Triple Bottom

was formed on 07.04 at 02:30:15 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of SILVER M5. Features of the pattern: The lower line of the pattern has coordinates 28.95 with the upper limit 28.95/28.75, the projection of the width is 495 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 28.45, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

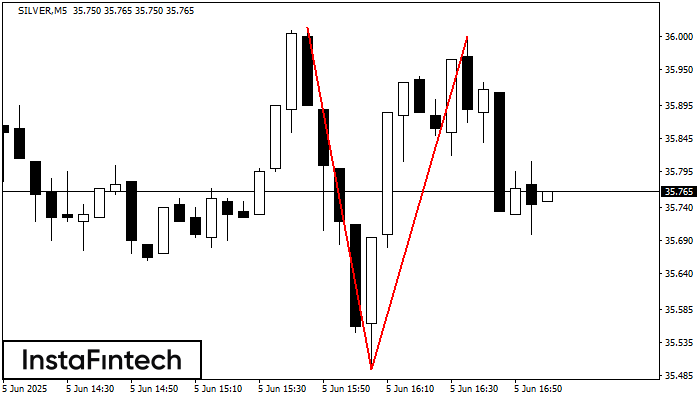

Teratas Ganda

was formed on 05.06 at 16:00:27 (UTC+0)

signal strength 1 of 5

Pada grafik SILVER M5 pola reversal Teratas Ganda telah terbentuk. Karakteristik: batas atas 36.00; batas bawah 35.49; lebar pola 505 poin. Sinyal: tembusan ke batas bawah akan menyebabkan kelanjutan tren

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window

Panji Bullish

was formed on 05.06 at 15:48:56 (UTC+0)

signal strength 1 of 5

Pola Panji Bullish terbentuk di grafik #EBAY M5. Ini adalah jenis pola kelanjutan. Diduga, jika harga ditetapkan di atas titik tertinggi panji di 78.55, tren naik selanjutnya mungkin terjadi

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window

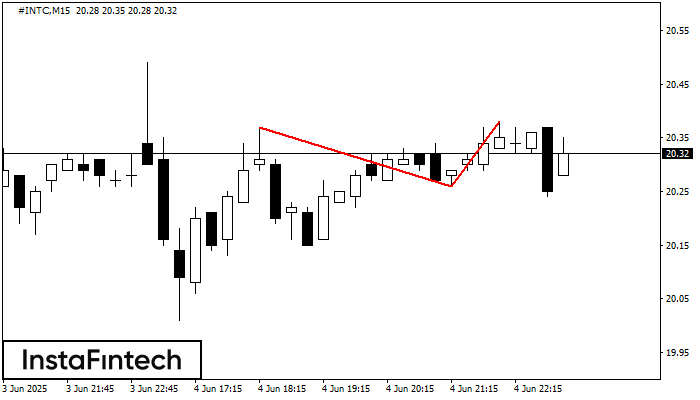

Teratas Ganda

was formed on 05.06 at 15:30:37 (UTC+0)

signal strength 2 of 5

Pola Teratas Ganda telah terbentuk pada #INTC M15. Pola ini menandakan bahwa tren telah berubah dari kenaikan menjadi penurunan. Mungkin, jika dasar pola di 20.26 ditembus, maka pergerakan menurun akan

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window