Double Bottom

was formed on 14.04 at 22:00:04 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on EURJPY M30; the upper boundary is 163.14; the lower boundary is 162.05. The width of the pattern is 107 points. In case of a break of the upper boundary 163.14, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bullish pennant

was formed on 05.06 at 17:30:09 (UTC+0)

signal strength 2 of 5

The Bullish pennant signal – Trading instrument #EBAY M15, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 78.52, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

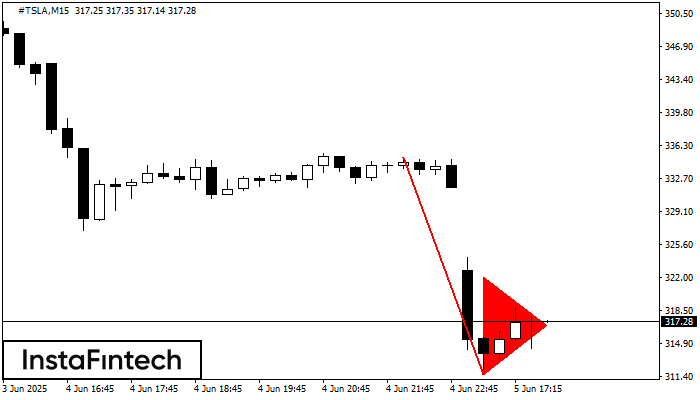

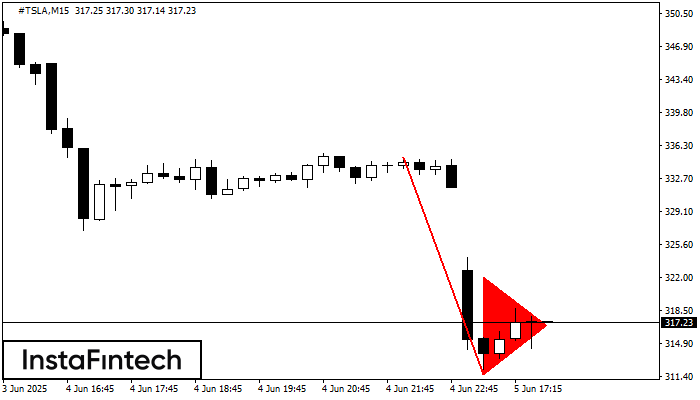

Bearish pennant

was formed on 05.06 at 16:45:18 (UTC+0)

signal strength 2 of 5

The Bearish pennant pattern has formed on the #TSLA M15 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish pennant

was formed on 05.06 at 16:45:10 (UTC+0)

signal strength 2 of 5

The Bearish pennant pattern has formed on the #TSLA M15 chart. It signals potential continuation of the existing trend. Specifications: the pattern’s bottom has the coordinate of 311.59; the projection

The M5 and M15 time frames may have more false entry points.

Open chart in a new window