Inverse Head and Shoulder

was formed on 07.04 at 03:00:19 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCAD formed the Inverse Head and Shoulder pattern. The Head’s top is set at 0.7904 while the median line of the Neck is found at 0.7863/0.7887. The formation of the Inverse Head and Shoulder pattern evidently signals a reversal of the downward trend. In other words, in case the scenario comes true, the price of NZDCAD will go towards 0.7919

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

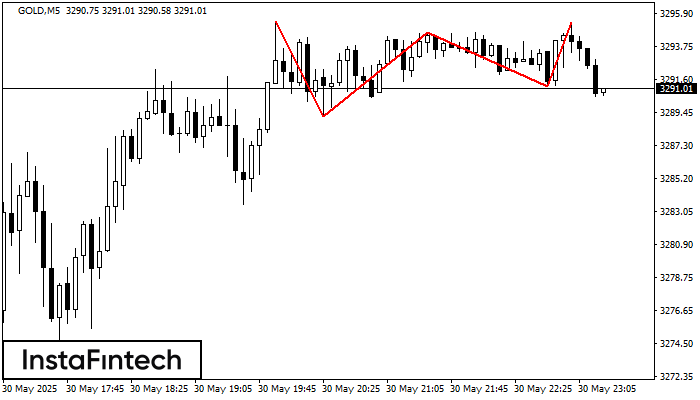

Тройная вершина

сформирован 30.05 в 22:20:23 (UTC+0)

сила сигнала 1 из 5

По GOLD на M5 сформировалась фигура «Тройная вершина». Характеристика: Границы имеют восходящий угол. Нижняя граница фигуры имеет координаты 3289.23/3291.16, при этом верхняя граница 3295.36/3295.32. Проекция ширины 613 пунктов. Формирование фигуры

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

Перевернутая голова и плечи

сформирован 30.05 в 21:50:24 (UTC+0)

сила сигнала 1 из 5

По #AMZN на M5 сформировалась фигура «Перевернутая голова и плечи». Голова закреплена на 201.64, при этом средняя линия шеи расположена на 204.52/205.01. Формирование фигуры «Перевернутая голова и плечи» наиболее вероятным

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

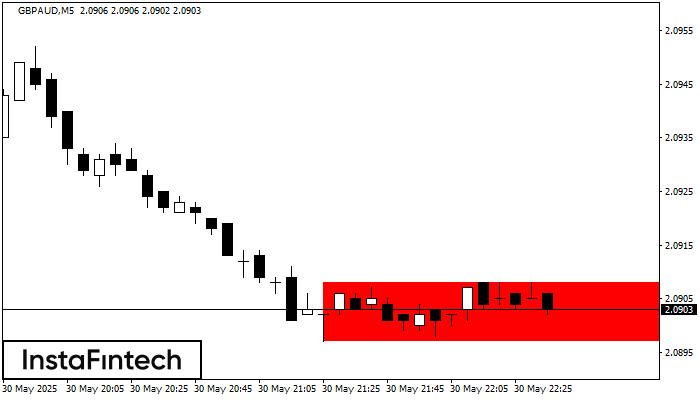

Прямоугольник

сформирован 30.05 в 21:36:36 (UTC+0)

сила сигнала 1 из 5

По торговому инструменту GBPAUD на M5 сформировалась фигура продолжения тренда - «Прямоугольник». Фигура имеет границы: Нижняя 2.0897; Верхняя 2.0908. В случае пробоя нижней границы вероятно дальнейшее движение в сторону тренда

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне