Lihat juga

28.03.2025 05:01 AM

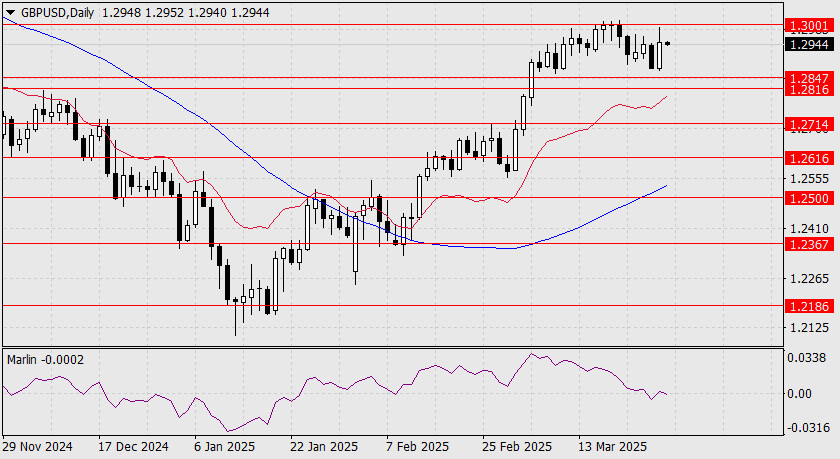

28.03.2025 05:01 AMAlthough the U.S. data showed a growth of 2.4% compared to the expected 2.3%, the dollar index fell by 0.28%. The pound surged by 78 pips, nearly reaching the 1.3001 target. The Marlin oscillator on the daily timeframe has returned to positive territory, possibly indicating that its previous drop into bearish territory on Wednesday was a false signal. It's now evident that the price is gathering momentum to break through 1.3001 and continue rising to the next resistance at 1.3101, the high from October 15, 2024.

Today's UK GDP and retail sales data are expected to be neutral or moderately weak. The consensus forecast for Q4 GDP is 0.1% (1.4% y/y, unchanged), and retail sales for February are projected to fall by 0.3% (0.5% y/y vs. 1.0% y/y in January). The trade balance for January may show a slight improvement from -£17.45 billion to -£16.80 billion. These figures may serve as a foundation for ongoing bullish consolidation.

On the H4 chart, the pound decisively broke through the signal level of 1.2944, briefly climbing above the Kijun line and nearly reaching the 1.3001 target. The price hovers near this level, and the Marlin oscillator moves sideways. Market participants are awaiting UK economic data.

The boundary of the alternative scenario lies much lower, at yesterday's low of 1.2867, near the target range of 1.2816/47. A downward move would only be deemed valid if the price falls below this range. Until then, any possible decline toward this support may be a false move.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada grafik per jam, pasangan GBP/USD pada hari Rabu berkonsolidasi di atas level retracement lemah 161,8% di 1,3520. Konsolidasi ini memungkinkan ekspektasi pertumbuhan berlanjut menuju level retracement berikutnya di 1,3620

Indikator eagle menunjukkan sinyal negatif untuk euro, yang mengisyaratkan kemungkinan penurunan dalam beberapa hari ke depan. Oleh karena itu, prospek kami tetap bearish selama harga berkonsolidasi di bawah level psikologis

Di sisi lain, jika kekuatan bullish mendominasi, kita bisa mengharapkan rebound teknikal di sekitar 3.355. Area ini sebelumnya telah memberikan titik rebound yang baik untuk emas, dan kali ini harga

Dengan kondisi indikator Stochastic Oscillator yang berada di level Overbought dan muncul Divergensi antara indikator tersebut dengan pergerakan harga indeks Nasdaq 100, sehingga dalam waktu dekat berpotensi untuk terkoreksi hingga

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.