Lihat juga

31.03.2025 11:43 AM

31.03.2025 11:43 AMGBP/USD

Analysis: The 4-hour chart analysis of the British pound major shows that the upward wave from January 13 remains incomplete. Its first part (A) has been completed. Since early March, the middle part of wave (B) has been forming in a sideways flat. This wave is developing as a contracting flat and is still incomplete. At the time of analysis, quotes are at the lower boundary of the established price corridor.

Forecast: In the coming days, the flat structure of the pound's movement is expected to complete. In the second half of the week, a reversal may form near the support zone, followed by renewed price growth. The expected weekly upper boundary is shown by the calculated resistance.

Potential Reversal Zones Resistance:

Recommendations:

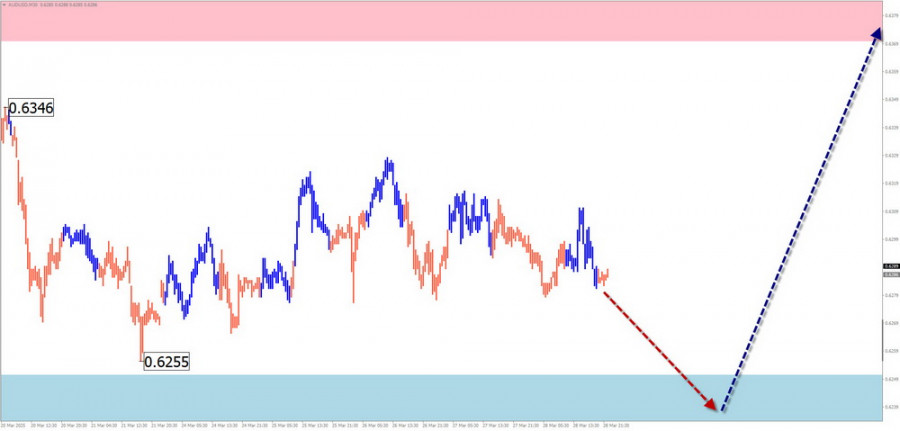

AUD/USD

Analysis: The Australian dollar major has been in an upward wave since February. Throughout the current month, a counter-correction has been developing within it, forming a contracting flat. As of now, this structure remains incomplete. Price is moving in a sideways corridor between opposing zones.

Forecast: During the upcoming week, the AUD/USD pair is expected to remain in a sideways flat. A downward bias is more likely in the first half of the week. A directional shift and renewed price growth may occur closer to the weekend.

Potential Reversal Zones Resistance:

Recommendations:

USD/CHF

Analysis: In the short term, USD/CHF price direction is defined by a bearish wave since January last year. On a larger scale, this represents a correction. The pair has reached the upper boundary of the broad potential reversal zone on the daily time frame.

Forecast: At the beginning of the week, the most likely scenario is sideways consolidation along the support zone. A reversal setup is expected later. Price growth may begin closer to the weekend.

Potential Reversal Zones Resistance:

Recommendations:

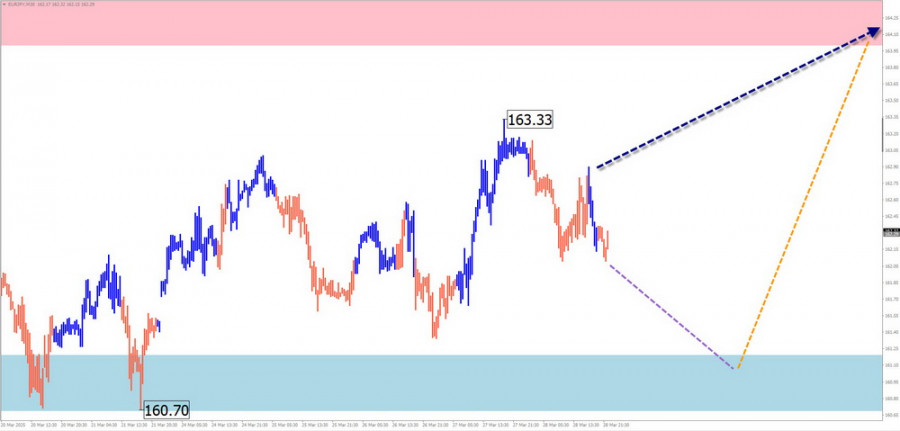

EUR/JPY

Analysis: The global trend continues to push EUR/JPY quotes north on the chart. The price has reached the lower boundary of a strong weekly support zone. Over the past two weeks, a correction has been forming. The wave structure is not yet complete.

Forecast: This week, a completion of the current downward movement is expected, followed by sideways drifting near the support area. Toward the weekend, the likelihood of a reversal and resumed price growth increases.

