Lihat juga

27.03.2025 07:02 PM

27.03.2025 07:02 PMTrade analysis and tips for trading the British pound

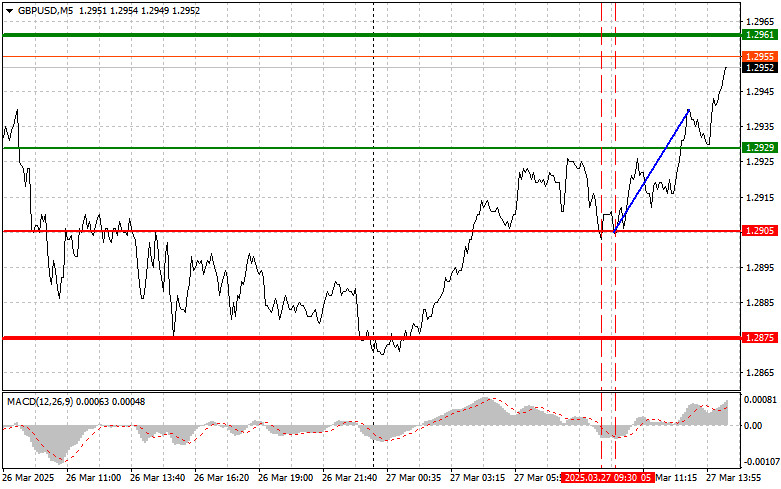

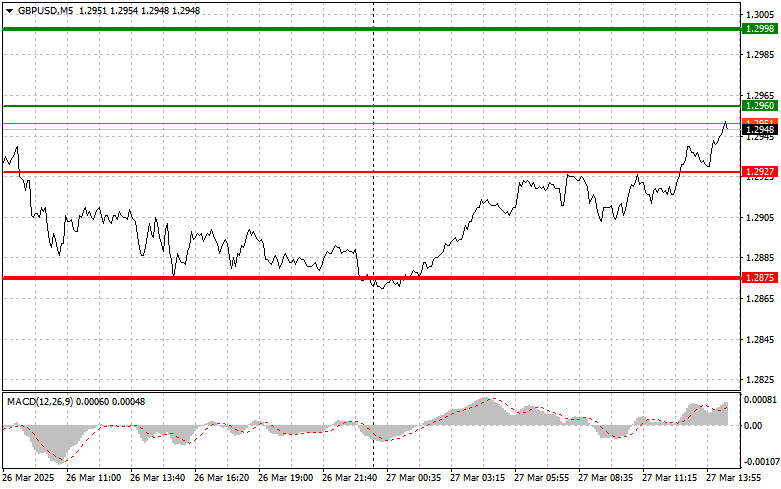

The test of the 1.2905 level occurred when the MACD had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the pound. A second test of 1.2905, while the MACD was in oversold territory, triggered Scenario #2 for buying, which resulted in the pair gaining more than 50 points.

The absence of economic data from the UK allowed the pound to rise, continuing the Asian correction that followed yesterday's sell-off. Investors likely saw this as a buying opportunity, as the market was oversold after a recent string of negative news from the U.S. Additionally, the lack of UK data left the currency market awaiting new drivers, which favored speculative pound buying.

Now investors' attention is focused on a series of key macroeconomic indicators from the U.S. Special emphasis will be placed on GDP change data for Q4, the Core Personal Consumption Expenditures (PCE) Index, and the number of initial jobless claims. The GDP report will provide insight into the resilience of the U.S. economy amid ongoing challenges such as inflation and high interest rates. The PCE Index, being one of the key inflation indicators, will also draw significant attention. Its dynamics will help assess the effectiveness of the Federal Reserve's efforts to contain price growth. If the index declines, the dollar may also weaken.

Finally, the jobless claims data will offer a snapshot of the labor market. An increase in claims could indicate deteriorating economic conditions and heightened recession risks.

As for the intraday strategy, I will primarily rely on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at the entry point around 1.2960 (green line on the chart), with a target of rising to 1.2998 (thicker green line). Around 1.2998, I will exit the buy positions and open sell trades in the opposite direction (targeting a 30–35 point move from the level). A pound rally today is only expected following weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.2927 level, while the MACD is in oversold territory. This would limit the downward potential of the pair and trigger an upward reversal. A rise to the opposite levels of 1.2960 and 1.2998 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout below the 1.2927 level (red line on the chart), which would lead to a rapid decline in the pair. The main target for sellers will be the 1.2875 level, where I plan to exit the sell trades and immediately open buy positions in the opposite direction (targeting a 20–25 point rebound). Sellers will step in if strong U.S. data is released. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.2960 level, while the MACD is in overbought territory. This would limit the pair's upward potential and lead to a downward reversal. A decline to the opposite levels of 1.2927 and 1.2875 can be expected.

Chart Notes:

Important: Beginner Forex traders must be extremely cautious when making market entry decisions. It is best to stay out of the market before the release of major fundamental reports to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember, to trade successfully, you must have a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on current market conditions is an inherently losing intraday strategy.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji harga di 144.06 bertepatan dengan saat ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual dolar. Akibatnya, pasangan ini jatuh

Pengujian harga di 1,3529 pada paruh kedua hari bertepatan saat indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli pound. Akibatnya, pasangan

Uji level harga 1,1396 bertepatan dengan saat indikator MACD baru saja mulai bergerak naik dari garis nol. Ini mengonfirmasi titik entri yang tepat untuk membeli euro, menghasilkan kenaikan lebih dari

Ulasan Trading dan Tips untuk Trading Yen Jepang Pengujian harga di 144.01 pada paruh pertama hari terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik

Ulasan Trading dan Kiat-kiat untuk Trading Pound Inggris Pengujian harga di 1,3526 pada paruh pertama hari terjadi ketika indikator MACD baru saja mulai bergerak naik dari titik nol, mengonfirmasi titik

Ulasan dan Kiat-kiat untuk Trading Euro Pengujian harga di 1,1382 terjadi ketika indikator MACD baru saja mulai bergerak naik dari level nol, mengonfirmasi titik entri yang tepat untuk membeli euro

Uji harga di 143.12 terjadi ketika indikator MACD sudah bergerak naik secara signifikan dari level nol, yang membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Uji harga di 1.3502 terjadi pada sore hari ketika indikator MACD sudah bergerak turun secara signifikan dari titik nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual

Uji harga pada 1,1395 bertepatan dengan indikator MACD, yang telah bergerak turun secara signifikan dari level nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual euro. Ekonomi

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.