Lihat juga

02.04.2025 07:04 AM

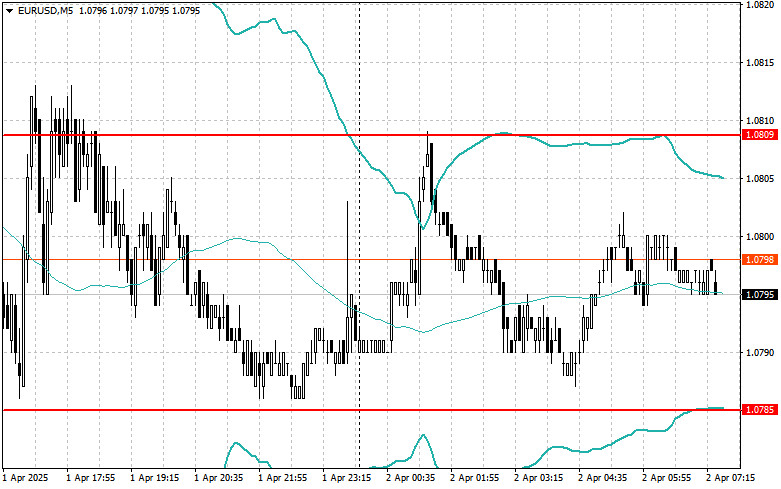

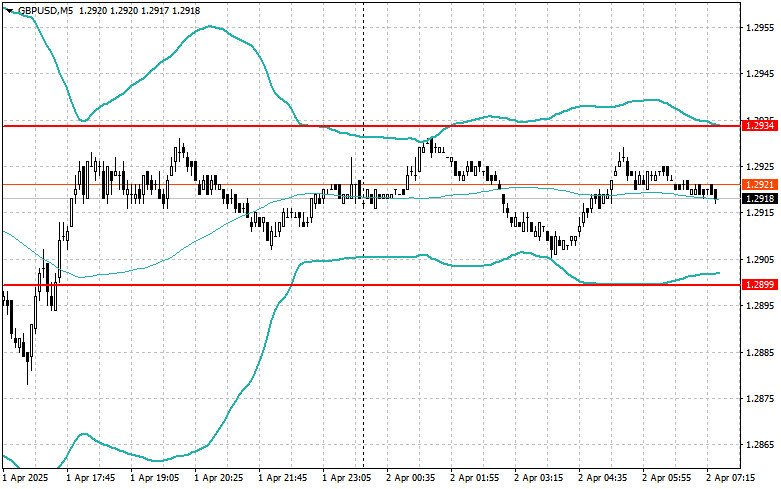

02.04.2025 07:04 AMThe euro and the pound are trading within sideways channels, but both currencies are experiencing increasing pressure. Today's key development is expected to arise from the announcement of trade tariffs by the United States, along with relevant details. There are no significant economic data releases from the eurozone or the UK today.

Yesterday's data showing a slowdown in price growth in the eurozone failed to support the euro since easing inflation gives the European Central Bank room to continue cutting interest rates. The market seems to be pricing in more complex factors than just current inflation figures. Traders will seek additional signals from the ECB regarding the future trajectory of interest rates, paying special attention to how the ECB evaluates the influence of geopolitical tensions from tariffs and the energy crisis on the regional economy.

As mentioned above, there are no eurozone releases in the first half of the day, so trading will likely remain subdued. Traders will likely await news from the U.S., where labor market data is expected. These figures could significantly influence the Federal Reserve's decisions on monetary policy going forward. The focus will also shift toward trade tariffs, which are raising concerns over slowing global growth and prompting market participants to remain cautious and avoid risky assets.

