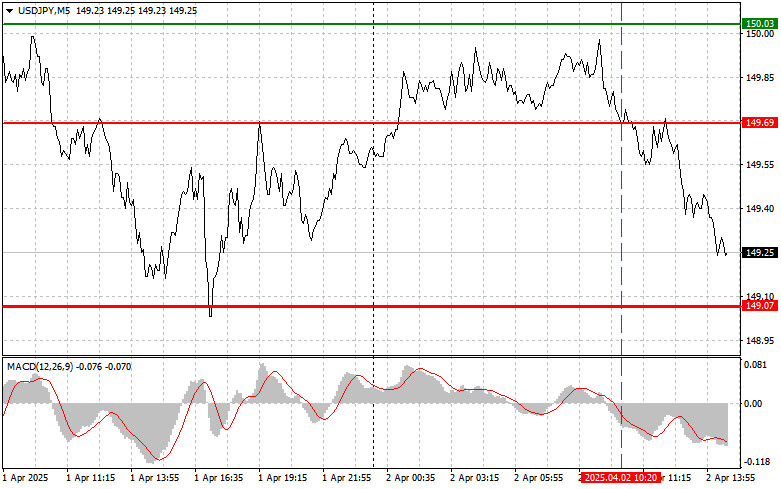

The price test at 149.69 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the dollar and missed the entire move down.

In the second half of the day, all attention will shift to Trump's speech and the announcement of reciprocal tariffs. This decision will undoubtedly trigger a chain reaction across the global economy, provoking volatility in the currency markets and heightening fears of a looming trade war. The initial trader reaction will be crucial. If the actual tariffs differ significantly from Trump's earlier statements, demand for the U.S. dollar will likely return—leading to a weakening of the yen.

As for today's intraday strategy, I will rely primarily on Scenarios #1 and #2.

Buy Signal

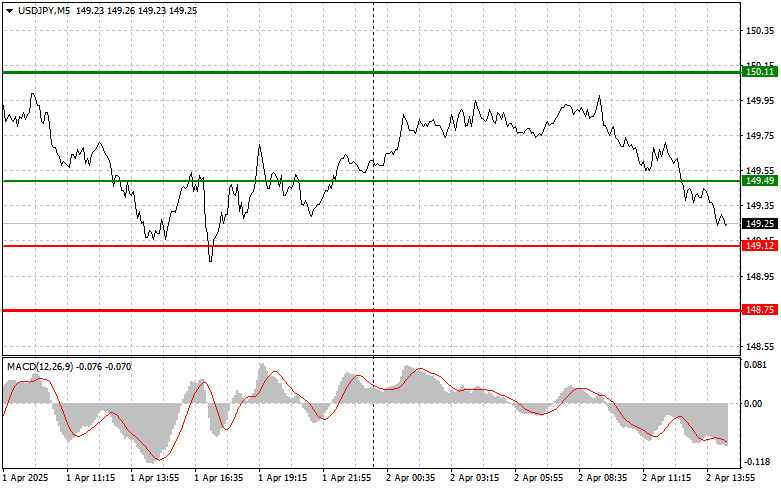

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 149.49 (green line on the chart), targeting a rise to 150.11 (thicker green line). Around 150.11, I will exit long positions and open short positions in the opposite direction (aiming for a 30–35 point retracement). A rise in the pair may occur as part of an upward correction. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 149.12 level, while the MACD is in the oversold area. This would limit the pair's downside and trigger a reversal to the upside. A move toward the opposite levels of 149.49 and 150.11 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a break below 149.12 (red line on the chart), which would likely lead to a quick decline. The key target for sellers is 148.75, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point bounce). Selling pressure could emerge at any time today—especially after Trump's speech. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to move down from it.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of 149.49, while the MACD is in the overbought zone. This would cap the upward potential and trigger a reversal to the downside. A move toward the opposite levels of 149.12 and 148.75 can be expected.

Chart Explanation:

Important Note:

Beginner Forex traders must make market entry decisions with extreme caution. It is best to stay out of the market before the release of major fundamental data to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit—especially if you're not practicing proper money management and trading with large volumes.

And remember, successful trading requires a clear trading plan, such as the one I've outlined above. Making spontaneous decisions based on current market conditions is an inherently losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga di 148,08 terjadi saat indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual dolar. Akibatnya, pasangan ini jatuh sebanyak

Uji harga pada 1.3493 terjadi ketika indikator MACD mulai bergerak naik dari tanda nol, yang mengonfirmasi titik masuk yang tepat untuk membeli pound dan menghasilkan pertumbuhan menuju level target 1.3546

Uji level harga 1,1709 terjadi ketika indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang tepat untuk membeli euro. Akibatnya, pasangan ini naik lebih dari

Dolar AS anjlok setelah para trader menyimpulkan bahwa Federal Reserve tidak punya pilihan selain memangkas suku bunga pada bulan September tahun ini. Pertumbuhan lapangan kerja yang lemah di sektor non-pertanian

Uji level harga 148,46 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, yang mengonfirmasi titik entri yang tepat untuk menjual dolar. Akibatnya, pasangan ini turun menuju

Uji level harga 1.3418 terjadi ketika indikator MACD sudah bergerak jauh di atas tanda nol, yang membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli pound dan melewatkan

Level harga 1,1660 diuji saat indikator MACD baru mulai bergerak naik dari titik nol, yang mengonfirmasi kebenaran titik masuk untuk membeli euro. Akibatnya, pasangan ini naik 20 poin. Rilis data

Dolar AS telah kehilangan posisi secara signifikan terhadap sebagian besar aset berisiko. Data lemah kemarin tentang lowongan pekerjaan dan perputaran tenaga kerja dari Biro Statistik Tenaga Kerja AS memberikan tekanan

Ulasan Trading dan Kiat-kiat Trading untuk Yen Jepang Level harga 148,80 diuji ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli

Pengujian level harga 1.3380 terjadi ketika indikator MACD baru saja mulai bergerak naik dari tanda nol, mengonfirmasi titik masuk yang tepat untuk membeli pound. Akibatnya, pasangan ini naik menuju level

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.