Lihat juga

01.04.2025 09:13 AM

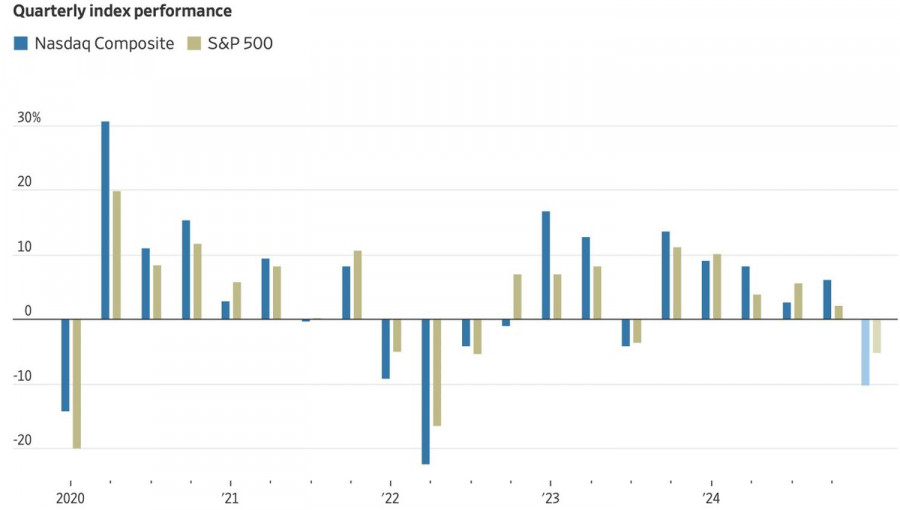

01.04.2025 09:13 AMThe S&P 500 had its worst quarter in three years. Investors are shifting capital from North America to Europe. Once-booming US tech stocks have collapsed. Major banks and respected institutions are raising the odds of a recession for the American economy. That's a lot of bad news for a broad stock index, isn't it? However, buying the dip towards the lower boundary of the sideways range at 5,500–5,790 has borne fruit — just in time for America's "Liberation Day".

Performance of US stock indices

Donald Trump's policies have caused turmoil not only in financial markets but also among the general public. According to the latest Associated Press poll, nearly 60% of Americans disapprove of the president's protectionist stance, and 58% are dissatisfied with his overall handling of the US economy. The market sell-off reflects investor skepticism, but the Republican leader remains undeterred. He insists the country must endure short-term pain to reclaim a golden era for America.

That "Liberation Day" will come on April 2, when the White House is set to announce new tariffs. According to Wall Street Journal sources, the president is weighing two options: blanket 20% import tariffs or tailored, reciprocal tariffs. The former could send another shock through financial markets, while the latter might calm nerves.

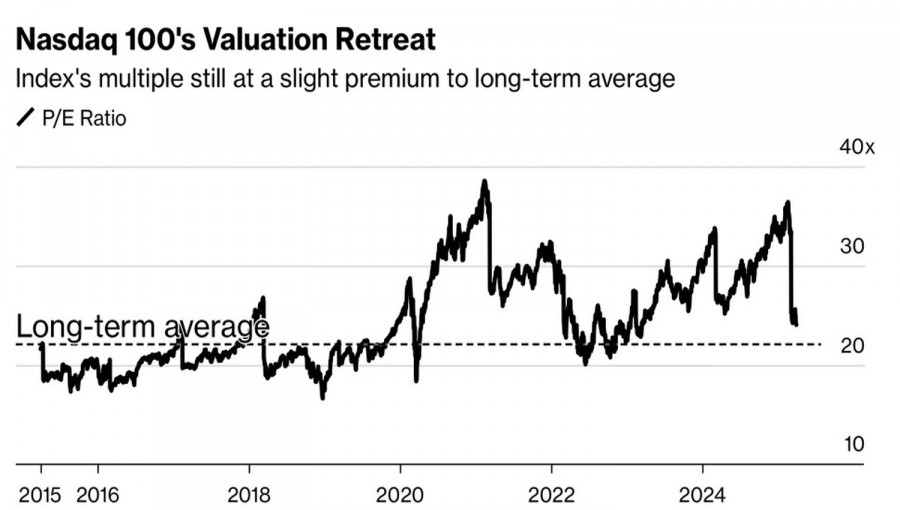

Following JP Morgan and Moody's Analytics, Goldman Sachs has raised the probability of a US recession from 20% to 35%. Yet investors have found new reasons for optimism. After a massive sell-off in tech stocks, forward P/E ratios are now approaching historical averages. In other words, stocks are no longer overvalued, making them more attractive.

US tech sector P/E trends

The White House's new tariffs could also slow capital outflows from North America to Europe. A full-blown trade war would likely hit the EU harder due to its large trade surplus with the United States. Moreover, part of the capital shift was driven by a 4.6% gain in the euro against the dollar in the first quarter. As a result, European investors lost about 13% on US-listed assets.

According to Wells Fargo, the dollar's January-March slide was temporary. Looking ahead, tariffs and trade tensions could boost the greenback by 1.5% to 11%, with maximum gains expected if America's trade partners avoid a full-scale retaliatory response.

From a technical standpoint, the S&P 500 has bounced off the lower boundary of the previously established 5,500-5,790 consolidation range. Long positions opened at the 5,500 level appear to be worth holding. A break above the resistance levels at 5,625 (pivot) and 5,670 (fair value) would allow for additional long positions.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Rabu, pasangan mata uang GBP/USD berjuang untuk menghindari penurunan baru. Kemarin, kami menunjukkan bahwa tidak ada alasan untuk penurunan baru mata uang Inggris. Kami tetap berpegang pada pandangan

Pada hari Rabu, pasangan mata uang EUR/USD kembali diperdagangkan dengan sangat lemah, mempertahankan kecenderungan penurunan. Satu-satunya peristiwa signifikan hari itu termasuk indeks aktivitas jasa ISM dari AS dan laporan

Menyadari bahwa situasi menjadi buntu dan penyelesaiannya dapat mengorbankan banyak posisi di Parlemen, Reeves memutuskan untuk berbicara kepada rakyat Inggris, mendesak mereka untuk mendukung usulannya menaikkan pajak. Bagaimana

Pada pasangan USD/CHF, pembeli terus tertarik selama enam hari berturut-turut, mencapai level tertinggi sejak 12 Agustus. Momentum ini telah mendorong harga di atas level kunci 0,8100 dan didukung oleh pembelian

Setelah mengalami penurunan selama lima hari, pasangan euro-dolar kini memasuki fase stagnan. Selama lima hari trading berturut-turut, pasangan ini aktif mengalami penurunan di tengah penguatan dolar AS secara keseluruhan. Hanya

Setelah Bank of Canada (BoC) memangkas suku bunga sebesar seperempat poin dan ekspektasi terhadap kebijakan suku bunga Federal Reserve menjadi lebih hawkish, pelemahan lebih lanjut dari dolar Kanada menjadi hampir

Sejarah berulang. Terkadang tampak hampir seperti salinan. Pasangan EUR/USD terus turun selama lima hari perdagangan berturut-turut. Ini menandai rentetan penurunan terpanjang sejak Juli. Baik di pertengahan musim panas maupun akhir

Emas berusaha memperpanjang rebound intraday yang sederhana tetapi menunjukkan sedikit keyakinan bullish, tetap di bawah level psikologis kunci $4.000. Perubahan sentimen risiko global membantu logam mulia safe-haven ini menarik pembeli

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.