Potential Reversal Zones Resistance:

Recommendations:

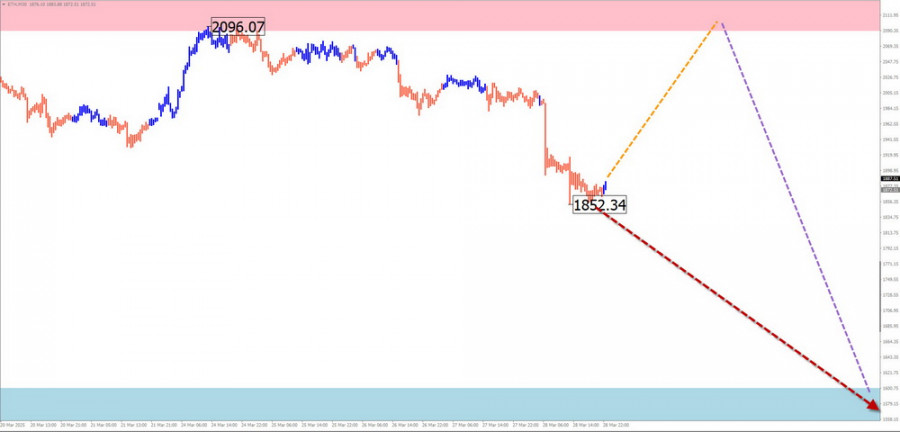

#Ethereum

Analysis: A bearish wave has been forming on Ethereum's chart since early December. In early March, price broke through a key potential reversal zone. For the past two weeks, ETH has been consolidating sideways. The wave structure is still incomplete.

Forecast: The overall sideways movement is expected to continue this week. An upward bias in the first half of the week will likely shift to a downward one by the weekend. A breakout above resistance upon trend change is unlikely.

Potential Reversal Zones Resistance:

Recommendations:

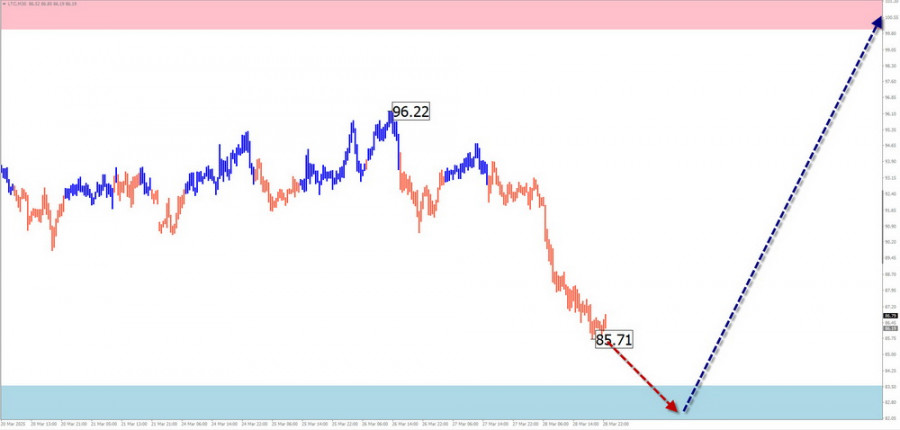

#Litecoin

Analysis: The current wave model on Litecoin's chart is an incomplete upward zigzag. The final wave part (C) began on March 11. Over the past two weeks, an intermediate pullback has been forming within its structure.

Forecast: At the start of the week, a decline to the calculated support zone is most likely. In the second half, the chance of a price recovery increases. The resistance zone sets the upper boundary for the weekly price range.

Potential Reversal Zones Resistance:

Recommendations:

Note: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The analysis on each time frame focuses on the last, incomplete wave. Dotted lines indicate projected movements.

Attention: The wave algorithm does not account for the duration of instrument movements over time.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

GBP/USD Analisis: Grafik harian pasangan mata uang Inggris menunjukkan struktur wave bullish yang sedang berlangsung sejak 13 Januari tahun ini. Bagian tengah wave (B) telah berkembang dalam beberapa minggu terakhir

EUR/USD Analisis: Pada pasangan utama euro, tren naik yang dimulai pada awal Februari terus berlanjut. Kuotasi tetap berada dalam zona potensi pembalikan yang luas. Selama tiga minggu terakhir, harga membentuk

Struktur gelombang untuk GBP/USD tetap agak ambigu, tetapi secara keseluruhan dapat dikelola. Saat ini, masih ada kemungkinan besar bahwa tren menurun jangka panjang akan berkembang. Gelombang 5 telah berbentuk meyakinkan

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.