Lihat juga

31.03.2025 09:35 AM

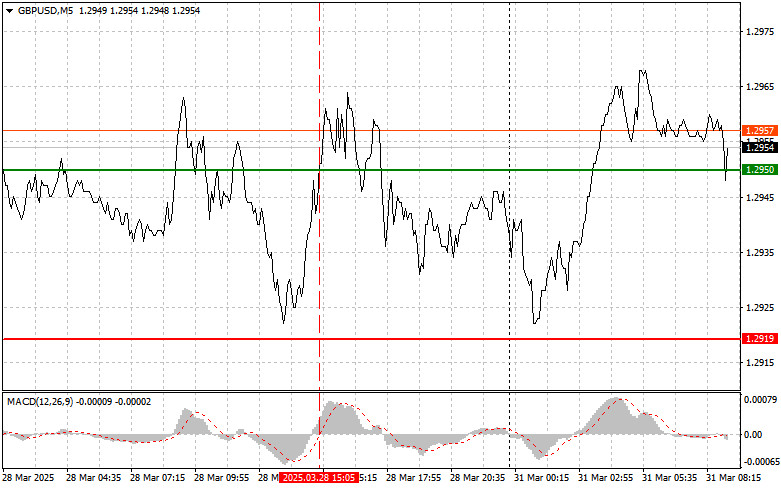

31.03.2025 09:35 AMThe price test at 1.2950 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I didn't buy the pound and stayed out of trades in the second half of the day.

After positive GDP data, the pound regained some strength at the end of last week, which helped limit the pair's downside potential. Weak U.S. data also helped traders ease the pressure. Unfortunately, UK GDP in the first quarter is expected to show even more modest growth, which may pressure the pound. Declining inflation—a key factor shaping the Bank of England's dovish monetary policy—supports this view.

Today during the European session, the UK will publish data on the number of mortgage approvals, net lending to individuals, and the change in the M4 money supply aggregate. While these figures help gauge the domestic health of the British economy, they are unlikely to significantly impact overall FX market dynamics, including the pound. Investors will likely focus on more significant macroeconomic drivers such as inflation, interest rates, and the geopolitical landscape.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.2965 (green line on the chart), targeting a rise to 1.3018 (thicker green line). Around 1.3018, I plan to exit long positions and open shorts in the opposite direction (expecting a move of 30–35 pips in the opposite direction). Pound growth should only be expected after strong economic data. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if the price tests 1.2935 twice consecutively while MACD is in oversold territory. This would limit the pair's downside potential and trigger a reversal to the upside. A rise toward the opposite levels, 1.2965 and 1.3018, may be expected.

Scenario #1: I plan to sell the pound today after breaking below 1.2935 (red line on the chart), which would lead to a quick decline. The key target for sellers will be 1.2885, where I intend to exit short positions and open long positions in the opposite direction (expecting a 20–25 pip bounce). Selling the pound is best done from higher levels. Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of 1.2965 while MACD is in overbought territory. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels, 1.2935 and 1.2885, may be expected.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga pada 154,66 bertepatan dengan indikator MACD yang baru mulai bergerak naik dari titik nol, yang memungkinkan pembelian dolar sesuai dengan tren. Namun, setelah kenaikan 10 pip, tekanan pada

Uji harga pada 1.3145 bertepatan dengan indikator MACD yang baru mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Namun, perdagangan mengalami kerugian karena pasangan

Uji harga pada 1,1633 bertepatan dengan indikator MACD yang naik secara signifikan di atas level nol, yang membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli euro. Ketiadaan

Euro, pound, dan aset berisiko lainnya terus naik terhadap dolar AS. Kebingungan di antara Federal Reserve AS, dengan pernyataan yang sangat berbeda dari para pembuat kebijakan, telah memberikan tekanan pada

Uji harga pada 1,3111 terjadi ketika indikator MACD baru saja mulai bergerak turun dari level nol, mengonfirmasi titik entri yang tepat untuk menjual pound. Bersama dengan data Inggris yang lemah

Pengujian harga pada 1,1593 terjadi ketika indikator MACD baru saja mulai bergerak naik dari titik nol, mengonfirmasi titik masuk yang tepat untuk membeli euro, mengakibatkan pertumbuhan menuju level target 1,1619

Uji harga di 154. 75 bersamaan dengan indikator MACD yang berada jauh di bawah angka nol, yang menerapkan batasan pada kemungkinan penurunan pasangan ini. Oleh karena itu, saya tidak melakukan

Uji harga pada 1,3108 terjadi ketika indikator MACD mulai bergerak turun dari level nol, mengonfirmasi titik entri yang tepat untuk menjual pound. Akibatnya, pasangan ini turun sebanyak 20 pip. Dimulainya

Pengujian harga pada 1,1580 terjadi saat indikator MACD mulai bergerak di atas titik nol, mengonfirmasi titik masuk yang tepat untuk membeli euro. Akibatnya, pasangan ini naik lebih dari

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.