Lihat juga

28.01.2025 02:17 PM

28.01.2025 02:17 PMUS stock futures showed slight gains after Monday's selloff driven by the tech sector, as traders seized the opportunity to buy heavily discounted assets. This approach, often referred to as buying the dip, reflects market participants' confidence in long-term growth prospects.

Despite recent fluctuations, analysts note that fundamental indicators remain strong. Many companies continue to report stable earnings and growth, which supports demand for stocks and futures. Traders are also closely monitoring economic data that could influence the Federal Reserve's future policy. A significant batch of statistics is expected today, potentially affecting tomorrow's decision on interest rates.

However, risks of renewed market pressure remain, which could amplify Monday's selloff in the fintech sector. Traders are advised to exercise caution and stay vigilant.

S&P 500 futures rose 0.4%, and Nasdaq 100 contracts gained 0.7% before the regular session opened, following a 3% drop on Monday. Nvidia Corp. jumped 5% in premarket trading after plunging 17% the previous day. Broadcom Inc. and Marvell Technology Inc. also rose. Constellation Energy Corp., which supports energy-intensive AI data centers, climbed 4.7% after a 21% drop yesterday.

Meanwhile, the US dollar strengthened against major currencies, while copper prices fell following comments by President Donald Trump on tariffs provided Monday evening. Trump stated his intent to impose comprehensive tariffs far exceeding the 2.5% proposed by the Treasury Secretary. Speaking in Florida, he also promised to target specific sectors, including semiconductors, pharmaceuticals, steel, copper, and aluminum.

As mentioned earlier, many traders remain bullish in the stock market, viewing the current decline as an opportunity to buy. Notably, the Trump administration's discussions on new tariffs throughout January have yet to result in implementation, sustaining demand for risk assets. Trump's advisors have considered gradually increasing tariffs by 2–5% monthly.

Treasury yields edged lower, with the 10-year yield rising by two basis points to 4.55%.

This week, traders are focused on earnings announcements from companies like Microsoft Corp. and Apple Inc., expected later this week. Forecasts suggest that earnings growth for major tech firms this season will be the slowest in the past two years.

Corporate Reports

According to a published memorandum, HSBC will scale back parts of its investment banking operations in Europe, the UK, and the US. The largest banking group in Europe plans to exit equity capital markets and advisory services outside its core operations in Asia and the Middle East in the coming months.

SAP SE shares hit a record high. Europe's largest tech company reported fourth-quarter cloud sales slightly exceeding analysts' expectations, thanks to new AI-driven offerings attracting customers.

Shares of Siemens Energy AG rose as much as 5.1% in early trading. The company raised its full-year revenue outlook after surpassing analysts' projections for first-quarter revenue and profit.

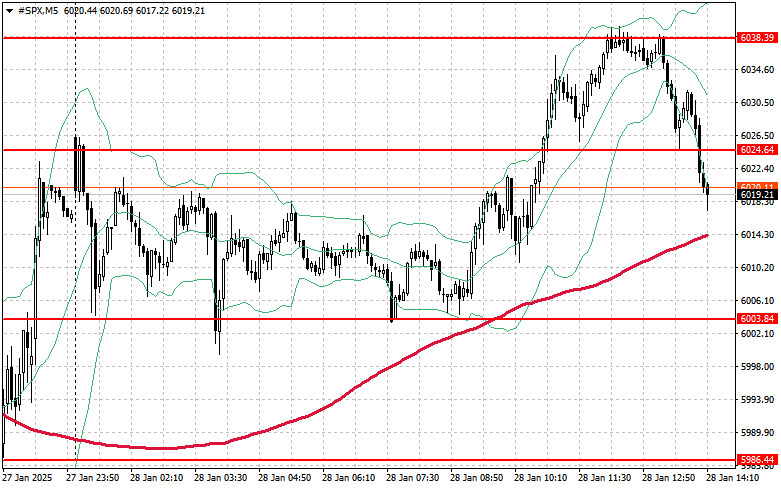

Demand remains strong for the S&P 500. Today, buyers may aim to break through the nearest resistance at $6,024, which would support the ongoing upward trend and pave the way for a push toward $6,038. Another key goal for bulls will be to maintain control above $6,047, solidifying buyers' positions. If demand for risk appetite declines and the market moves downward, buyers will need to step in around $6,003. A break below this level could push the index back to $5,986, allowing a decline toward $5,967.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Kemarin, indeks saham AS berakhir bervariasi. S&P 500 naik sebesar 0,06%, sementara Nasdaq 100 turun sebesar 0,26%. Dow Jones Industrial Average melonjak sebesar 0,68%. Indeks masa depan global melanjutkan kenaikan

Kemarin, indeks saham AS berakhir bervariasi. S&P 500 naik sebesar 0,21%, sementara Nasdaq 100 turun sebesar 0,25%. Dow Jones Industrial Average melonjak sebesar 1,18%. Indeks di Asia mengalami kenaikan seiring

Kemarin, indeks saham AS ditutup dengan kenaikan yang signifikan. S&P 500 naik sebesar 1,54%, dan Nasdaq 100 meningkat sebesar 2,27%. Dow Jones Industrial Average menguat sebesar 0,81%. Pertumbuhan pasar saham

Akibat dari hari Jumat lalu, indeks saham ditutup bervariasi. S&P 500 naik sebesar 0,13%, sementara Nasdaq 100 turun sebesar 0,21%. Dow Jones industri menguat sebesar 0,16%. Indeks naik sementara obligasi

Pasar keuangan dan teknologi internasional kini telah memasuki tahap kestabilan yang cukup, namun di balik ketenangan ini terdapat faktor-faktor yang bisa berpengaruh besar terhadap kondisi investor dan performa aset dalam

Kemarin, indeks saham AS ditutup dengan kerugian. S&P 500 turun sebesar 1,12%, sementara Nasdaq 100 turun sebesar 1,90%. Dow Jones Industrial Average kehilangan 0,84%. Indeks Asia juga mengalami penurunan pada

Kemarin, indeks saham AS ditutup dengan kenaikan. S&P 500 naik sebesar 0,37%, sementara Nasdaq 100 naik 0,35%. Dow Jones Industrial Average menguat sebesar 0,38%. Indeks-indeks pulih saat pembeli kembali

Kemarin, indeks saham AS ditutup dengan penurunan. S&P 500 turun sebesar 1,17%, Nasdaq 100 anjlok sebesar 2,04%, dan Dow Jones Industrial Average melemah 0,53%. Indeks global terus menurun setelah penurunan

Kemarin, indeks saham ditutup bervariasi. S&P 500 naik sebesar 0,17%, sementara Nasdaq 100 meningkat 0,46%. Dow Jones Industrial Average turun sebesar 0,48%. Namun, hari ini, tekanan di pasar kembali muncul

Kemarin, indeks saham AS ditutup lebih rendah. S&P 500 turun sebesar 0,99%, Nasdaq 100 jatuh sebesar 1,57%, dan Dow Jones Industrial Average turun sebesar 0,93%. Selama sesi perdagangan hari

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.