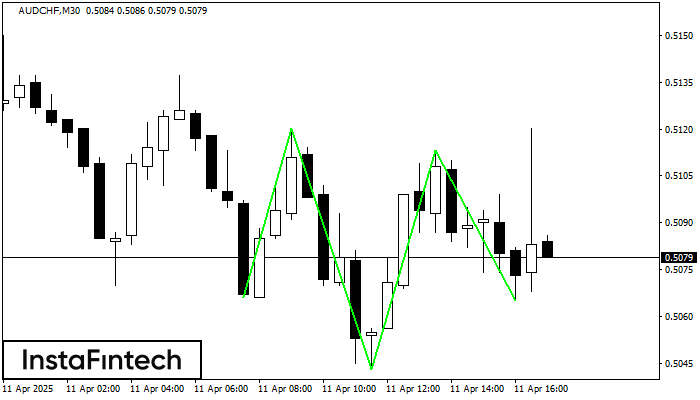

Inverse Head and Shoulder

was formed on 11.04 at 15:59:57 (UTC+0)

signal strength 3 of 5

According to the chart of M30, AUDCHF produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 0.5043 while the median line of the Neck is set at 0.5120/0.5113. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of AUDCHF will go towards 0.5143.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

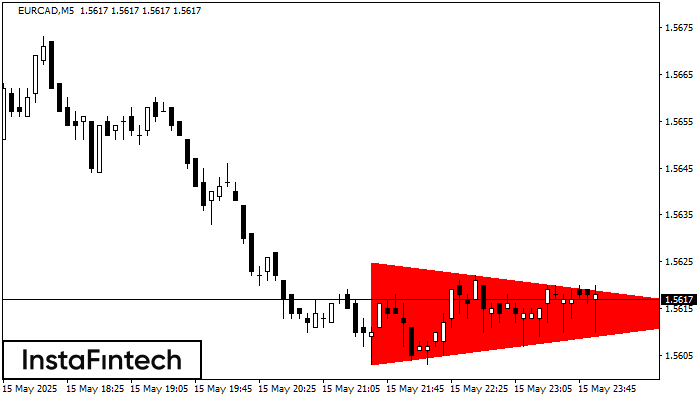

Segi Tiga Simetri Menurun

was formed on 15.05 at 23:00:07 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, EURCAD membentuk corak Segi Tiga Simetri Menurun. Cadangan dagangan: Penembusan sempadan bawah 1.5603 mungkin mendorong kepada kesinambungan aliran menurun

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

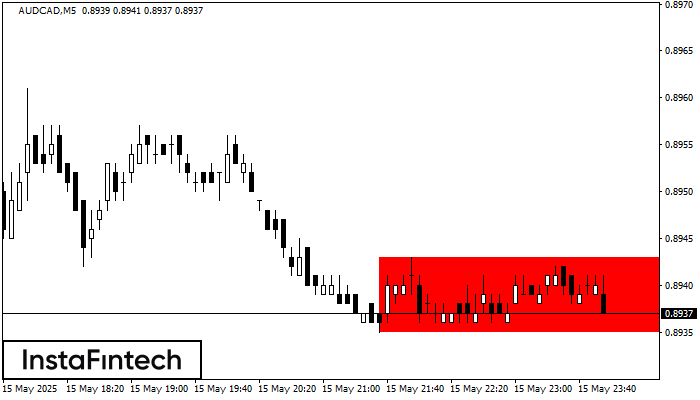

Segi Empat Menurun

was formed on 15.05 at 22:58:25 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, AUDCAD telah membentuk Segi Empat Menurun. Jenis corak ini menunjukkan kesinambungan aliran. Ia terdiri daripada dua tahap: rintangan 0.8943 - 0.0000 dan sokongan 0.8935 – 0.8935. Sekiranya

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

Triple Bottom

was formed on 15.05 at 22:30:23 (UTC+0)

signal strength 2 of 5

Corak Triple Bottom telah dibentuk pada NZDCHF M15. Ia mempunyai ciri-ciri berikut: tahap rintangan 0.4912/0.4911; tahap sokongan 0.4901/0.4902; lebar corak adalah 11 mata. Dalam situasi penembusan paras rintangan 0.4912, harga

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window