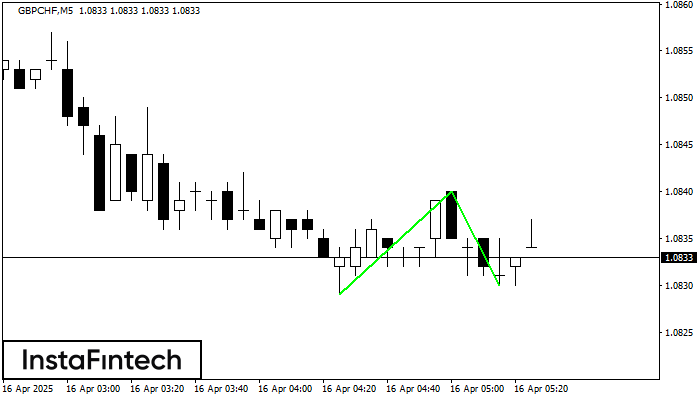

Double Bottom

was formed on 16.04 at 04:30:21 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on GBPCHF M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 1.0840 is broken. The further movements will rely on the width of the current pattern 11 points.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bullish Symmetrical Triangle

was formed on 05.06 at 09:01:33 (UTC+0)

signal strength 1 of 5

According to the chart of M5, SILVER formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 34.35/34.45 whereas the upper border goes across 34.55/34.45

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

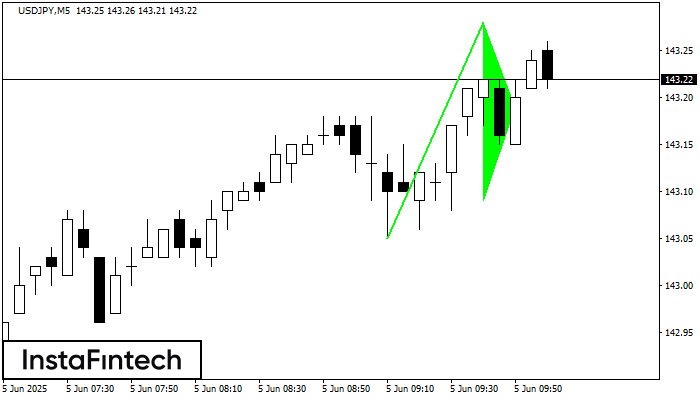

Bullish pennant

was formed on 05.06 at 09:01:26 (UTC+0)

signal strength 1 of 5

The Bullish pennant signal – Trading instrument USDJPY M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 143.28, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

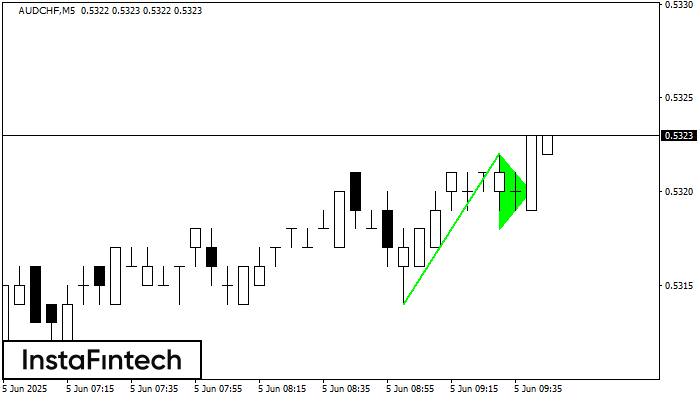

Bullish pennant

was formed on 05.06 at 08:46:29 (UTC+0)

signal strength 1 of 5

The Bullish pennant pattern is formed on the AUDCHF M5 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high

The M5 and M15 time frames may have more false entry points.

Open chart in a new window