Lihat juga

28.03.2025 11:39 AM

28.03.2025 11:39 AMMarkets are now fully convinced that the U.S. President will follow through on his plans to implement severe customs tariffs aimed at closing the domestic market and, in doing so, stimulating domestic manufacturers.

Understanding this, investors have essentially paused trading, waiting to see what happens on April 2.

When observing the behavior of stock, commodity, debt, and currency markets — along with the crypto market — it becomes clear that activity is waning. Watching Trump and his dynamic personality, anything can be expected on April 2. In the past, he has made dramatic promises only to just as easily backtrack on them.

So, what might happen on Wednesday, April 2?

Two scenarios are likely on the table, based on the personality of the 47th U.S. President.

Scenario one: He theatrically announces the restrictive measures previously outlined. In this case, a localized wave of negativity can be expected, triggering broad market selloffs. The extent of the downturn will depend on Trump's commentary — how long the measures will last, what accompanying conditions they will carry, and so on.

Scenario two: A softer approach, where only partial measures are enacted — for instance, not all promised tariffs are implemented, or some are delayed for certain countries. This scenario would allow loopholes for imports to enter the U.S. The markets may react positively to such news, as the worst-case scenario is already largely priced in.

This is the dilemma investors currently face. Because of the uncertainty factor, market activity has stalled — no one wants to take risks and most prefer to adopt a wait-and-see approach.

What can we expect from the markets today?

Most likely, no significant movements are expected across market segments. Consolidation ahead of April 2 is the most probable scenario. The ICE U.S. Dollar Index will likely hover just above the 104.00 mark. Equities could trade sideways, gradually moving toward the lower ends of their ranges. Gold is expected to find support amid uncertainty and global geopolitical tensions. Crude oil prices will likely remain under pressure, correcting lower from their recent local highs.

Daily Forecasts:

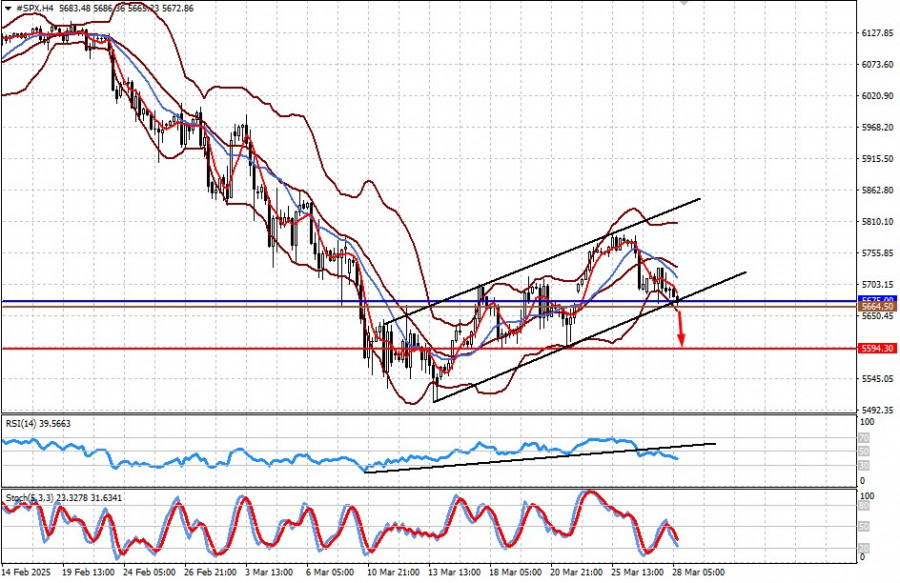

#SPX The CFD contract on the S&P 500 futures is resting on the short-term uptrend support line. A breakout below the 5675.00 level and a sustained move lower could lead to a decline toward 5594.30. The 5664.50 level may serve as an entry point.

#NDX The CFD contract on NASDAQ 100 futures is also positioned at the short-term uptrend support line. A breakout below the 19652.40 level and a consolidation under it may lead to a drop toward 19154.20. The 19621.50 level may serve as an entry point.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Jumat, pasangan mata uang GBP/USD juga diperdagangkan lebih tinggi. Namun, perlu dicatat bahwa mata uang Inggris—yang pernah dipuji karena ketahanannya yang luar biasa terhadap dolar dalam beberapa tahun

Pada hari Jumat, pasangan mata uang EUR/USD melanjutkan kenaikannya yang stabil. Pada titik ini, tidak ada lagi pertanyaan tentang apa yang terjadi di pasar mata uang—semuanya sangat jelas. Donald Trump

Akan ada beberapa peristiwa penting dalam minggu mendatang. Tentu saja, laporan seperti produksi industri, penjualan ritel, dan penjualan rumah baru perlu diperhatikan. Sekilas, laporan-laporan ini tampaknya tidak mampu mengubah sentimen

Euro menunjukkan kenaikan tajam terhadap dolar AS. Pasangan EUR/USD telah mencapai level tertinggi dalam tiga tahun dan tidak menunjukkan tanda-tanda melambat. Sementara itu, menurut survei para ekonom, pejabat di European

Pada hari Kamis, para investor menyadari bahwa saat ini tidak ada yang namanya stabilitas. Volatilitas pasar yang tinggi tetap ada dan akan terus mendominasi untuk beberapa waktu. Penyebab yang sedang

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Jumat, tetapi tidak ada yang diperkirakan akan memengaruhi pasar. Tentu saja, kita mungkin melihat reaksi jangka pendek terhadap laporan individu, tetapi secara umum

Pada hari Kamis, pasangan mata uang GBP/USD juga diperdagangkan lebih tinggi. Sebagai pengingat, faktor makroekonomi dan fundamental tradisional saat ini memiliki sedikit atau tidak ada pengaruh pada pergerakan mata uang

Pada Rabu malam, pasangan mata uang EUR/USD mengalami penurunan tajam, tetapi menunjukkan sedikit pemulihan sepanjang hari. Pada hari Kamis, pertumbuhan berlanjut—serangkaian fluktuasi ini hanya bisa digambarkan sebagai roller coaster. Pergerakan

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.