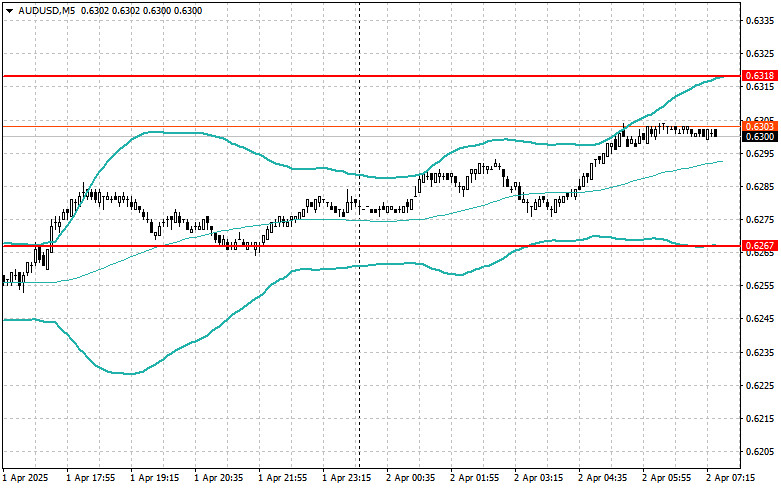

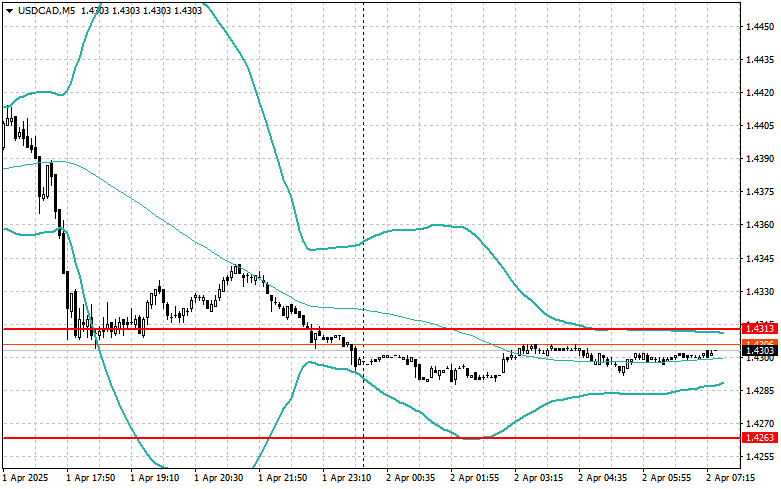

If the information about tariffs matches economist expectations, the Mean Reversion strategy is preferable. If the data turns out significantly above or below expectations, the Momentum strategy would be more appropriate.

Buy on a breakout above 1.0813, targeting 1.0850 and 1.0884

Sell on a breakout below 1.0780, targeting 1.0757 and 1.0730

Buy on a breakout above 1.2939, targeting 1.2970 and 1.2988

Sell on a breakout below 1.2903, targeting 1.2868 and 1.2838

Buy on a breakout above 149.95, targeting 150.20 and 150.50

Sell on a breakout below 149.62, targeting 149.30 and 148.97

Look to sell after a failed breakout above 1.0809 with a return below that level

Look to buy after a failed breakout below 1.0785 with a return back above that level

Look to sell after a failed breakout above 1.2934 with a return below

Look to buy after a failed breakout below 1.2899 with a return back above

Look to sell after a failed breakout above 0.6318 with a return below

Look to buy after a failed breakout below 0.6267 with a return back above

Look to sell after a failed breakout above 1.4313 with a return below

Look to buy after a failed breakout below 1.4263 with a return back above

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga di 148,08 terjadi saat indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual dolar. Akibatnya, pasangan ini jatuh sebanyak

Uji harga pada 1.3493 terjadi ketika indikator MACD mulai bergerak naik dari tanda nol, yang mengonfirmasi titik masuk yang tepat untuk membeli pound dan menghasilkan pertumbuhan menuju level target 1.3546

Uji level harga 1,1709 terjadi ketika indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang tepat untuk membeli euro. Akibatnya, pasangan ini naik lebih dari

Dolar AS anjlok setelah para trader menyimpulkan bahwa Federal Reserve tidak punya pilihan selain memangkas suku bunga pada bulan September tahun ini. Pertumbuhan lapangan kerja yang lemah di sektor non-pertanian

Uji level harga 148,46 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, yang mengonfirmasi titik entri yang tepat untuk menjual dolar. Akibatnya, pasangan ini turun menuju

Uji level harga 1.3418 terjadi ketika indikator MACD sudah bergerak jauh di atas tanda nol, yang membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli pound dan melewatkan

Level harga 1,1660 diuji saat indikator MACD baru mulai bergerak naik dari titik nol, yang mengonfirmasi kebenaran titik masuk untuk membeli euro. Akibatnya, pasangan ini naik 20 poin. Rilis data

Dolar AS telah kehilangan posisi secara signifikan terhadap sebagian besar aset berisiko. Data lemah kemarin tentang lowongan pekerjaan dan perputaran tenaga kerja dari Biro Statistik Tenaga Kerja AS memberikan tekanan

Ulasan Trading dan Kiat-kiat Trading untuk Yen Jepang Level harga 148,80 diuji ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli

Pengujian level harga 1.3380 terjadi ketika indikator MACD baru saja mulai bergerak naik dari tanda nol, mengonfirmasi titik masuk yang tepat untuk membeli pound. Akibatnya, pasangan ini naik menuju level

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.