Lihat juga

27.03.2025 06:59 PM

27.03.2025 06:59 PMTrade analysis and tips for trading the euro

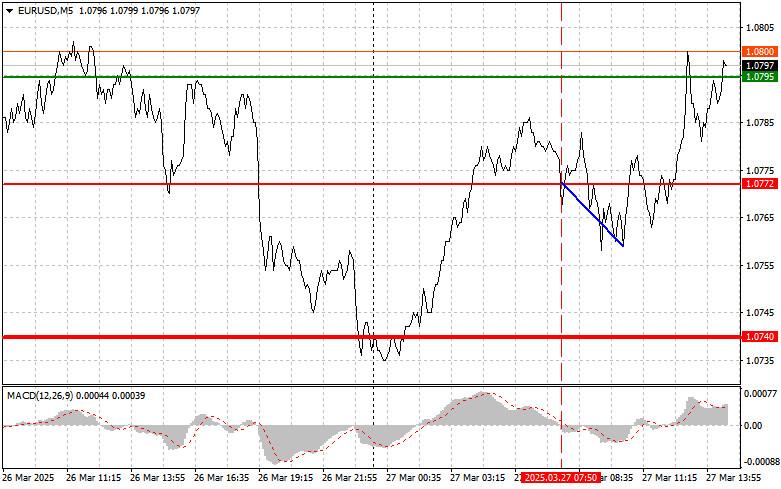

The test of the 1.0772 level occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a proper entry point for selling the euro. However, the pair failed to stage a significant drop, and after a 10-point decline, demand for the euro returned.

Published data on lending activity in the eurozone turned out to be relatively favorable, which positively impacted the euro's position. This served as a kind of relief for the currency, which had been under pressure from geopolitical uncertainty and fears of an economic downturn. However, it's worth noting that the current stabilization in the euro does not yet appear to be reliable—especially after yesterday's new auto tariffs from Donald Trump.

During the U.S. session, investor focus will shift to key macroeconomic reports. In particular, downward revisions to final U.S. GDP figures for the last quarter of the previous year could spark fresh inflows into the euro and, consequently, dollar selling. Traders will closely analyze signs of a slowdown in economic growth, which could influence future decisions by the Federal Reserve. Equally important will be the release of the Personal Consumption Expenditures (PCE) index. An increase in the PCE could strengthen expectations of tighter monetary policy, while a decline may negatively affect the dollar's position. Additionally, investors will be watching the number of initial jobless claims. An increase in this indicator may signal labor market stagnation, which could also weaken the U.S. dollar.

The day will conclude with a speech by FOMC member Thomas Barkin. His remarks on the current state of the economy and the outlook for monetary policy could trigger heightened volatility in the currency markets. Typically, this week's political statements have been interpreted in favor of dollar strength.

As for the intraday strategy, I will rely more on scenarios #1 and #2

Buy Signal

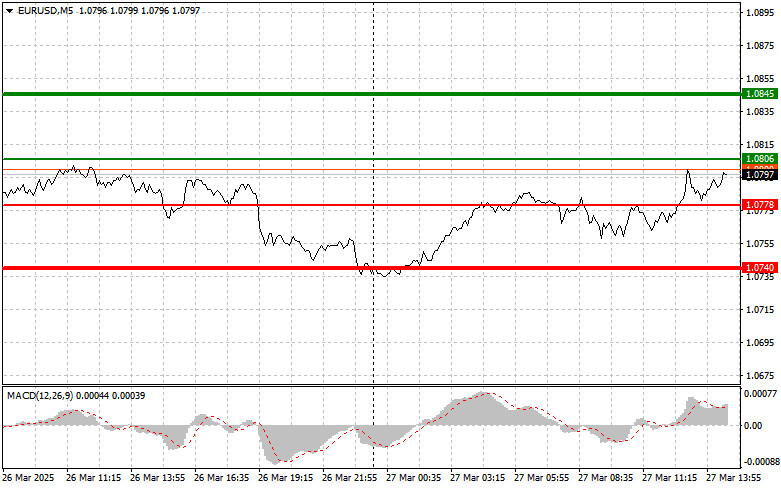

Scenario #1: Buy the euro today on a move to the 1.0806 level (green line on the chart) with a target of rising to 1.0845. At 1.0845, I plan to exit the trade and open short positions in the opposite direction, targeting a 30–35 point pullback from the entry point. A euro rally today will only be feasible following weak U.S. data and dovish Fed commentary. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0778 level, with the MACD indicator in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. A rise to the opposing levels of 1.0806 and 1.0845 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0778 level (red line on the chart). The target will be the 1.0740 level, where I plan to exit the trade and immediately buy in the opposite direction, aiming for a 20–25 point rebound. Selling pressure may return if the Fed maintains a hawkish stance. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0806 level, with the MACD indicator in overbought territory. This will limit the pair's upward potential and prompt a reversal downward. A decline to the opposing levels of 1.0778 and 1.0740 can be expected.

Chart Notes:

Thin green line – the entry price for buying the trading instrument. Thick green line – the estimated price at which to set Take Profit or manually lock in profit, as further growth beyond this level is unlikely. Thin red line – the entry price for selling the trading instrument. Thick red line – the estimated price at which to set Take Profit or manually lock in profit, as further decline beyond this level is unlikely. MACD indicator – use overbought and oversold zones as guidance when entering the market.

Important: Beginner traders in the Forex market should be extremely cautious when entering trades. It's best to stay out of the market before the release of key fundamental reports to avoid sudden price spikes. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, to trade successfully you need a clear trading plan—such as the one outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday trade

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga pada 154,66 bertepatan dengan indikator MACD yang baru mulai bergerak naik dari titik nol, yang memungkinkan pembelian dolar sesuai dengan tren. Namun, setelah kenaikan 10 pip, tekanan pada

Uji harga pada 1.3145 bertepatan dengan indikator MACD yang baru mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Namun, perdagangan mengalami kerugian karena pasangan

Uji harga pada 1,1633 bertepatan dengan indikator MACD yang naik secara signifikan di atas level nol, yang membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli euro. Ketiadaan

Euro, pound, dan aset berisiko lainnya terus naik terhadap dolar AS. Kebingungan di antara Federal Reserve AS, dengan pernyataan yang sangat berbeda dari para pembuat kebijakan, telah memberikan tekanan pada

Uji harga pada 1,3111 terjadi ketika indikator MACD baru saja mulai bergerak turun dari level nol, mengonfirmasi titik entri yang tepat untuk menjual pound. Bersama dengan data Inggris yang lemah

Pengujian harga pada 1,1593 terjadi ketika indikator MACD baru saja mulai bergerak naik dari titik nol, mengonfirmasi titik masuk yang tepat untuk membeli euro, mengakibatkan pertumbuhan menuju level target 1,1619

Uji harga di 154. 75 bersamaan dengan indikator MACD yang berada jauh di bawah angka nol, yang menerapkan batasan pada kemungkinan penurunan pasangan ini. Oleh karena itu, saya tidak melakukan

Uji harga pada 1,3108 terjadi ketika indikator MACD mulai bergerak turun dari level nol, mengonfirmasi titik entri yang tepat untuk menjual pound. Akibatnya, pasangan ini turun sebanyak 20 pip. Dimulainya

Pengujian harga pada 1,1580 terjadi saat indikator MACD mulai bergerak di atas titik nol, mengonfirmasi titik masuk yang tepat untuk membeli euro. Akibatnya, pasangan ini naik lebih dari

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.